Talk about jumping the gun.

Equifax and TransUnion have stopped offering traditional credit reports, replacing them with the more expensive trended credit reports that Fannie Mae plans to start using, but that other investors don't.

The move has forced mortgage lenders to pay for extra data they don't need and their investors don't require.

"The industry now has trended credit data whether you want it or not," said Stan Baldwin, chief operating officer of credit reporting agency Informative Research, a company that provides merged reports from the bureaus to lenders.

The two credit bureaus stopped selling the traditional reports earlier this month, well before the

"There won't be an option to get the old version, but the old data's still there — it's just that the trended data is added," said Susan Chana, a senior director of public relations at Equifax.

While a traditional credit report provides a "snapshot" of how borrowers have been using credit instruments like cards and auto loans, trended data shows how consumers have utilized these credit trade lines going back 24 months in Equifax's case and 30 months in TransUnion's.

Equifax does charge a slightly higher price that varies by user for the trended data, Chana said. Both

Lenders and credit resellers like Baldwin said they understand the need for trended data, but they wonder why they, and ultimately their borrowers, must buy trended data when it's not required, like when they are selling a loan to Freddie Mac or originating government-insured products.

"We can't parse out, 'This is going to be a Fannie Mae DU loan.' So for every FHA, VA, USDA and Freddie Mac loan, the consumer has to pay the slightly higher price. It's $3 more," said Catherine Blocker, an executive vice president at Guild Mortgage in San Diego. "So from a practicality standpoint, we end up having to pay for the trended credit data."

"It's frustrating to pay for it for many loans that don't require it," she added.

Aside from Fannie's upcoming requirement, trended data provide more value to lenders in underwriting or other risk assessments of their own loans, according to TransUnion.

"Trended data can not only significantly improve lenders' ability to predict risk, but can also positively impact vast numbers of consumers in the housing market through better pricing and access to mortgage loans," said Joe Mellman, vice president and mortgage business leader at TransUnion, in an email.

The data can be used to distinguish between borrowers who are "transactors" and tend to pay off their debt, or at least more than the minimum due, and "revolvers," who maintain higher balances. The ability to make that distinction could benefit transactors as it suggests they are more likely to repay their loans.

Yet it could also result in more denials for individual revolvers, even though Fannie had said it doesn't anticipate overall loan

"Down the road, as we start seeing DU findings that incorporate this data, we may get a loan that was an 'approve eligible' and now it's a 'refer' because of trended credit data, possibly," Blocker said. "Basically that's a denial."

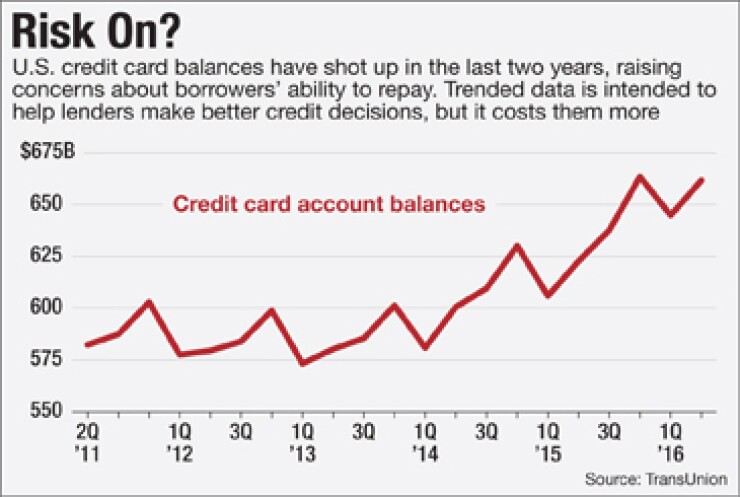

Fannie's trended data initiative is starting by focusing on consumers' revolving credit card debt. Total levels of revolving debt have been trending slowly upward.

General purpose credit card debt totaled nearly $662 billion in the second quarter, compared with a little more than $582 billion in the second quarter of 2013, according to TransUnion.

However, "transactor" consumers that tend to have higher credit scores generally carry lower levels of debt that trended data aims to help highlight. Lenders currently submit FICO scores that don't take trended data into account. Fannie has been under pressure to

Lenders "can make more informed decisions" about loans by referring internally to trended data, regardless of its submission to DU, but Fannie Mae doesn't mandate it, said Pete Bakel, senior director for external communications at Fannie. He declined comment on the two credit bureaus' decision to discontinue traditional credit reports for other loans.

But lenders have a lot of factors to weigh in deciding whether to use trended data in underwriting for all loans, including how examining the additional data might affect processing time and how much that time expenditure is worth.

Until the extent to which trended data's effect on Fannie's loan decisions and pricing becomes clearer, Blocker said it would probably be examined on a case-by-case basis.

"I think if we got a denial, or a refer, from Desktop Underwriter and we couldn't really tell why, we would then go and review all the trended credit data to see if the answer might be there, because it might be a person who's just a revolver, who pays the minimum amount due each month," she said.

Experian, the third company that provides the tri-merged credit reports typically used in the mortgage industry, does offer the traditional report alone at a lower price, according to spokesperson Susan Henson. Experian also offers trended data with a lag, and will make it

Experian's data has not been part of Fannie's trended data requirement but could be. So for now could lenders use its less-expensive traditional credit report only when not selling to Fannie? If a lender wants a saleable loan, the answer is no, as investors require a three-file merged report, Blocker said.