WASHINGTON — In a huge win for housing advocates and a setback for the banking industry, the Supreme Court on Thursday upheld the use of "disparate impact" in a Texas case alleging housing-related discrimination.

The high court ruled 5-4 that disparate impact, which says lenders and other defendants can be found liable for racial discrimination even if it was unintended, is recognized under the Fair Housing Act. The case — Texas Department of Housing and Community Affairs v. Inclusive Communities Project — is likely to bolster the use of the legal theory by the Consumer Financial Protection Bureau and other authorities, although numerous disparate cases have also been brought under a different law.

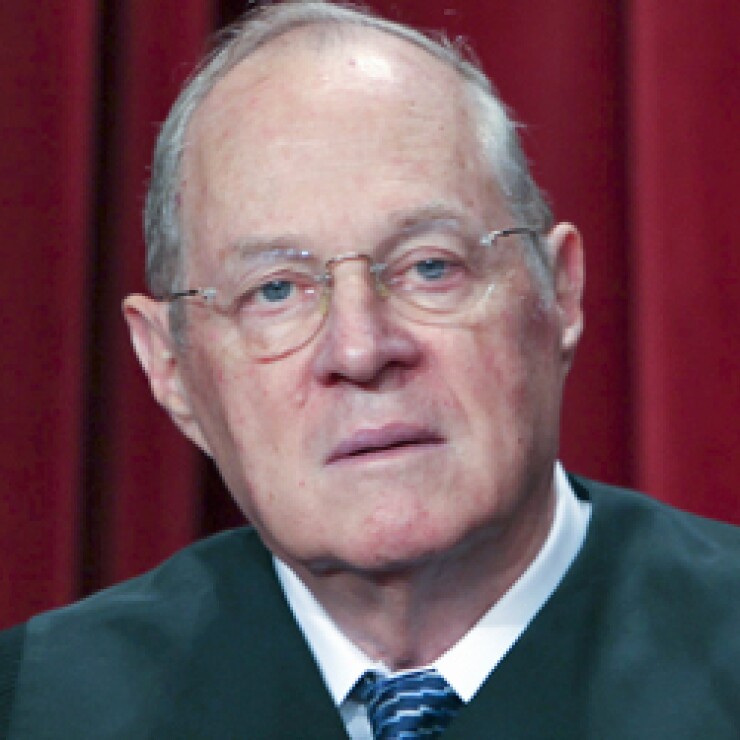

"The Court holds that disparate-impact claims are cognizable under the Fair Housing Act," wrote Justice Anthony Kennedy, who wrote the opinion and ruled alongside the court's four progressive justices.

But the decision is a blow to lenders and industry advocates who say disparate impact unfairly victimizes financial institutions that are not aware that their credit policies may have a disproportionate effect on minority neighborhoods.

The American Bankers Association "and our members are strong advocates for fair lending and enforcement of the Fair Housing Act. Disparate Impact theory, however, is not the right tool to achieve fairness and prevent discrimination in lending," Frank Keating, the ABA's president and chief executive, said in a statement. "This approach can have unintended consequences, such as causing financial institutions to shrink their operations rather than risk litigation, hurting the very groups it is intended to help."

But consumer groups applauded the decision.

"For many years, the application of disparate impact doctrine has helped to expose housing practices that may appear neutral on their face but have discriminatory effects on protected classes," John Taylor, president and chief executive of the National Community Reinvestment Coalition, said in a statement. "Housing discrimination today often isn't as blatant as it was in the past, so this is a vital tool for enforcing fair housing law. We applaud the Supreme Court for making the right decision today."

Yet groups on both sides of the debate were still busily trying to interpret the long-term effects of the ruling when it came out Thursday morning.

Questions still loomed about how the decision would be applied. For example, Joshua Block, a staff attorney for the American Civil Liberties Union,

In the specific case, the Inclusive Communities Project — a housing advocacy group — sued the state of Texas over claims that its policy of distributing housing tax credits led to affordable housing options being concentrated in minority areas.

In his opinion, Kennedy wrote that disparate impact has long been established in fair housing cases.

"In light of the longstanding judicial interpretation of the FHA to encompass disparate-impact claims and congressional reaffirmation of that result, residents and policymakers have come to rely on the availability of disparate-impact claims," he wrote, adding that many large American cities that could be potential defendants in similar cases sided with the plaintiffs in the Texas case.

But in a dissenting opinion, Justice Samuel Alito wrote that the court's approach in the decision "is a serious mistake.

"The Fair Housing Act does not create disparate-impact liability, nor do this Court's precedents," Alito wrote.