-

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

The White House Council of Economic Advisers released a research study analyzing the economic impact of state income tax elimination.

January 29 -

A record amount of equity is now held by property owners 62 and older, with a growing share transferring homes to their heirs and not putting them up for sale.

January 26 -

The $13 billion auction was awarded at 4.846%, about a basis point lower than its yield in trading just before 1 p.m.

January 21 -

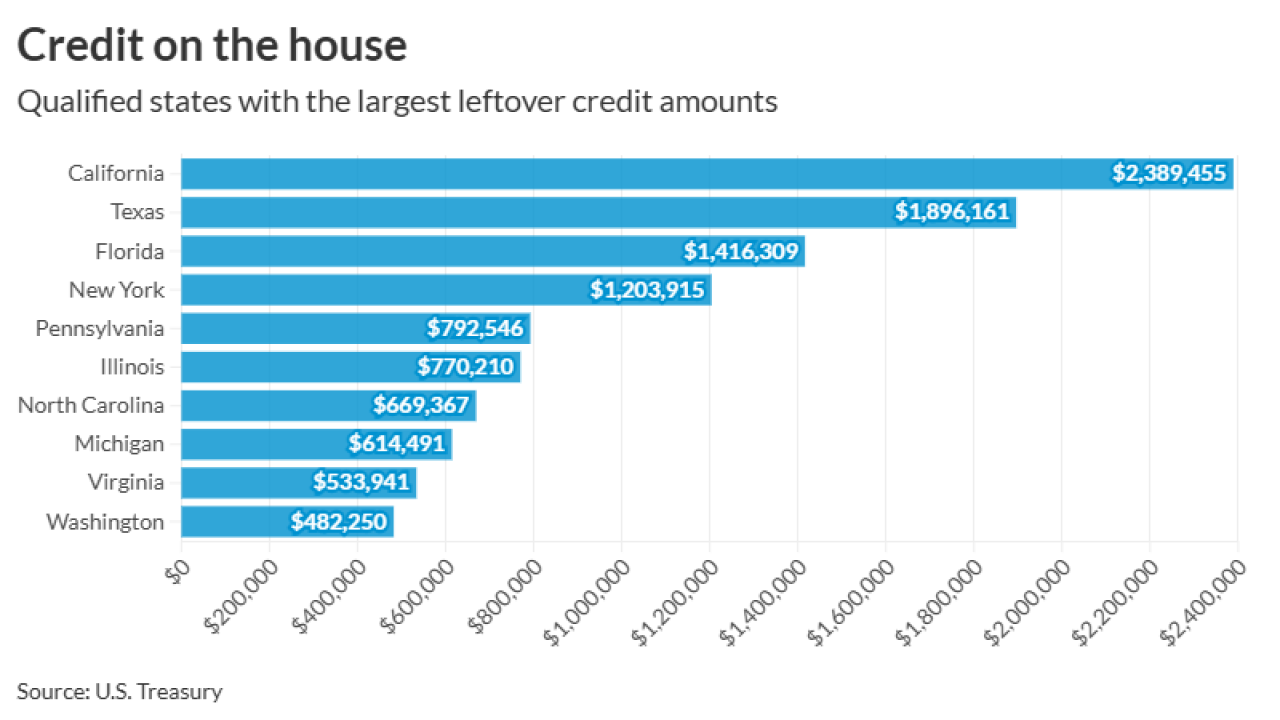

The carryovers range from some $2.4 million in California and some $1.9 million in Texas to $44,851 in Alaska and $39,297 in Vermont.

December 22 -

Congress has passed a bill giving taxpayers who have been affected by natural disasters some extra time to file a claim for a tax credit or refund.

December 18 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Treasury Secretary Scott Bessent said the Federal Reserve Board should reject the renomination of any regional Federal Reserve Bank presidents who have not lived in their districts for three years, signaling a potential confrontation when reappointments come before the board in February.

December 3 -

The import taxes — initially set at 25% for cabinets, vanities and upholstered wooden furniture — officially took effect on Tuesday at 12:01 a.m. New York time.

October 14 -

Federal Reserve Vice Chair Philip Jefferson said despite the near term cloudiness to economic projections, he does expect inflation to resume its downward trajectory next year and reach the Fed's 2% inflation target in the coming years.

September 30 -

Trump administration tariff policy led lumber futures prices to surge over the first half of 2025, but the front-loading of purchases led to a current glut.

September 10 -

Premiums for property insurance have risen over 69% since 2019, far outpacing other components of the monthly mortgage payment, ICE Mortgage Technology found.

September 8 -

Even with direct costs of import taxes excluded, prices for residential construction goods and services increased by the most in two years, NAHB said.

August 15 -

Core CPI, which excludes food and energy, rose to 3.1%, up from 2.9% in June.

August 12 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said she foresees three interest rate cuts for this year, a view bolstered by the latest employment data.

August 11 -

The tax delinquency rate hit a seven-year high last year with residents of some states seeing amounts owed increasing by more than 50% since 2019.

August 8 -

President Trump's imposition of sweeping tariffs on more than 90 countries Thursday represents a major shift in the U.S. trade stance, but the impact on inflation, the Federal Reserve and the economy are still unclear.

August 7 -

Groups like the Mortgage Bankers Association and National Housing Conference welcomed the decision to increase the secondary market for the credits.

August 5 -

More powerful storms and pricier building costs are behind the increases in premiums, said the report's authors.

August 4 -

The 35% levy on Canadian goods does not include any carve outs for lumber or building supplies, with their costs already rising, Cotality's Selma Hepp said.

August 1