-

Publicly traded mortgage technology firms seeking growth could eventually end up squaring off against or buying privately owned point of sale system startups.

April 17 -

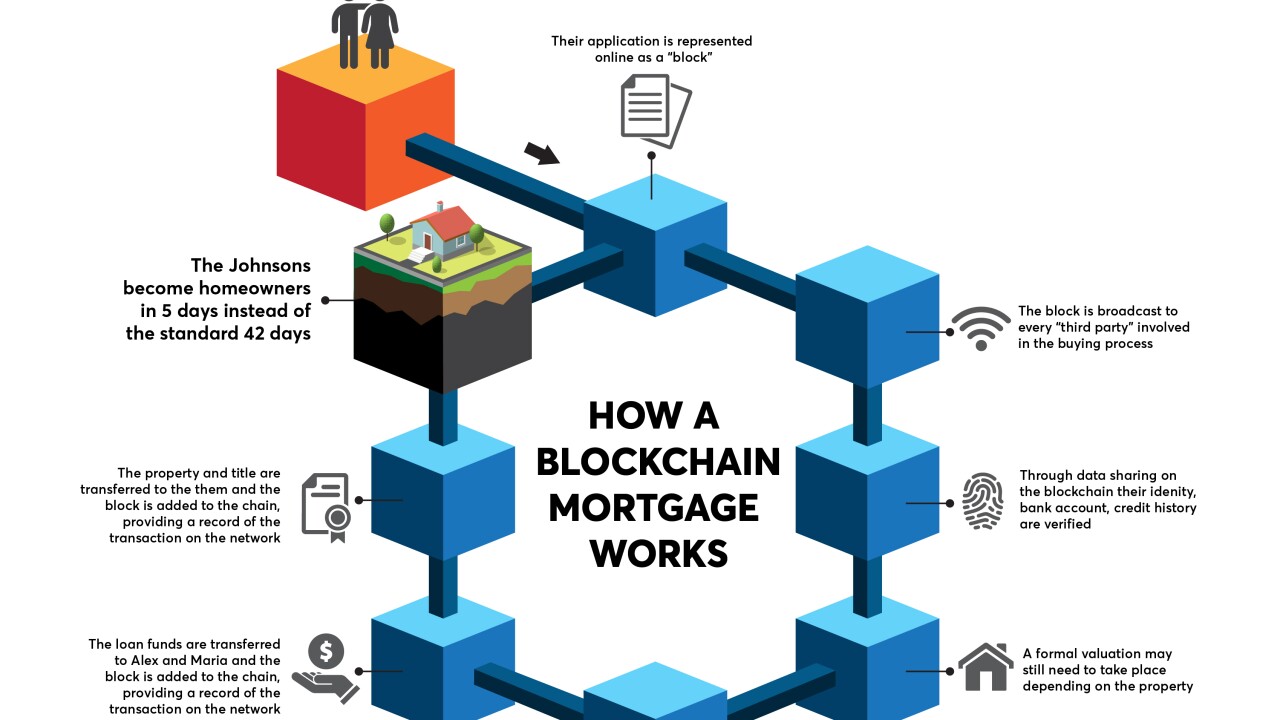

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

The Mortgage Bankers Association is calling for Ginnie Mae, states, the Internal Revenue Service and other government agencies to overcome remaining digital mortgage challenges.

April 16 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

Automating the mortgage process will force tighter margins, but drive higher volume, for lenders.

April 12 HouseCanary

HouseCanary -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

While the mortgage industry heads in a digital direction, homebuyers are still expecting a more electronic experience during the mortgage process, which would also stand to benefit lenders.

April 11 -

Applications can now be made on the bank's app or website, but closings will still be in person. With this move, BofA joins Quicken Loans, Lenda, SoFi and others offering a mostly digital mortgage. The trend is sure to continue.

April 11 -

Lennar Corp.'s home finance subsidiary with the help of Blend rolled out its own digital mortgage platform, as another small lender tries to keep up with Rocket Mortgage.

April 9