-

Pfotenhauer held many positions in the mortgage and title industries in his long career, including being the chair of Merscorp, MORPAC and MISMO.

January 22 -

While the company did notify the public and regulators in May 2019, executives were not aware at the time that there was previous knowledge of the security vulnerability within the company.

June 15 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

First American Financial, Old Republic, Stewart reveal how the third-quarter results point their way forward.

October 26 -

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 16 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

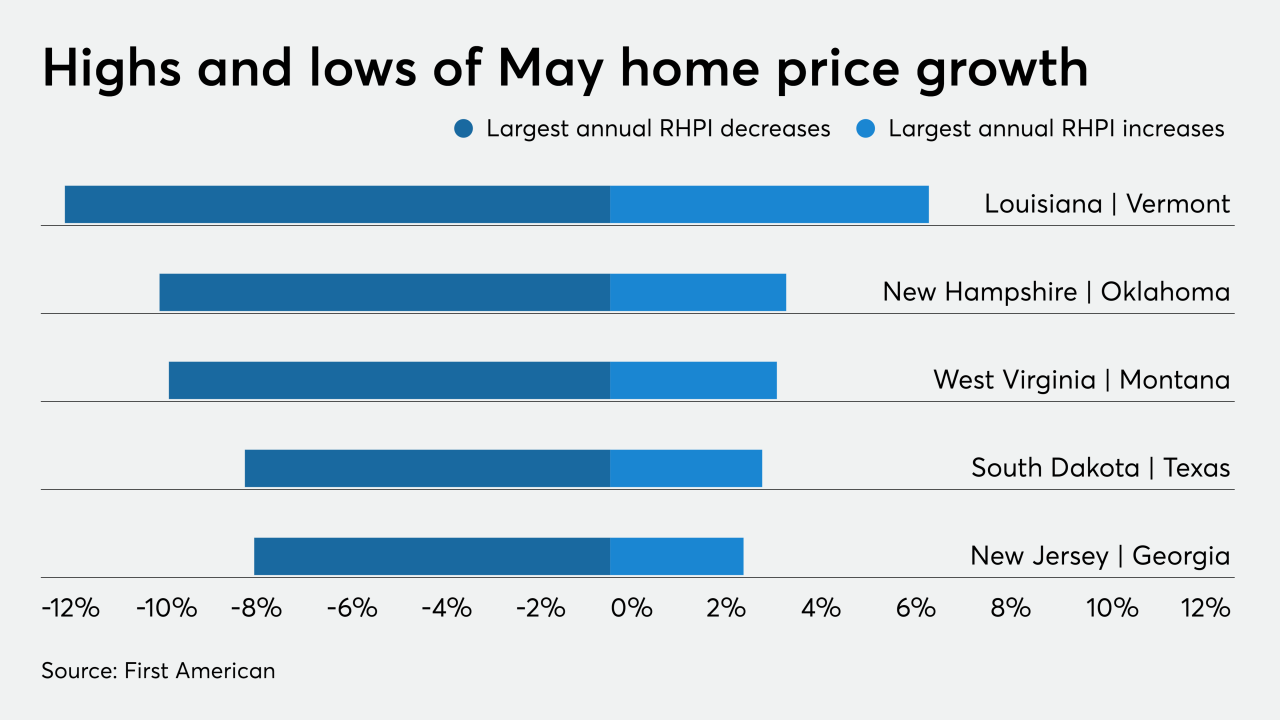

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

Uncertainty over the economy, the pandemic and politics are keeping existing owners from listing their homes.

August 21 -

May’s overall delinquency rate was up over 100% from the prior year.

August 11 -

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

Tight inventory is expected to drive home prices higher over the summer, according to First American.

July 27 -

The surge of COVID-19 cases in much of the nation put a hold on reopening the economy, adding risk to the housing market, First American said.

July 16 -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

First American's Loan Application Defect Index is higher on a month-to-month basis for the first time since February 2019.

June 29 -

Cannae Holdings, a spinoff of Fidelity National Financial, is trying to stage an unsolicited takeover of the property data, analytics and services firm that once had ties to Fidelity's competitor.

June 26