-

A culture that celebrates diversity, fun, and an employee-driven value system.

January 29 -

National Mortgage News presents the second annual Best Mortgage Companies to Work For — a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

January 29 -

Rooted in increased regulations and general customer backlash, there is a growing emphasis on collecting consent and ensuring privacy of customer data, especially following enactment of the California Consumer Privacy Act.

January 28 PossibleNOW

PossibleNOW -

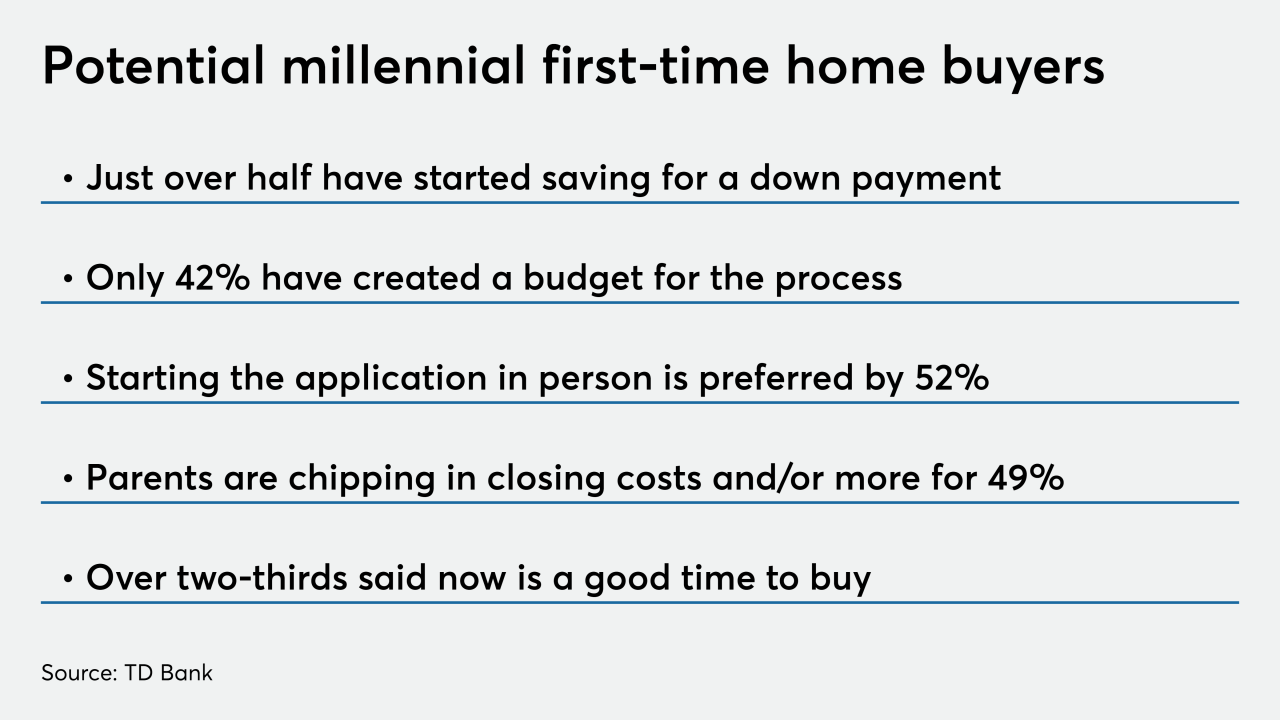

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

IBM called for rules aimed at eliminating bias in artificial intelligence to address concerns which range from identifying faces in security-camera footage to making determinations about mortgage rates.

January 21 -

Blend, a vendor that outfits some of the biggest banks and other lenders with consumer-facing digital mortgage technology, has released a new mobile application for mortgage professionals.

January 17 -

Under terms of the settlement approved by a Georgia court Monday, Equifax may also have to pay an additional $125 million if the initial amount doesn't cover all the claims.

January 16 -

Mortgage lenders' uptake of innovations in artificial intelligence, big data and other technologies has been relatively slow. It's an approach that may not be tenable in 2020.

January 16 -

Dan Gilbert has been back in the office and could soon be making his first public appearance since suffering a stroke last May, Quicken Loans CEO Jay Farner said.

January 16