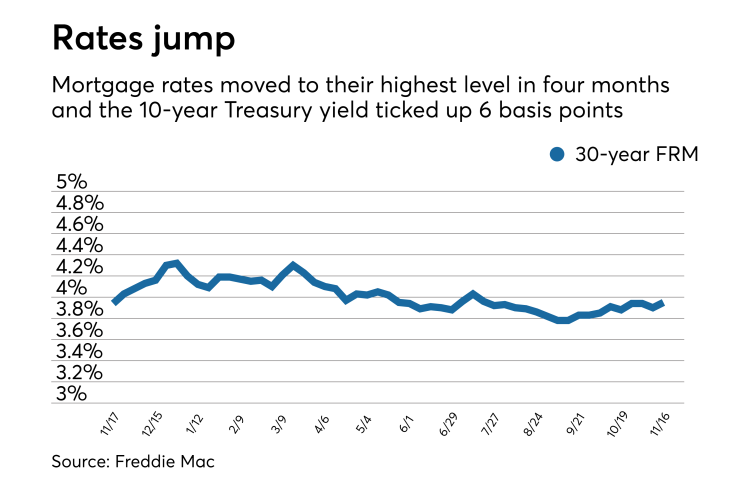

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 3.95% | 3.31% | 3.21% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 3.95% for the week ending Nov. 16,

"Rates increased this week. The 10-year Treasury yield ticked up 6 basis points, while the 30-year mortgage rate jumped 5 basis points. Today's survey rate is the highest rate in nearly four months," Sean Becketti, Freddie Mac's chief economist, said in a press release.

The 15-year fixed-rate mortgage averaged 3.31%, up from last week when it averaged 3.24%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.14%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.21% this week with an average 0.4 point, down from last week when it averaged 3.22%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.07%.

"After a minor surge late last week following the release of the Senate's tax reform bill and strong economic data from the European Union, mortgage rates held steady for the first half of this week," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"All eyes are on the tax reform bill this week, as the House is expected to vote on it. If the bill passes, it could put upward pressure on rates as investors become more optimistic that the tax cuts will take effect," Terrazas said.