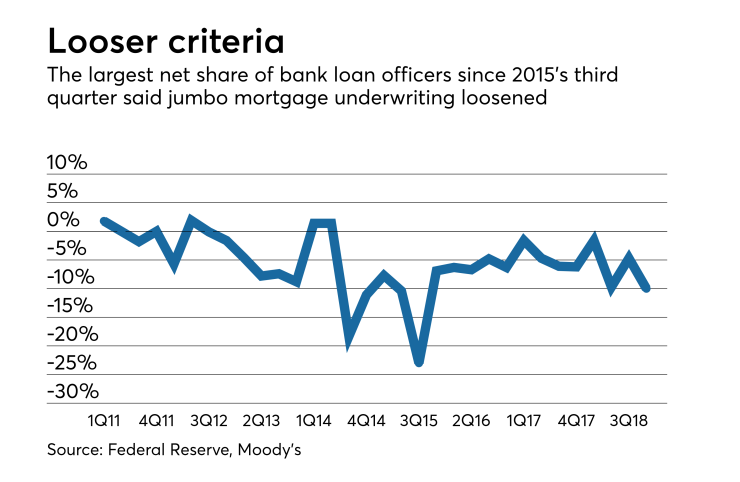

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

There was a 10% net loosening of underwriting criteria for jumbo loans that meet the qualified mortgage test, according to the Federal Reserve's most recent Senior Loan Officer Opinion Survey, which measures originator opinion of their own institution's standards. The fourth quarter survey reflects changes in third quarter underwriting standards, according to the Fed.

This was the largest net negative differential since the third quarter of 2015, when there was 25% net loosening response.

In addition, the raw percentage of respondents that said standards had somewhat loosened was the fourth most since the start of 2011 at 13.3%. The largest percentage of loan officers that said standards loosened was in the 2015 third quarter survey at 24.6%.

Jumbo mortgage credit availability in October

There has been weakening

Increased

Loosened underwriting "is moderately credit negative," but it was not unexpected given the previously tight standards along with current market conditions, the Moody's report said.

"Residential mortgage loan originations and margins have declined over the last year as interest rates have increased and refinance originations have plummeted," Moody's said. "Therefore, we expect residential mortgage underwriting to continue loosening, likely at an accelerated pace, over the next 12-18 months, with underwriting continuing to normalize toward historical average underwriting standards."

The total outstanding residential mortgage loan balance is $10.2 trillion at the end of the second quarter, a 2.7% increase from the same period last year. This was due to an increase in purchase volume as well as loosened underwriting standards, Moody's said. This is still below the peak of $10.7 trillion outstanding in early 2008.