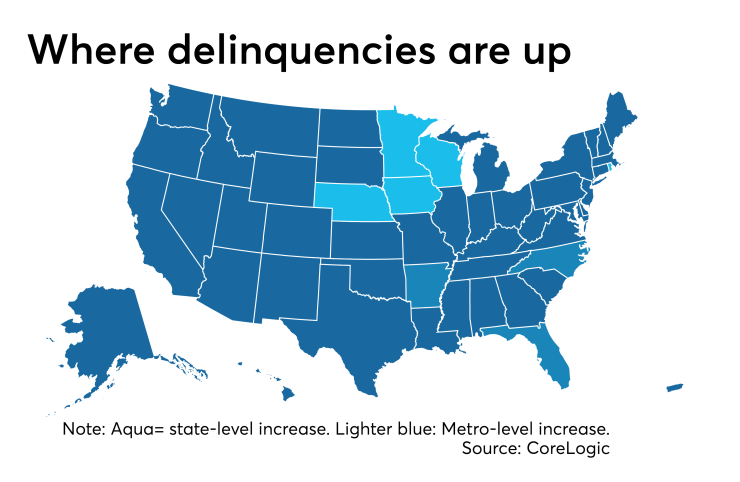

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

On an annual basis, late payments in aggregate ticked up very slightly in five states where there also were year-over-year increases in unemployment, according to CoreLogic’s latest monthly report.

Iowa's overall delinquency rate inched up by 0.2 percentage points, while the other states experience 0.1 percentage point increases.

Minnesota and Nebraska experienced "statistically significant" annual percentage-point increases in their unemployment rates in August at 0.5 and 0.4, respectively, according to the Bureau of Labor Statistics. Rhode Island’s increase was 0.3, and Iowa and Wisconsin had 0.1 percentage point increases.

In addition, serious delinquency rates inched up year-over-year in 47 metropolitan areas during August.

Some of the biggest, local percentage-point increases in serious delinquency rates were in Dubuque, Iowa (2.2), Pine Bluff, Ark. (1.1), Goldsboro, N.C. (0.6), and Panama City, Fla. (0.5).

CoreLogic characterized some of these gains as temporary ones linked to natural disasters.

"Several metros in hurricane-ravaged areas of the Southeast have experienced higher delinquency rates of late. We expect to see these metros return to predisaster delinquency rates over the next several months," Frank Martelli, president and CEO of CoreLogic, said in a press release.

The national serious delinquency rate of 1.3% was the lowest seen in August since 2005, and overall rate of delinquency for loans with payments late by 30 days or more was down by 0.2 percentage points from a year ago at 3.7%.

Transition rates, which CoreLogic examines because they are considered to be less volatile than early-stage delinquencies, were stable in August.

The share of mortgages held by borrowers who went from paying on time to making payments 30 days late held steady at 0.8% compared to a year ago. In comparison, the 30-day transition rate in the United States was 1.2% just prior to the Great Recession in January 2007. It peaked at 2% in November 2008.