Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

Net earnings for the third quarter were $12.4 million, down 14% from

The Velocify deal also reduced Ellie Mae's

Revenue increased by 15% to $123 million from $107 million one year prior, while total operating expenses increased to $60.5 million from $49.6 million. Revenue per closed loan was $176, up from $154 one year prior.

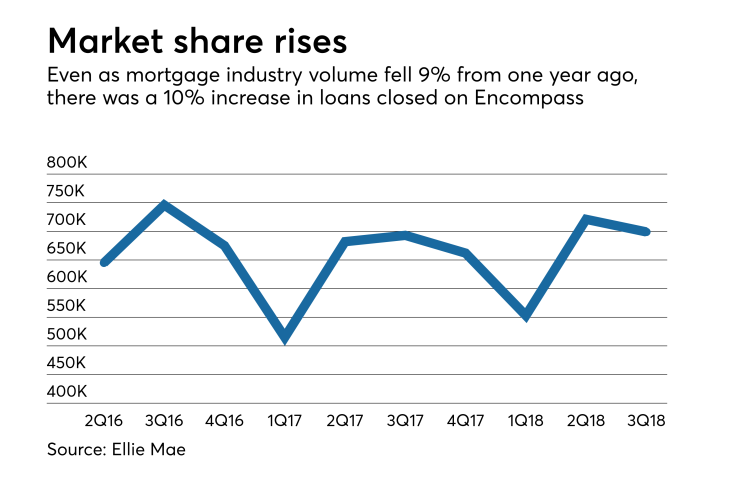

Ellie Mae estimated that 699,000 loans were closed on Encompass during the quarter, up from 693,000 on a year-over-year basis, but down from 721,000 in the second quarter.

"We were able to increase loan volume on our platform year-over-year despite industry mortgage volumes being down 9% on an absolute dollar basis and down approximately 13% on a unit basis," President and CEO Jonathan Corr said in a press release.

"Rising rates, low housing inventory and overall home affordability are serving as significant headwinds to the overall mortgage market. While we believe these headwinds are temporary, they are prompting us to reset our assumptions for the year."

For the full year, Ellie Mae's revenue is now expected to be in the range of $477 million to $480 million, a decrease from the prior guidance of $495 million to $505 million the company gave in July.

But it zeroed in on its earnings target, reducing the range to between $22 million and $24 million from the previous $19 million to $23 million. For the fourth quarter, the company is predicting net income of between zero and $2 million, with revenue between $113 million and $116 million.

"Over the long-term, we expect the mortgage industry to trend to a sustained purchase-driven market and we believe we are well positioned to drive further market share gains and technology adoption across our large customer base," Corr said.