There will be some job cuts and United Guaranty Corp. will eventually be rebranded now that the purchase of the private mortgage insurer by Arch Capital Group Ltd. has been completed.

American International Group, New York, agreed in August to sell United Guaranty to Arch Capital

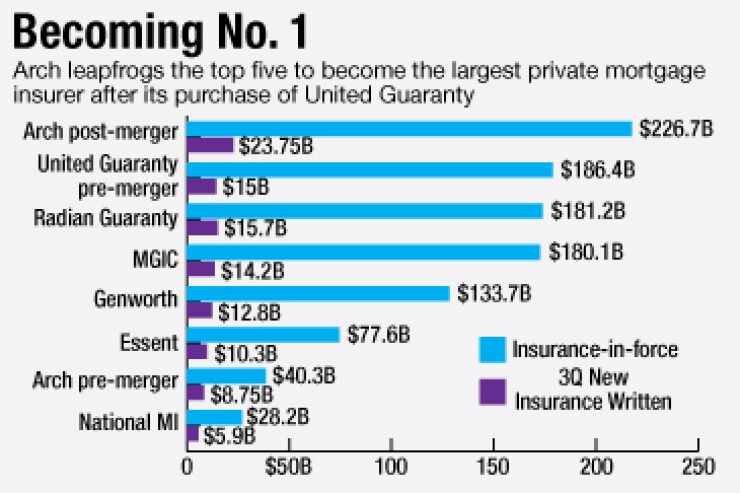

UG was the largest private mortgage insurance company as measured by insurance-in-force with $186.4 billion as of Sept. 30, 2016. Arch Capital got into the business in January 2014

Radian Guaranty is the second largest in terms of IIF with $181.2 billion, while Mortgage Guaranty Insurance Corp. is third with $180.1 billion.

Now that the deal is completed, the headquarters of Arch U.S. MI is being moved from Walnut Creek, Calif. to United Guaranty's offices in Greensboro, N.C.

David Gansberg will remain in charge of Arch U.S. MI Holdings as its president and CEO. UG's president and CEO Donna DeMaio will stay on as a senior advisor at Arch Capital Group (US) Inc., said Andrew Rippert, the CEO of Arch Capital's global mortgage group, in an interview. In that capacity she will report to Marc Grandisson, the president and COO of the Hamilton, Bermuda-based Arch Capital Group Ltd.

DeMaio will work with Arch on integrating the operations of UG, along client transitions and cultural integrations. Plus she will work with Grandisson on broader issues across Arch as those opportunities and issues arise.

"The great thing is that Donna will be around to make sure, to help us to integrate and transition customers, which I think is a very important thing because customer service for us at Arch — as it was at UG — a is of paramount importance. We can't have any disruption in customer service, client service of our mortgage insurance business," Rippert said.

For now, United Guaranty will continue to operate under its current name. But "ultimately it will be under the Arch brand" which is common practice at the company, he said.

There will be cuts in the sales force. Prior to the completion of the deal, UG had a 100-person sales organization, while Arch had a 75-person team.

"Having a 175-sales person team for a sales operation for any MI company is probably way too many people. UG had the right size sales force for the size operation they were," he said.

The prevailing view after the deal was announced was that Arch

"Even if it was one and one equals two from a market share perspective, which there is a chance it could be, you still don't need a sales force the size of the combined sales force of both organizations," Rippert said. "It still doesn't require that number of people."

There are also likely to be job reductions in Walnut Creek, although Arch will maintain a presence there even after the move to Greensboro is completed, which could take as long as two years.

Prior to the deal, Arch Global MI had 400 employees and the transaction added about another 1,000, Rippert said.

Right now Arch's primary focus is on continuity in customer service and the writing of new business.

"Our guiding principle is to be efficient but not be efficient to the point of disrupting customer service or new business production," he said.