As the mortgage industry points to the

"Streamlining time-consuming processes, as well as delivering an improved consumer experience, is top of mind for real estate professionals," said First American Chief Economist Mark Fleming in a press release. "Fintech is here to stay."

About 45% of real estate and title professionals claim the most important fintech needed to facilitate transactions is secure collaboration and communication portals, which is not surprising considering wire fraud is on the rise throughout the industry, according to Fleming.

About 34% of those surveyed believe remote online notarization and electronic closing tools will make a solid impression on the housing market, with 65% intending to adopt this technology within the next 12 months. About 30% say they will require this software within the next three to six months.

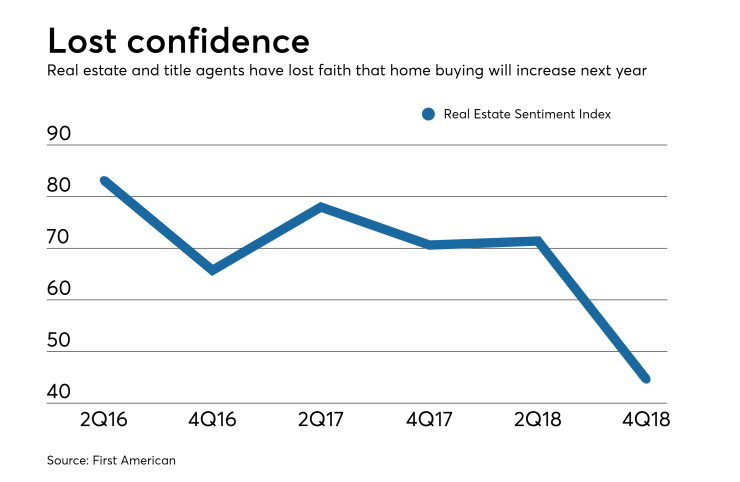

Despite taking steps forward with technology, real estate and title agents are losing faith in the housing market. Confidence that residential purchase volume will grow plummeted 36.9% from a year ago, while optimism about higher refinance volume also fell 41.2%.

"This is likely due to rising mortgage rates and high house prices," explained Fleming.

"Until now, rising rates had only impacted the outlook for the refinance market. However, this quarter, in addition to the impact on buyer's affordability, rising mortgage rates reduce the incentive for existing homeowners to sell their homes. Those who don't sell, don't buy either, and that is contributing to the decline in sentiment," he said.