-

"These changes reflect adjustments we're making to ensure our staffing levels, locations and expertise align with current business needs; efficiencies we have gained through technology; and progress against our transformation work," the company said in a statement.

January 13 -

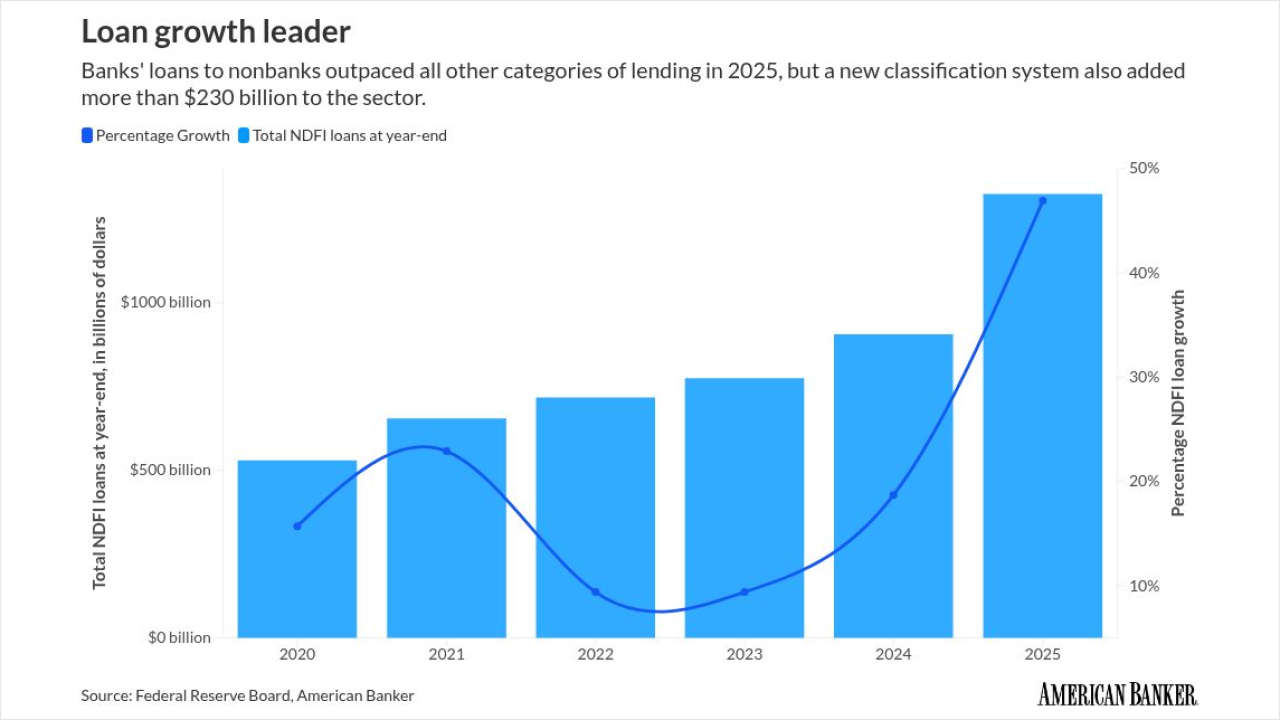

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

Fifth Third announced it plans to buy the Dallas bank in a $10.9 billion transaction.

October 6 -

A recent deal involving a troubled Texas bank shows that even the most lopsided depository can find an exit.

May 26 -

The Sunshine State deal comes following a banner year for credit union-bank combinations, despite pushback from community banking advocates.

April 22 -

Royal Bank of Canada executives said they plan to start originating more mortgages in the United States, and they indicated that they may ditch the City National Bank brand.

March 27 -

The Mississippi lender said regulators have signed off sooner than expected on its $103.6 million acquisition of First Chatham Bank. The bank's CEO and deal advisers said the speedy approval bodes well for future M&A.

March 25 -

The Connecticut bank said its newly minted president, Steven Sugarman, successfully led a private placement and signed a long-term employment agreement that makes him a potential CEO. David Lowery, current chief executive of Patriot, plans to step down in April.

March 20 -

Joseph Otting, who is leading Flagstar's turnaround, said potential buyers may be interested in acquiring the regional bank once it gets past certain challenges.

February 11 -

The Long Island-based company, which is in the middle of a makeover, saw its stock price rise sharply after reporting a net loss that was less than what analysts expected.

January 30 -

Florida-based Amerant Bancorp recently restructured its securities portfolio after selling its Houston branches.

January 6 -

The Dallas bank has spent the last three years building itself into a new company. Now, it has to prove the investments will pay off.

October 17 -

After the bank's 2014 spinoff from Royal Bank of Scotland, its executives worked to shore up weaknesses. Now they're concentrating on how to close the gap with regional banking peers.

September 24 -

Executives at the super-regional bank told investors that years of investments are poised to start paying off in rising profits, but the market seemed skeptical about the company's plan forward.

September 12 -

The third-largest Canadian bank's proposed minority stake in KeyCorp is an unconventional way to generate more U.S. revenue. Analysts say it's a less risky approach than buying an American bank outright.

August 23 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12