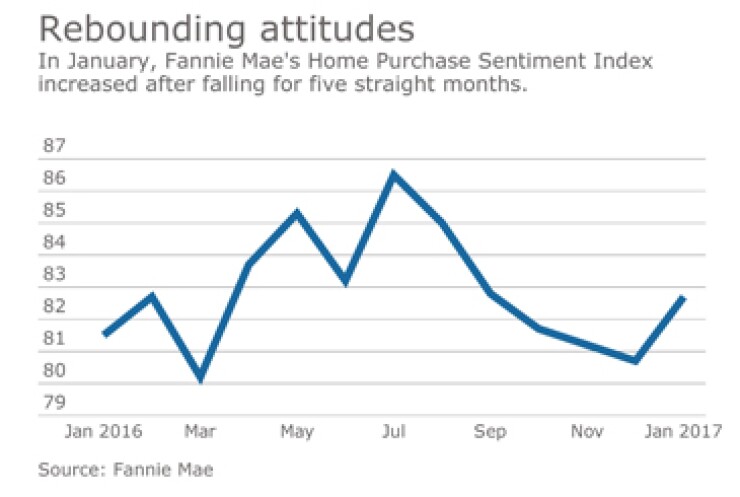

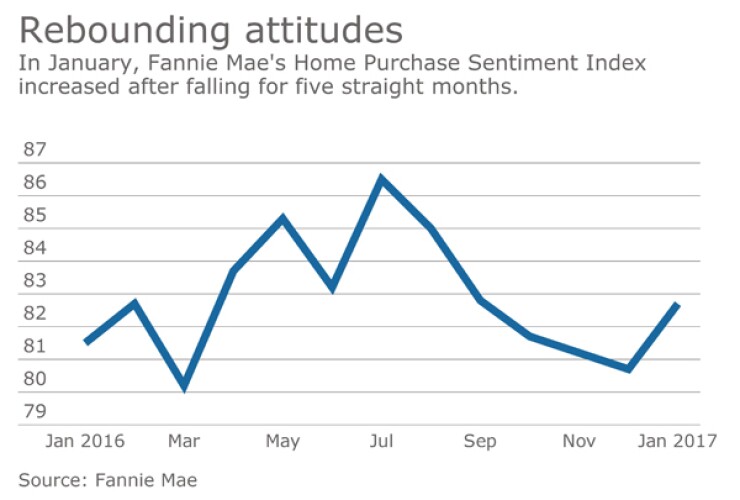

The Fannie Mae Home Purchase Sentiment Index rose two percentage points to 82.7 in January, reflecting the more positive consumer outlook following November's presidential election.

The index is based on the results of six questions from Fannie Mae's National Housing Survey. Four of the six components improved in January from the month prior.

"Three months after the presidential election, measures of consumer optimism regarding personal financial prospects and the economy are at or near the highest levels we've seen in the nearly seven-year history of the National Housing Survey," Doug Duncan, senior vice president and chief economist at Fannie Mae, said in a news release.

"However, any significant acceleration in housing activity will depend on whether consumers' favorable expectations are realized in the form of income gains sufficient to offset constrained housing affordability," Duncan added. "If consumers' anticipation of further increases in home prices and mortgage rates materialize over the next 12 months, then we may see housing affordability tighten even more."

The share of respondents who said mortgage rates will go down over the next 12 months stayed the same as in December at negative 55%.

The only other component not to increase was the net share of Americans who said it is a good time to buy a house, which fell by 3 percentage points to 29% and matched the survey low from May and September.

The net share of respondents who believed that home prices will rise increased by seven percentage points in January to 42%. Similarly, the net share of respondents who believed their household income is significantly higher than a year ago rose by five percentage points to 15% in January, reversing the previous month's drop.

Meanwhile, the net share of those who said it is a good time to sell rose by two percentage points to 15%. And the net share of respondents who said they are not concerned about losing their job rose one percentage point to 69%.