-

Ocwen Financial Corp. lost $6.1 million in the third quarter, as pretax losses from its origination business outweighed any profits generated from the servicing side.

November 2 -

A joint venture between loanDepot and OfferPad will broker loans for consumers who need financing to bridge gaps between the sale of one property and the purchase of another.

November 2 -

Walter Investment Management Corp. was supposed to prosper by snapping up mortgage cast-offs from big banks at fire-sale prices. Instead, Walter is belatedly joining the list of companies burned by the U.S. housing crisis.

October 25 -

From recruitment strategies to leveraging technology without losing the personal touch, here's a look at four challenges and opportunities for the resurgent mortgage broker channel.

October 12 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

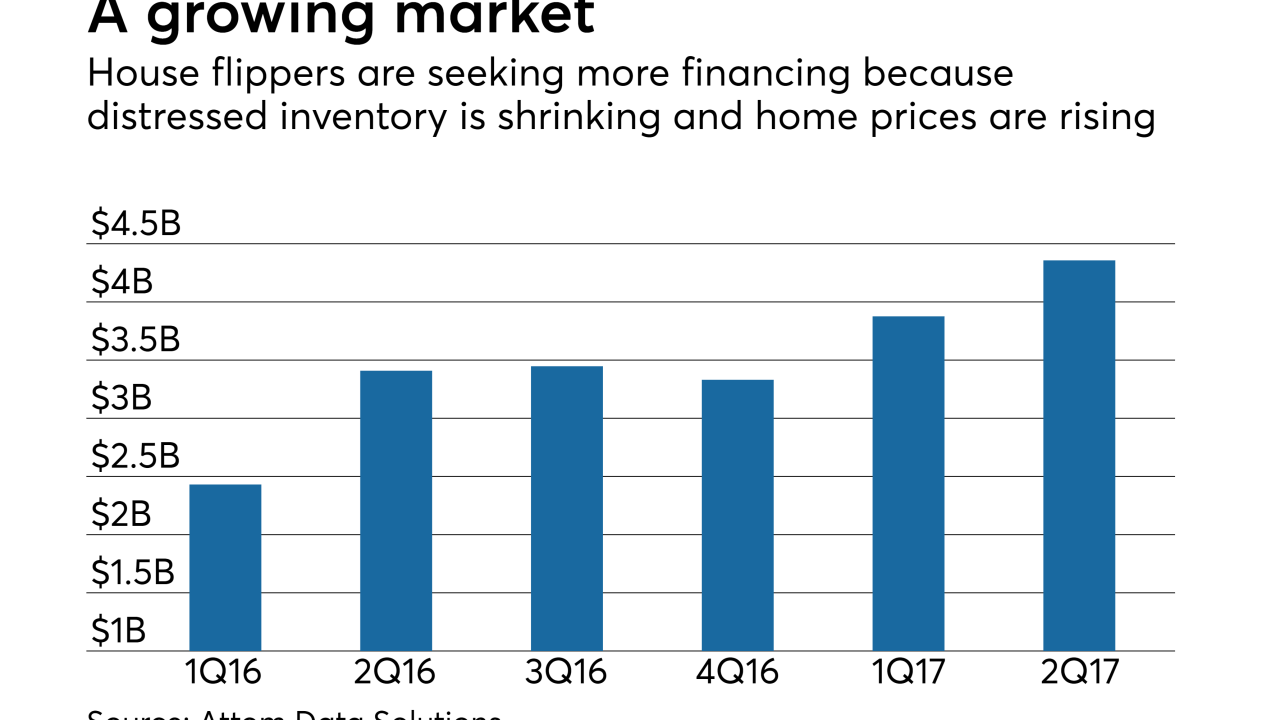

A new wholesale loan channel at CoreVest will work with mortgage brokers who are starting to source loans to house flippers for the first time.

September 28 -

The shift to a purchase market and an increase in wholesale mortgage originations contributed to a nearly 17% year-over-year rise in fraud risk during the second quarter, according to CoreLogic.

September 19 -

Walter Investment Management Corp. is in danger of having its stock delisted from the New York Stock Exchange as its average market capitalization remains below required minimums.

August 17 -

Western Bancorp, a wholesale mortgage originator, was acquired by Eli Global, a privately held investment company. Terms of the deal were not disclosed.

August 16 -

There is substantial doubt about Walter Investment Management Corp.'s ability to continue as a going concern if a restructuring plan is not approved and it needed to file a prepackaged bankruptcy plan.

August 10 -

Walter Investment Management Corp. will close its Ditech subsidiary's Irving, Texas, office by the end of 2017, according to an internal memo. It's the first step in an effort to ultimately reduce Walter's physical footprint from 13 offices to as few as four.

July 14 -

United Wholesale Mortgage will vacate its offices in Troy, Mich. for a bigger headquarters building in Pontiac and relocate all 2,100 employees.

June 30 -

Home Point Financial Corp. sold its reverse mortgage lending business to Huron Valley Financial. Terms of the deal were not disclosed.

June 27 -

David Schneider has joined Stearns Lending as its chief executive officer, replacing Brian Hale, who will be leaving the company at the end of the month.

May 18 -

Nexera Holding, which has operated as an online lender under the name Newfi, is applying that branding to the company as a whole.

May 15 -

Walter Investment Management Corp.'s first-quarter net income included a $42 million after tax gain from the sale of Green Tree Insurance Agency.

May 10 -

United Shore Financial Services has agreed to pay a total of $1.4 million to consumers and California regulators to settle allegations it collected interest payments it was not entitled to.

April 10 -

LoanDepot Inc. is exploring the possibility of reviving a stock offering after cancelling one in November 2015

March 16 -

JPMorgan Chase & Co. agreed to pay $55 million to settle U.S. allegations of racial discrimination in home loans through mortgage brokers, leading black and Hispanic borrowers to pay higher interest rates and fees from 2006 to 2009, a person familiar with the matter said.

January 18 -

Through Motto Mortgage, Remax is looking to give its smaller franchisees the same ability to offer one-stop shopping to homebuyers as larger operators, in a way that will not raise red flags for regulators.

January 10