A 10-basis-point year-over-year increase in gross margin on loans sold, along with a nearly 30% increase in origination volume, helped Waterstone Mortgage turn around its fourth-quarter results.

Waterstone Mortgage, a unit of Waterstone Financial in Wauwatosa, Wis., had fourth-quarter net income of $2.4 million, compared with net income of $4.1 million

"The mortgage banking segment continued to benefit from increased production volumes of refinance products, while maintaining a continued focus on cost discipline throughout the organization," Waterstone Financial CEO Douglas Gordon said in a press release.

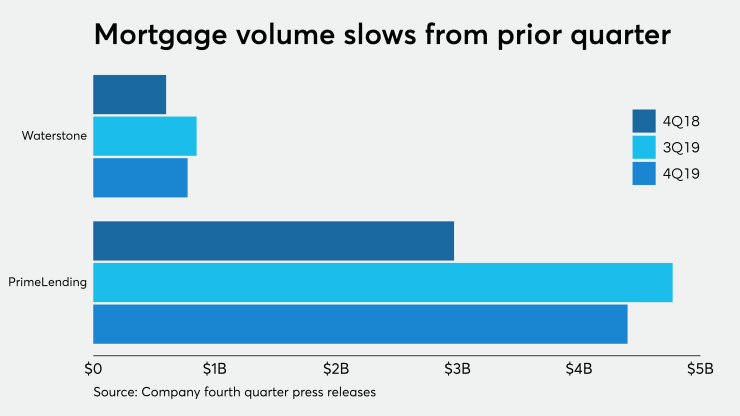

The company originated $777.1 million in the quarter, down from $851.3 million in the third quarter, but up from $600.2 million a year ago. Refinancings made up 28% of originations, the most for Waterstone Mortgage in any quarter in 2019, and well up from 9% for the fourth quarter of 2018.

Its gross margin on loans sold — defined as noninterest income divided by total loan originations — was 4.27%, compared with 4.17% a year ago.

Total noninterest income was $32.4 million, compared with $36.5 million in the prior quarter and $25 million for the fourth quarter of 2018.

Meanwhile, noninterest expense was $28.7 million, down from $30 million in the third quarter and up from $25 million for the fourth quarter of 2018.

Waterstone Financial, which is also the parent of WaterStone Bank, had net income of $8.8 million in the quarter, up from $5.7 million one year prior.

Separately, Hilltop Holdings reported that its PrimeLending unit had $120.6 million of net gains from loan sales and other mortgage production income in the fourth quarter. This was down from $157.1 million in the third quarter, but up from $90.6 million in the fourth quarter of 2018. Mortgage loan origination fees were $36.9 million, versus $37.8 million and $26.6 million, respectively.

Total originations for the quarter were $4.4 billion, nearly one-third of which were refinancings. PrimeLending

As measured in basis points, net gain on sale was 304 bps, down from 335 bps in the third quarter and 334 bps a year prior.

Hilltop reported $8.5 million of pretax income from mortgage banking for the fourth quarter.

"PrimeLending rebounded from a challenging year in 2018 by generating $65 million of pretax income in 2019, an increase of $52 million," Hilltop CEO Jeremy Ford said in a press release.

Parent company Hilltop earned $49.3 million in the fourth quarter, up from $28.1 million in the same period of 2018. Hilltop’s businesses include PrimeLending's parent PlainsCapital Bank, Hilltop Securities and National Lloyds Corp. (a property and casualty insurance holding company).

After the earnings were released, Hilltop disclosed it sold National Lloyds (whose market is owners of lower value homes and mobile homes) to Align Financial Holdings from $150 million in cash.