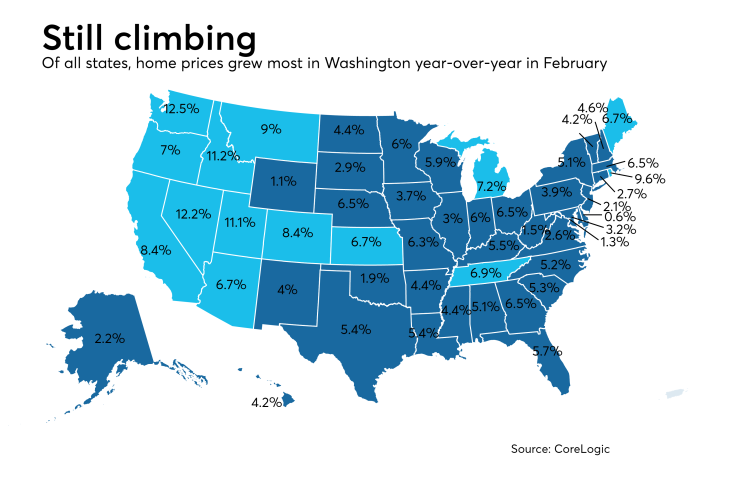

Home values grew in all 50 states in February, but their appreciation is expected to slow within the next year, according to CoreLogic.

Nationally, home prices rose 6.7% year-over-year in February and by 1%

Though household income is on the rise, it is not growing fast enough for potential homeowners to keep up with climbing home prices and mortgage rates, meaning borrowers struggling with tight housing inventory will continue to suffer with affordability issues.

The mortgage payment is taking "a bigger bite out of income for new homebuyers," according to Frank Nothaft, chief economist for CoreLogic.

Nearly half of the nation's 50 largest metropolitan areas are considered overvalued, with house prices accelerating particularly fast in the West. But contrary to homebuyers thinking values will continue to soar, the nation should see appreciation rates tame next year.

"A number of Western states have had hot housing markets. Idaho, Nevada, Utah and Washington all had home prices up more than 11% over the last year," said Nothaft in a press release.

"With the recent rise in mortgage rates, affordability has fallen sharply in these states. We expect home price growth to slow over the next 12 months, dropping to 5% to 6% in Idaho, Utah and Washington, and slowing to 9.6% in Nevada," he said.

In February, Washington led all states in annual home price growth as prices shot up 12.5% from the previous year.