-

It’s too soon to gauge the true impact of recent tax cuts on loan demand, but anecdotes from bankers suggest that, after months of stagnation, pipelines are filling up again.

February 14 -

Bonus depreciation, Section 179, interest and loss limitations — what does it all mean?

February 5 Engineered Tax Services

Engineered Tax Services -

The changes to the tax code reduced Radian Group's fourth-quarter net income as the company took an incremental provision of $102.6 million.

February 1 -

The busy legislative agenda laid out by President Trump in the State of the Union speech Tuesday night casts doubt on how quickly Congress can move on financial services legislation, particularly a housing finance reform package.

January 31 -

A larger standard deduction could help renters become homeowners faster, and builders' lower taxes could expand inventory that competes with single-family rentals, according to Fannie Mae Chief Economist Doug Duncan.

January 29 -

Flagstar Bancorp swung to a fourth-quarter loss as the company took an $80 million noncash charge to earnings because of the tax reform bill.

January 23 -

Home remodeling activity reached a high not seen since 2001, signaling homeowners are either gearing up to sell their properties or committing to staying put for a bit longer.

January 22 -

The changes created by tax reform will be a mixed influence on housing as consumers will have more to spend to buy a property, but lose other benefits of homeownership.

January 22 -

In the nation's hottest housing markets, inventory shortage has reached crisis levels, according to Zillow.

January 19 -

The percentage of refinances grew to 40% of all closed loans in December, according to Ellie Mae.

January 17 -

Though multifamily housing starts are projected to slightly moderate this year and next, production levels are expected to remain in a steady range considered normal, according to the National Association of Home Builders.

January 12 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

Consumer confidence in the housing market during December was better than it was 12 months prior but weaker than in November.

January 8 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8 -

Manhattan home resales fell in the fourth quarter as buyers wavered ahead of the expected tax overhaul and stood firm in their refusal to overpay.

January 4 -

Employees at HarborOne Bank and its Merrimack Mortgage Co. subsidiary will see their minimum wage rise to $15 per hour, the latest company to accelerate plans to hike salaries.

December 28 -

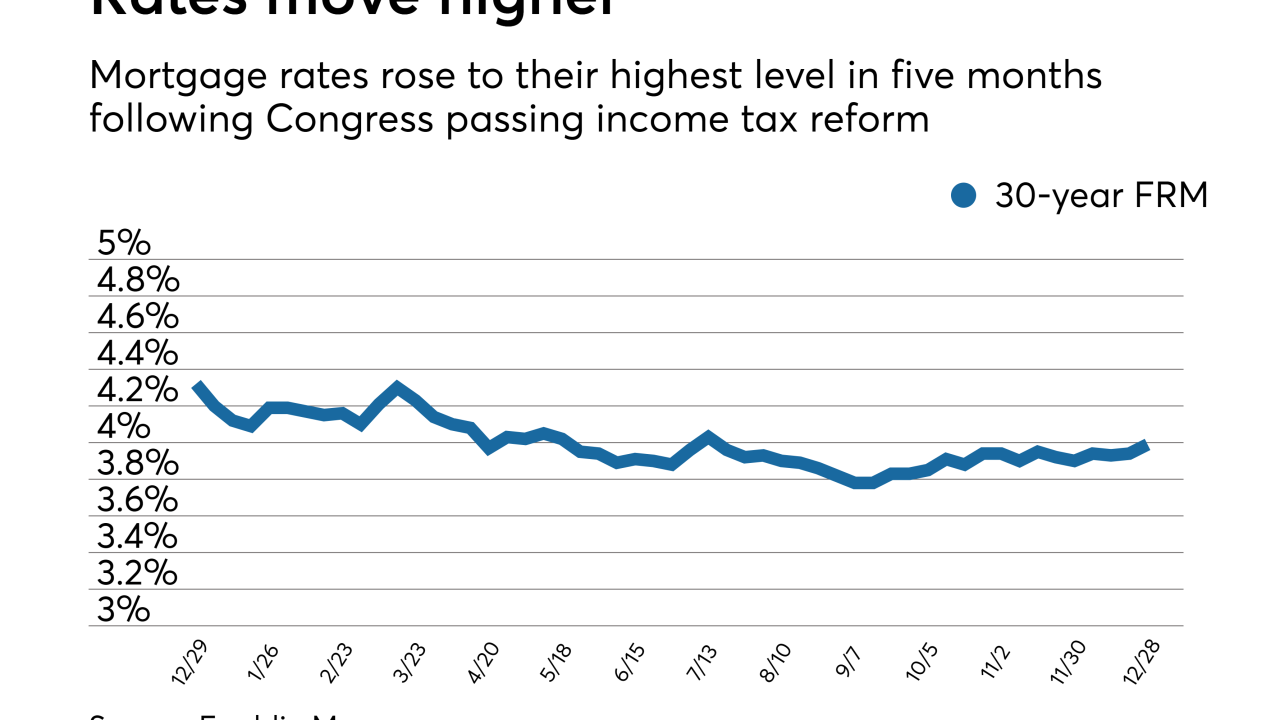

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26