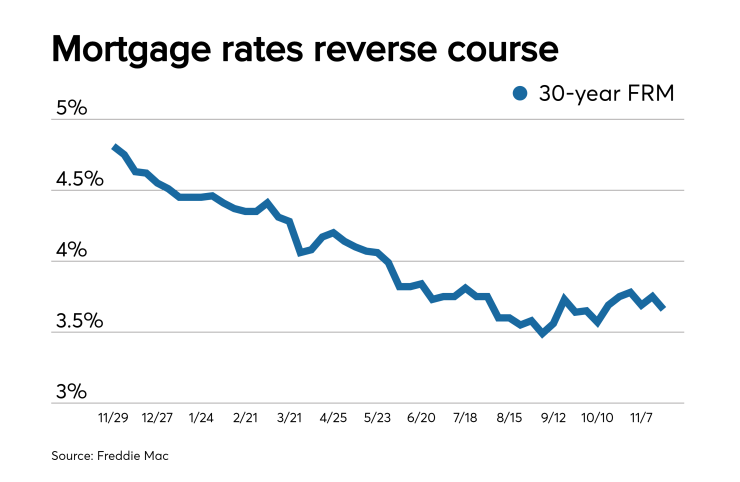

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.66% | 3.15% | 3.39% |

| Fees & Points | 0.6 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 3.66% for the week ending Nov. 21,

Rates had generally trended upward since the week of Oct. 10, when the average for the 30-year FRM fell to 3.57%.

"The housing market continues to steadily gain momentum with rising homebuyer demand and increased construction due to the strong job market, ebullient market sentiment and low mortgage rates," Sam Khater, Freddie Mac's chief economist, said in a press release. "Residential real estate accounts for one-sixth of the economy, and the improving real estate market will support economic growth heading into next year."

The 15-year fixed-rate mortgage averaged 3.15%, down from last week when it averaged 3.2%. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.24%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39% with an average 0.4 point, down from last week when it averaged 3.44%. A year ago at this time, the five-year adjustable-rate mortgage averaged 4.09%.

"Once again, it was the ongoing saga of U.S.-China trade talks that drove most of the market's movements. The discussions have shown signs of progress lately, which contributed to modest increases in bond yields and thus mortgage rates. However, despite growing optimism and the tentative agreement of an initial deal, the talks failed to yield meaningful developments in recent weeks," said Zillow economist Matthew Speakman when that rate tracker was released.

"Ambiguities regarding the tentative deal's details have thrown a wrench into the proceedings and reinjected doubts among investors, driving them to safer assets and nudging mortgage rates down."

In the short term, he is not expecting any large shift in mortgage rates, but that doesn't mean investors will not react to any trade or economic news.

"It's likely that market movements will be modest heading into the Thanksgiving holiday, but the possibility of trade-related developments will keep investors on their toes. What's more, rates are likely to respond to key readings on manufacturing and consumer spending, both due in the next seven days," Speakman said.