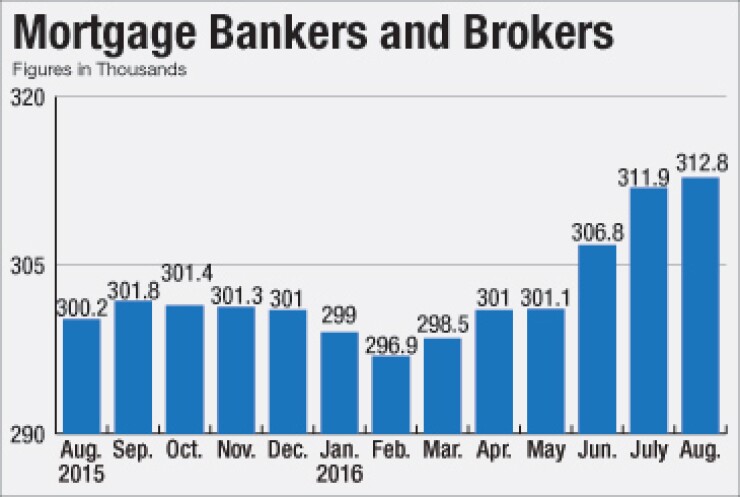

Hiring by independent mortgage banking and brokerage firms slowed in in August, after adding 5,100 full-time loan officers and other employees to their workforce in July.

The Bureau of Labor Statistics reported Friday that lenders in the nonbank mortgage and brokerage sector added 900 employees to their payrolls in August.

Total employment in this sector rose to 312,800 — the highest since 2008.

The slowdown came as both new and existing home sales declined in August and sales in previous months were revised downward, according to economists at Wells Fargo Securities.

The economists note that the lack of new and existing homes for sale is creating a drag on sales and the inventory issue is not going to be "rectified soon." But they are still bullish on the housing market.

"The August soft patch has not altered our outlook. Sales of new homes through the first eight months of this year are running 13.3% ahead of the same period in 2015 and starts of new single-family homes are up 9.1%," according to an Oct. 3 WFS Housing Chartbook.

Mortgage Bankers Association economist Joel Kane noted that low interest rates have sustained refinance activity. "In addition, lower rates also seem to be helping potential homebuyers enter the market, although purchase activity has eased in recent weeks," he said in a Sept. 12 Forecast Summary.

There was some encouraging data along with the bad news for housing, said Fannie Mae chief economist Doug Duncan.

"Housing seems to have hit a soft patch, with residential investment likely posting a second consecutive quarterly decline last quarter despite positive labor market and mortgage rate trends. The labor report did include an increase of 23,000 construction jobs and a 3.4% annual gain in construction wages, suggesting a coming improvement in housing supply," he said.

Meanwhile, BLS reported that the U.S. economy created 156,000 jobs in September, down slightly from 167,000 in August. The August employment report was revised upward from 151,000 jobs. The U.S. unemployment rate ticked up to 5% in September from 4.9% in August. There is a one-month lag in BLS reporting of mortgage industry jobs data.

Any jobs number above 150,000 is a "good number," according to Scott Anderson, Bank of the West chief economist. And it won't force the members of the Federal Open Market Committee to "deviate" from their "plan to raise rates before the end of the year," he said Friday.