The rate of home price recovery during the seven years that a foreclosure remains on a consumer's credit report is one measure of whether borrowers who strategically defaulted

But the results vary, depending on when, where and in what price tier that borrowers defaulted.

After dropping more than 30% from the April 2006 peak, average national home prices are down by only about 7%, according to CoreLogic's latest home price index data. Lower priced homes generally recovered less on average.

Zillow, which measures investment in a home compared to investment in the S&P 500 and renting in its Breakeven Horizon study, found that although most consumers who bought at the outset of the housing boom broke even twice, they currently have equity deficits.

"If you bought in 2005, you could be completely in the hole," said Svenja Gudell, Zillow's chief economist.

Many owners who bought in 2005 and 2009 are still stuck with homes worth less than if they had rented and invested in the S&P instead, Zillow found. But most of those who purchased in markets that bottomed in 2012 did see their value restored.

"If you bought your house in 2012, you most likely have at least broken even on that home," Gudell said.

In addition to timing, there are big regional differences in price trends to consider.

"The one that sort of jumps up at me is Northern California: the San Francisco area. I think that is the biggest percentage increase from the peak, not from the bottom. The places that are desirable places to live, they've come back," said Frank Pallotta, CEO of Steel Curtain Capital Group LLC, a mortgage industry advisory and consumer marketing firm.

Home prices peaked in the greater San Francisco market in June 2007, according to CoreLogic. By February 2011, prices had dropped 24%. But prices are now 37% from the pre-crash peak, according to the latest HPI data.

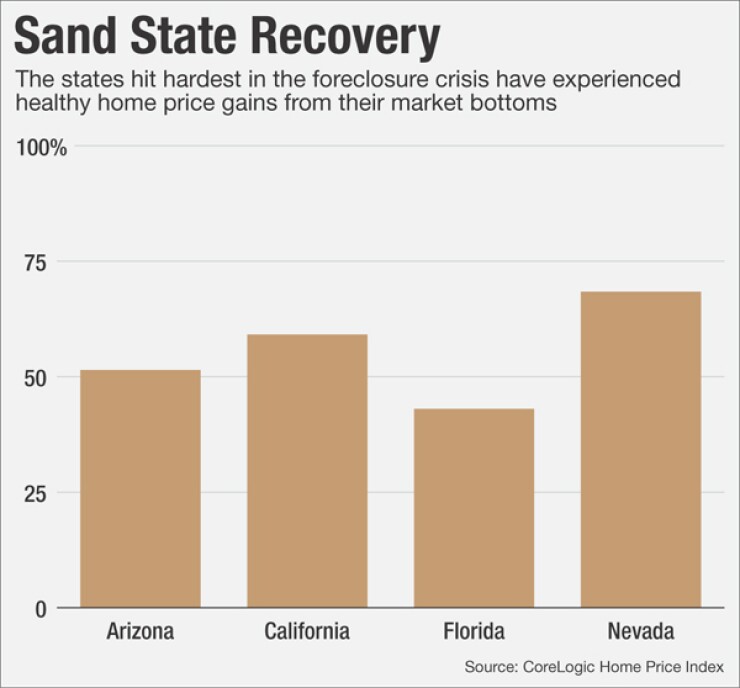

The sand states, in contrast, lost roughly 40% to 60% of their peak values between 2006 and the bottom in 2011-2012. Prices have recovered, but not fully. As of November 2015, the sand states have seen average home price levels still 8%-30% below their individual peaks.

Nationally, about 13% of loans were still seriously underwater as of the third quarter of 2015, but down from levels closer to 30% at the market's peak in 2012, according to separate studies by RealtyTrac and Zillow.

All this suggests that there could be a

Defaulters may have had some months where they saved money by not paying rent or making mortgage payments while they waited for a foreclosure to be processed, Equifax chief economist Amy Crews Cutts said. Foreclosure timelines in some states are long, she noted. Others are shorter. Also, defaulters who lose their homes in discounted foreclosure sales may not pay off their total debt.

"You're left selling [the home] for whatever the bank can sell it at, and then you walk away from the rest, so you'd have to tweak the analysis," said Gudell.

A lender or servicer could try to collect on the difference between the two, but they are not always successful.

Borrowers who strategically defaulted such that their credit was impaired at the bottom of the market also might have missed a good chance to buy and borrower at very favorable rates.

"A lot of people who lost equity in their primary residence but kept paying, and then had an opportunity and desire to buy a second home when it was at the bottom of the market have made huge equity gains," said Steve Calk, chairman and CEO of The Federal Savings Bank.