-

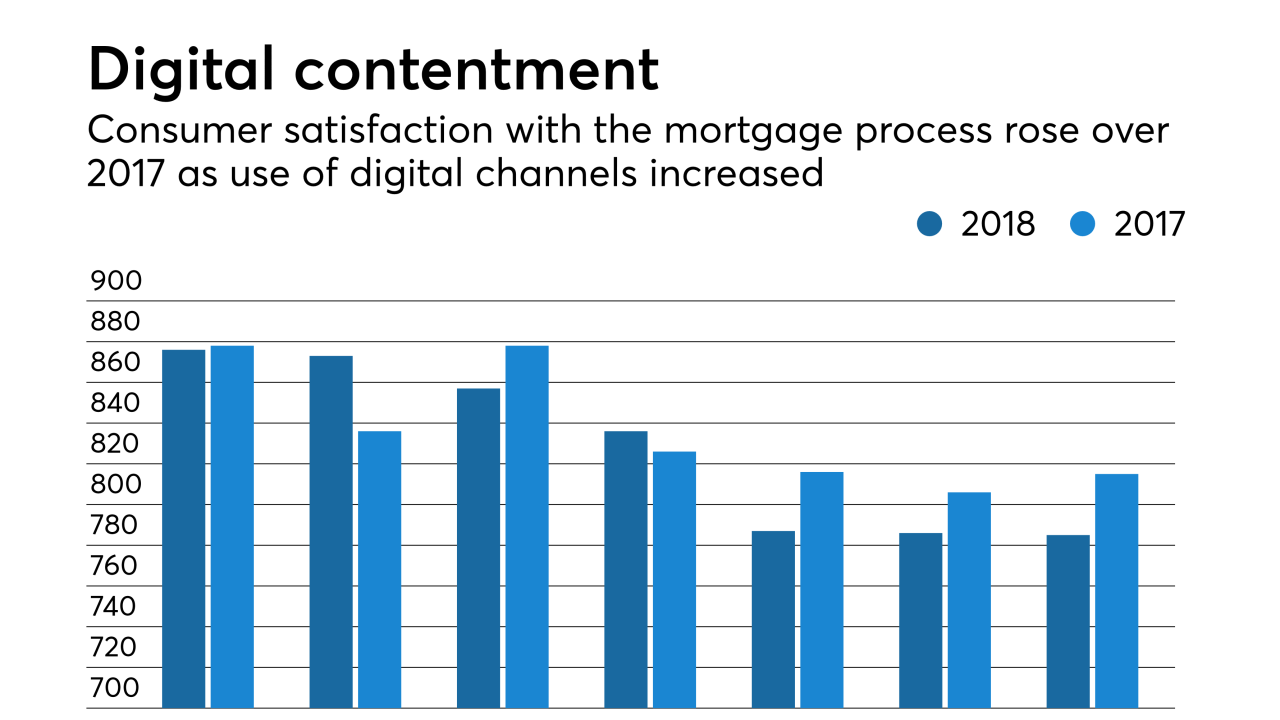

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

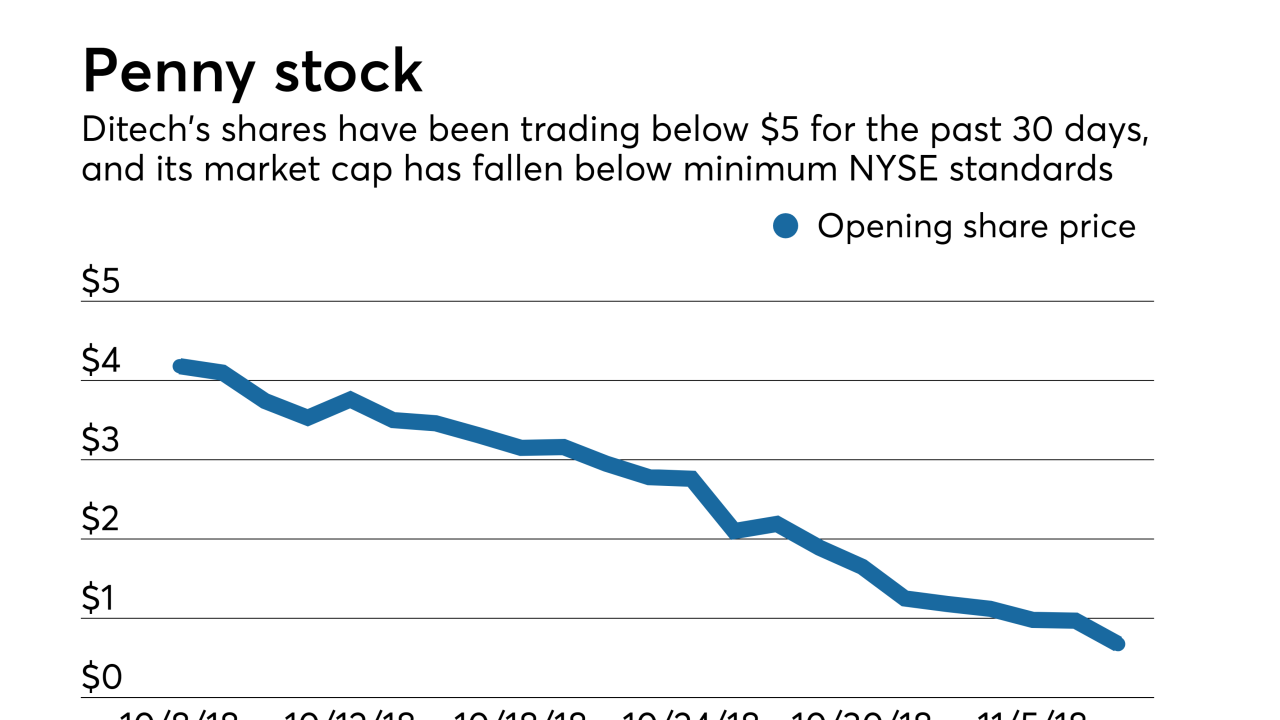

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

Texas is expected to be the tipping point in online closing adoption, and title companies predict that e-closings will soon be standard operating procedure.

November 6 NotaryCam

NotaryCam -

Amrock is calling for a new trial in its dispute with HouseCanary following a judge's denial of its motion to reverse an earlier decision in HouseCanary's favor.

November 1 -

Black Knight's third-quarter net earnings were slightly below the same period last year, although total revenue increased by 7% compared with one year prior.

October 30 -

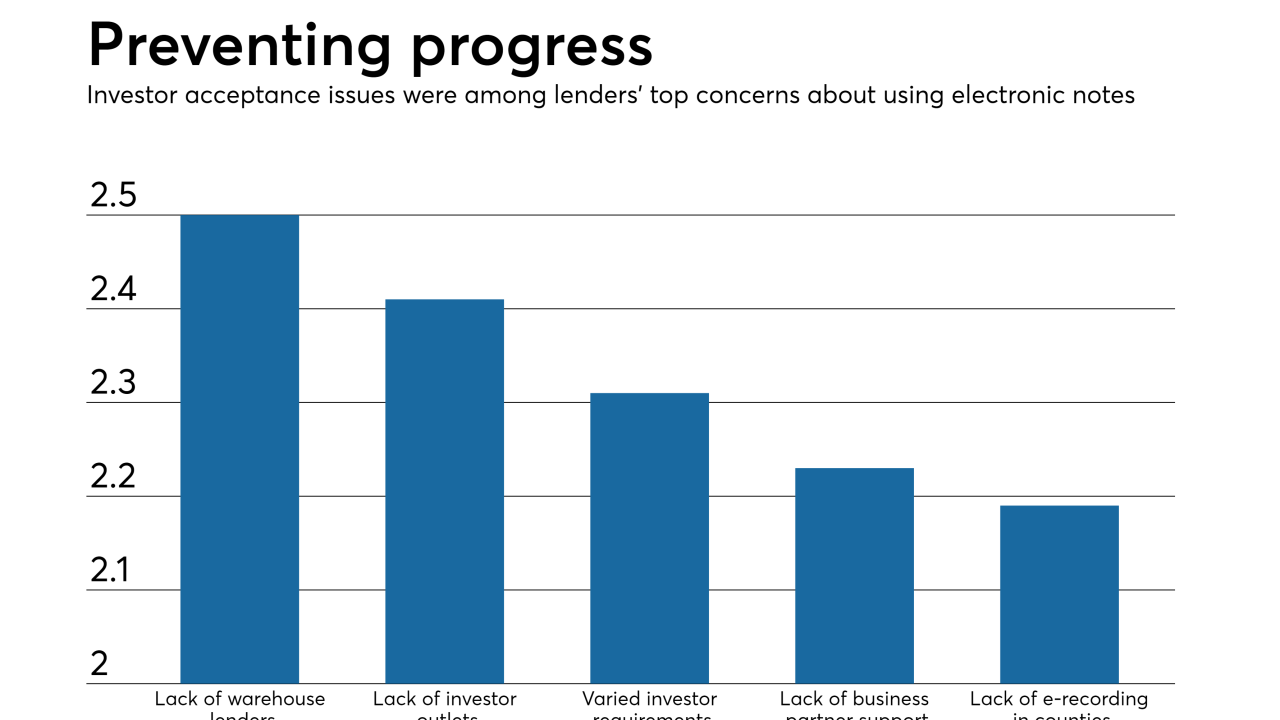

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

The Money Source is the latest mortgage company partnering with Ellie Mae to streamline workflows between lenders and correspondent investors through Encompass Investor Connect.

October 25 -

Larger mortgage companies are paying less than other creditors when fraud occurs, but the expense is still detracting enough from their revenue to cause concern.

October 23