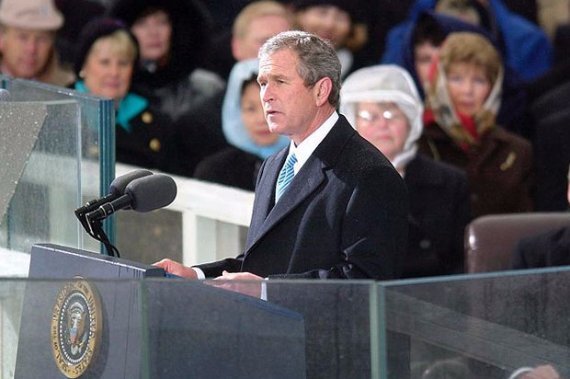

How Housing Fares When a New President Takes Office

January 4, 2017 4:40 PM

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

The acquisition complements existing lending channels at Carrington and also adds Reliance's full servicing portfolio to its platform, the company said.

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.