Loan officers still rule the roost at most mortgage origination shops, but processors may finally be starting to get their due.

Long gone are the days when the mortgage industry

At Churchill Mortgage, new hiring has focused on back-office workers who are "not paper-pushers, but good quality processors. That's something that I think everybody's looking for right now," said Matt Clark, chief financial and operations officer of the Brentwood, Tenn., lender that has branches in 13 states.

Like any origination-related position, the demand for processors fluctuates with rate-driven volume and the pace of new compliance requirements. The year started off with both

"We wouldn't be hiring if we thought it was a low-rate blip," Clark said of the strong start to 2015.

After a sharp drop in jobs at the

The cyclical nature of mortgage originations means it's imperative for lenders and workers alike to make employment decisions that won't be undermined by wild market swings. But lenders are more tolerant of short-term employment lapses for well-qualified underwriters than with sales-focused loan officers, said Eric Levin, a managing partner at mortgage and financial services recruiting firm Hammerhouse.

"At the end of the day those positions can become human capital," he said of back-office workers. But for loan officers, "the longer they are out of the business, the more chance there is that they don't have referral relationships anymore."

Finding a quality processor is on par with finding a strong compliance officer, said Churchill's Clark — which is saying something, given how sought-after compliance staff has been during the years of

"Good ones," he stressed about processors. "There are a lot out there that may not qualify."

But today, every mortgage production-related position is selective. Employers don't just want underwriters; they want people with the wherewithal to do a strong, defensible manual underwriting of a loan. In some cases, they may be willing to offer

"Probably the biggest demand is for good underwriters who are not just dependent on an automated underwriting system. Subjectivity is needed outside of the matrix and as the buybacks happen, you have to argue a decision," said David Lykken, managing partner of the consulting firm Mortgage Banking Solutions. "Smart business owners and executives are paying up for that position."

However, loan officers are still a very selective position for lenders to fill, said Kurt Noyce, president of Embrace Home Loans in Newport, R.I.

"The sales positions are always in fashion. I don't know if they're hot, [but] they probably remain the most challenging to fill in terms of finding quality," he said.

And a lender's job isn't over once it finds and hires a quality loan officer. More than compensation, a lender's best retention strategy is ensuring that loan officers and their referral partners, like real estate agents,

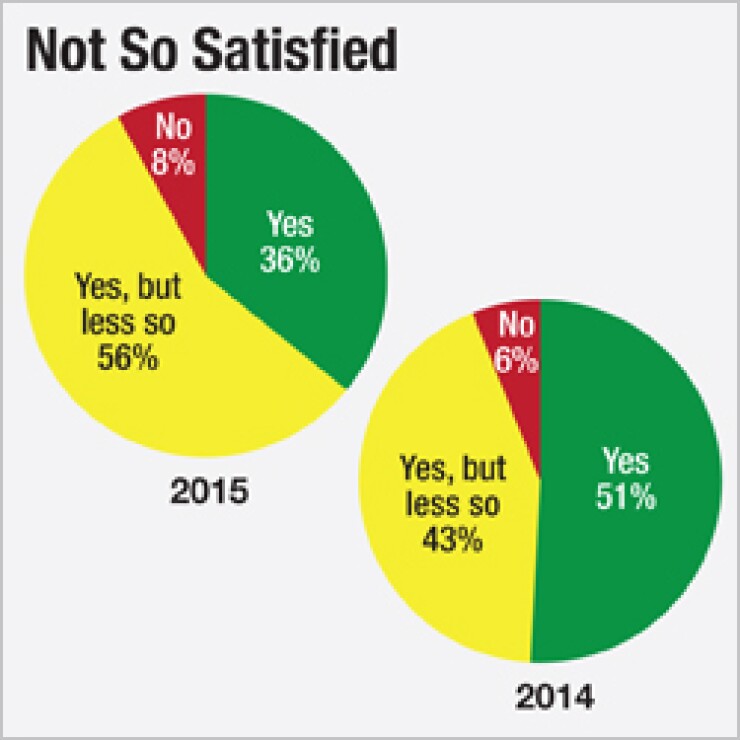

While most loan officers in an annual Hammerhouse survey said they were sufficiently rewarded by their careers (both monetarily and professionally), a greater share indicated that regulatory and market changes have made them less satisfied than in previous years.

"For your lower-producers, it may very well be salary," Levin said. Some also might be frustrated by compliance changes that have added complexity and effort to their work.

Despite the growing focus on the back office, loan officers who produce high volumes of purchase loans regardless of interest rates and are a good fit for the company's culture are always in high demand, because "that's what pays the salaries" of all the other positions, said Levin.