-

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

Optimal Blue is being combined with Compass Analytics.

July 27 -

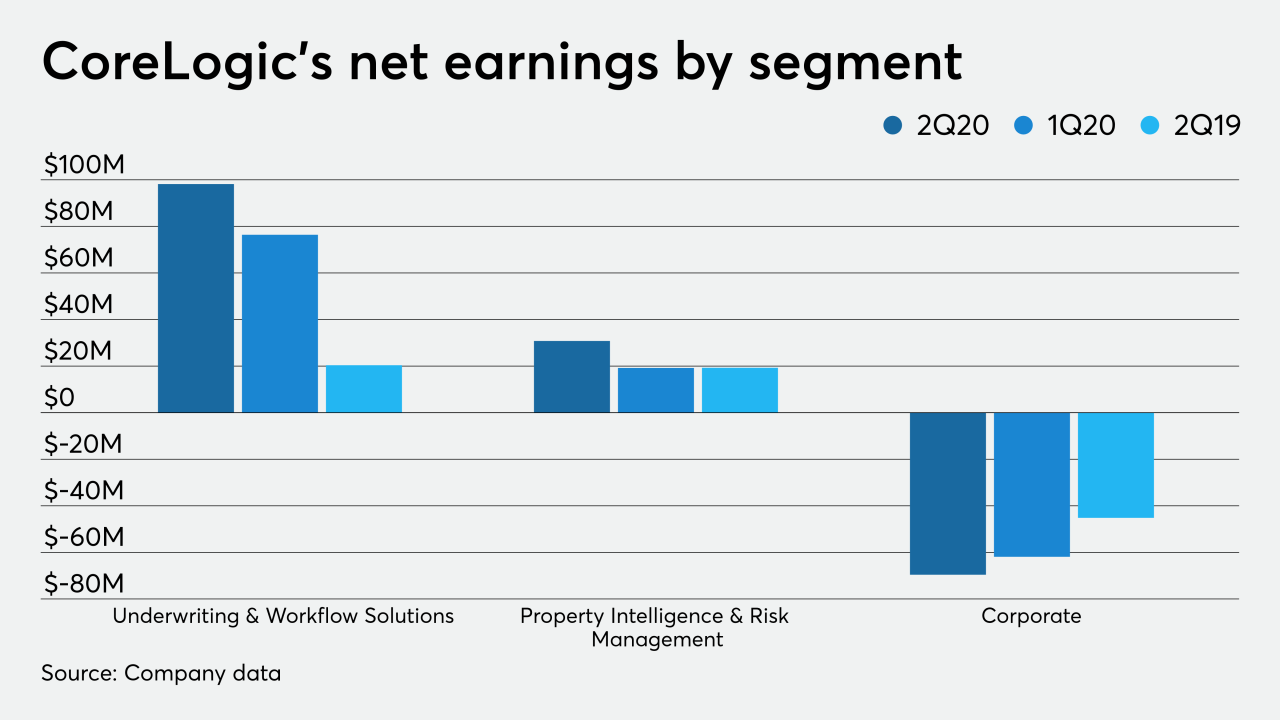

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

Almost six in 10 completely agreed that company-provided technology met or exceeded their expectations.

July 23 -

The technology company reiterated its call for the hostile bidders to raise their $65 per share offer.

July 20 -

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

It starts with understanding investor, insurer and regulatory requirements and how they're interpreted and applied.

July 20 Simplifile

Simplifile -

The chairman of the Association of Independent Mortgage Experts is distancing himself from the organization after a Quicken Loans executive's wife filed a defamation lawsuit against him for vulgar group texts.

July 17 -

Remarks that the head of the mortgage broker association made about a Quicken Loan executive's wife in a video text exchange led to a defamation lawsuit, and housing-finance companies are taking sides.

July 16 -

After months of pandemic-related delays, the joint venture between Guaranteed Rate and @properties started originating mortgages.

July 13