New York Community and Astoria Financial have a lot of explaining to do.

The banking companies left many industry observers scratching their heads after terminating their planned $2 billion merger, announcing the decision Tuesday in a one-paragraph press release that was short on details.

Many people are pondering why the deal, among the biggest announced last year, fell apart and what the future holds for each institution.

The $49.5 billion-asset New York Community had hoped that buying the nearly $15 billion-asset Astoria would help it confidently cross a key regulatory threshold. Astoria in Lake Success, N.Y., had been facing investor pressure to boost shareholder value or find a buyer before finding its way to New York Community in Westbury.

Several people have pointed to the role of regulators as a possible factor. New York Community announced last month that it would be unable to get regulatory approval in time to close the deal by Dec. 31.

"It is an example of the scrutiny…that big bank deals are getting," said William Wallace, an analyst at Raymond James, particularly if there is a "regulatory trigger" involved. "Regulators want to make sure they get it right."

One issue may have been commercial real estate concentrations, which has been a hot button issue for regulators. New York Community, which is already heavily concentrated in CRE, would have done little to address that by absorbing Astoria’s balance sheet.

New York Community is also poised to become a systemically important financial institution by crossing $50 billion of assets. While regulators have approved other large bank mergers, New York Community's looming SIFI status could present a challenge given its thrift status and its CRE concentration, industry observers said.

"A common method for regulators — when they aren't pleased with a deal — is to extend the period for approval," said Jeffrey Marsico, an executive vice president at Kafafian Group, which had worked with Astoria before the sale announcement. "I mostly think it was the CRE concentration of New York Community. It wouldn't be relieved much with the Astoria acquisition."

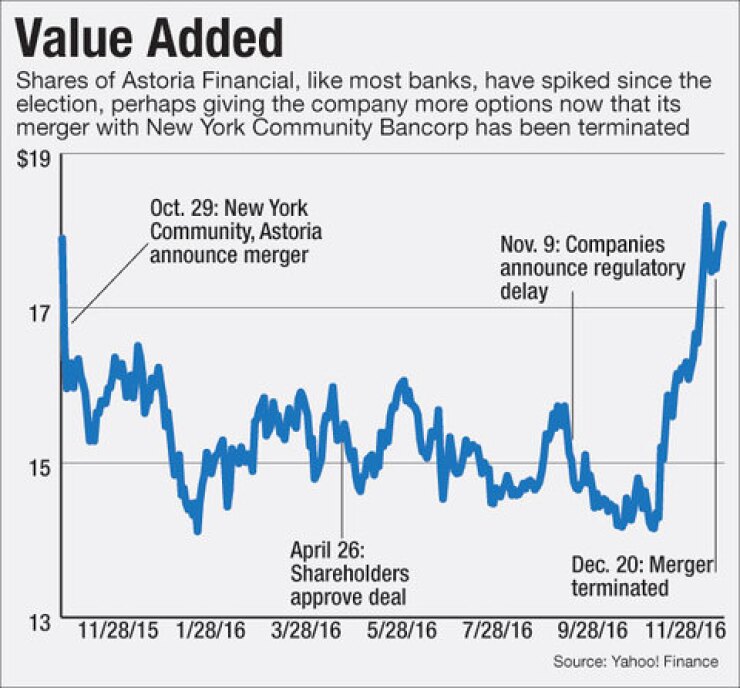

Internal issues could have also been at work, some industry observers said. It is possible that Astoria may have wanted to renegotiate, given the recent surge in bank stocks and an improved outlook for the industry following the outcome of last month's presidential election. (Those factors recently prompted PrivateBancorp to delay a shareholder vote tied to its proposed sale to Canadian Imperial Bank of Commerce.)

Regardless of the reasons, the deal's termination leaves more questions about the fate of each company.

Astoria did not return a call seeking comment, while New York Community declined to comment beyond what was said in the release. Representatives for the Federal Reserve and the Office of the Comptroller of the Currency declined to comment.

Astoria's board, which considered multiple offers last year, could have more leverage in future negotiations, industry observers said. The company’s shares have risen by 9% since the deal was announced in late October 2015 — and by 19% since the election — and the merger agreement had no breakup fee if the deal couldn’t be completed by Dec. 31.

Astoria could decide to remain independent.

Before agreeing to sell, Astoria had been diversifying beyond residential mortgages by scaling up in CRE and multifamily lending, Marsico said. The company has also been developing better core funding.

"Astoria does have some quality executives that aren't at retiring age," Marsico said. "They can go it alone being so deep into the transformation of their balance sheet. They could continue to amp up their balance sheet and look for targets to acquire."

While staying independent is possible, doing so can be extremely difficult once an institution starts preparing for a sale, industry experts said. Employee defections are a concern; Astoria's workforce at Sept. 30 was down by 11% from a year earlier, according to data from the Federal Deposit Insurance Corp.

Perhaps one of the banks that failed to snag Astoria could resurface, said Michael Iannaccone, a senior adviser at Tangent Capital Partners. "It's hard to find someone to sell and [know] what they're willing to sell for but because Astoria has already agreed to sell, you have the answers to those questions," he said.

As for New York Community, management might choose to stay below $50 billion in assets by selling off originations, a strategy it has employed in recent quarters, until it finds a new acquisition or Washington makes fundamental changes to the SIFI standard or other key bank regulations. But doing so would also limit the company's ability to boost profit.

Regulatory relief is not a guarantee, industry observers said. And it is unclear if the company could get approval for buying another institution, particularly if its own CRE concentrations were an issue for getting approval for the Astoria deal.

"I don't see them being in a hurry to go over $50 billion of assets, but I don't know what the downside to going over in the first quarter is either," Wallace said. "There's a lot of brain drain that comes with preparing for a merger."