Arch U.S. MI's

"I think if you have fewer competitors there is less pressure on pricing," said Fitch Ratings analyst Donald Thorpe. That being said, a company could still decide to cut price to get market share.

Arch was considered to be one of the

Still, Arch and United Guaranty see their respective pricing methodologies as a competitive differentiator that helps them more accurately model the long-tail MI business.

"We both focus on and culturally are aligned to appropriately price risk using all the tools in the toolkit including in-depth analytics," said Arch Capital Group CEO Dinos Iordanou during a conference call.

On the marketing side and customer satisfaction side, UG was better than Arch and it will incorporate that into its future operations, Iordanou added.

It is unlikely there will be any other consolidation in the MI space because this deal is the only apparent transaction in this very limited market.

"This is kind of the obvious one. Of the remaining players there aren't any obvious candidates to us," said Bose George, an analyst with Keefe, Bruyette & Woods.

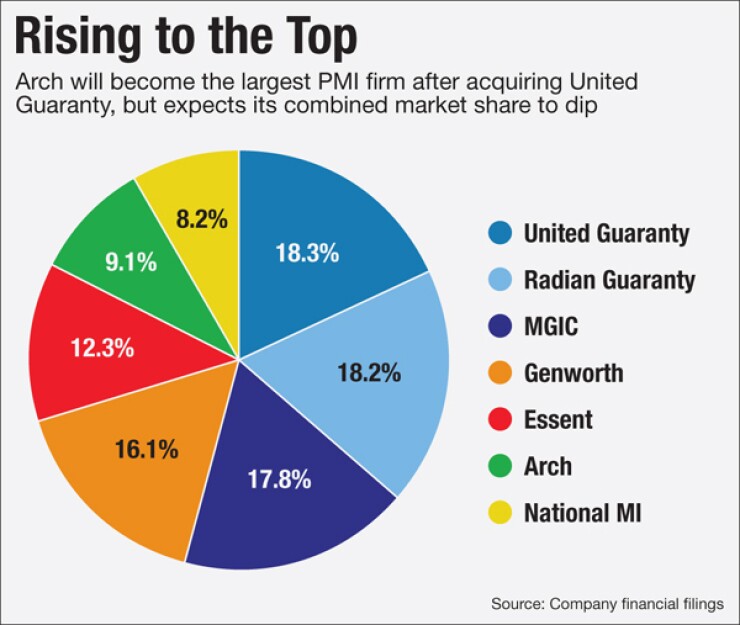

"This transaction made a lot of sense because one of the companies has a much smaller [market] share, so the amount of cannibalization is limited," he said, adding that an Arch/UG combination could lose as much as five percentage points from a pro forma 27.4% second-quarter NIW share for the merged entities.

If two of the larger players ended up combining, "you could end up losing quite a lot of business," he said.

The lenders who use both Arch and UG are likely to shift a portion of their business around to other underwriters.

However, given Arch's start as CMG Mortgage Insurance, whose

This particular transaction "should result in greater client retention than a hypothetical merger of two large mortgage insurers. Client retention is a meaningful consideration in mergers, reducing the attractiveness of combination between two established players," he said.

Consolidation is a hot topic in the industry. Assuming a mortgage originations market of $1.5 trillion per year, the share that would use private mortgage insurance is approximately $200 billion in originations and that was

But George believes this one deal could be the extent of any shrinkage in industry numbers. Still there are two names that have been mentioned as acquisition candidates.

There is Genworth, where the CEO of the parent company has already said the company is

But Genworth finished the second quarter with a 16.4% share, making it difficult to be absorbed by a larger player, George said. It is still a business that could be sold.

NMI Holdings, the only MI with a smaller market share than Arch, is not a candidate to be an acquirer as management said it has reached the amount of NIW it needs to be profitable on a consistent basis going forward. Thus the pressure on NMI to grow is diminished, George said.

Plus, Arch is more able to fund the acquisition of a larger player given the size of its holding company. NMI just achieved profitability for the first time this past quarter.

Still, NMI is likely to benefit as lenders shift some of their low down payment mortgages to other underwriters.

Another company that observers had

A Radian-Essent combination is challenging because it would create a company with a pro forma NIW market share of over 30%; with lenders looking to spread their risk around, that combination could lose around 10 percentage points making such a deal unlikely, George said.

Fitch Ratings does have some concerns about Arch Capital being able to integrate United Guaranty because of the unit's large size and Arch's limited experience in making acquisitions. But this concern is on the corporate level and not on the mortgage insurance operational level and so should not be a concern for lenders, explained Senior Director Brian Schneider.