-

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

A mortgage industry executive with ties to a firm penalized in a U.S. predatory lending crackdown is being considered by the Trump administration to run Ginnie Mae, according to people familiar with the matter.

September 17 -

Whether Congress and/or the mortgage industry is able to untangle two opposing threads in the Trump administration's plans is anyone's guess.

September 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Supreme Court may be closer to examining a key restraint on a president's ability to change CFPB leadership.

September 12 -

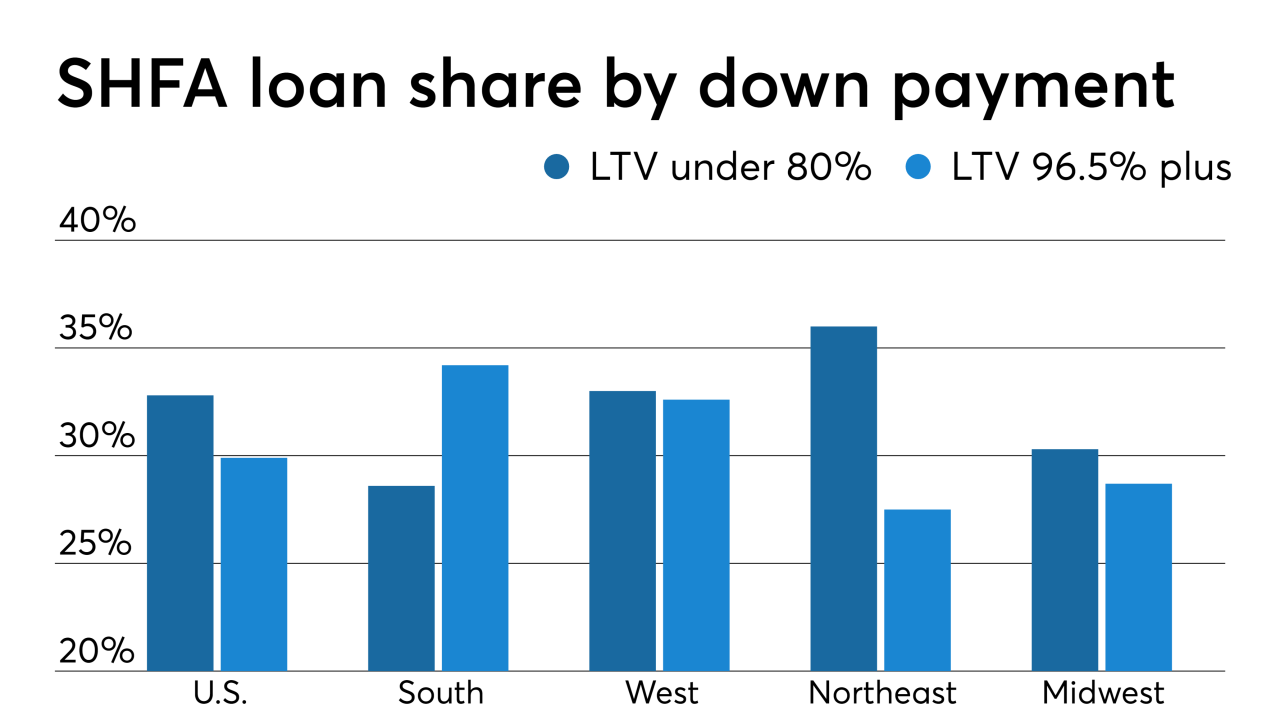

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

Senate Banking Committee members feel urgency to pass a bill dealing with Fannie Mae and Freddie Mac, but the same obstacles that have stalled congressional action for years remain.

September 10 -

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6

-

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5 -

From consumers straying from certain cities to regulations dictating how homes are built, here’s a look at how climate change is shaping the housing market.

August 29 -

Some believe the administration will delay action on Fannie Mae and Freddie Mac to avoid any political fallout. Others say the window for reform is closing.

July 29 -

Eric Blankenstein, now at HUD, is under fire for asking a subordinate to defend him after it was revealed he wrote racially charged blogs 14 years earlier.

July 29 -

Foreign purchases of U.S. residential real estate fell 36% to the lowest annual rate since 2013, as slowing overseas economies, the strong dollar and the White House's anti-immigrant rhetoric put a chill on demand.

July 17 -

The Trump administration is growing wary of taking bold steps toward freeing Fannie Mae and Freddie Mac from federal control before the 2020 election, said people familiar with the matter, in part because of the political risk of potentially upending the U.S. mortgage market.

July 12 -

Treasury and HUD are close to unveiling administrative and legislative options for ending the conservatorships of Fannie Mae and Freddie Mac. Will their findings be heavy on detail or leave a lot unanswered?

July 9 -

County supervisors approve a disputed project. Gov. Gavin Newsom agrees to a statewide housing policy. President Trump moves to ease home-construction regulations across the nation.

July 2 -

A group of Senate Democrats have called on HUD Secretary Ben Carson to reverse his agency’s opinion that borrowers in the Deferred Action for Childhood Arrivals program are ineligible for FHA loans.

June 26 -

The president signed an executive order Tuesday establishing a White House council dedicated to examining regulatory barriers to affordable housing.

June 25 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19