-

The monthly prepayment rate declined in January, an indication of the effects of higher interest rates.

February 23 -

Nationstar Mortgage Holdings reported significantly higher net income for the fourth quarter, due to improved revenue in its servicing segment.

February 22 -

International Document Services has updated its idsDoc technology to support upcoming changes to Home Mortgage Disclosure Act reporting.

February 17 -

Black Knight Financial Services has launched a new tool that identifies potential liabilities to reduce title insurers' claims.

February 15 -

Fannie Mae and Freddie Mac have released the final specification update regarding the Uniform Closing Dataset, the digital file format for the TRID Closing Disclosure form.

February 1 -

CoreLogic has released a new mobile application that provides access to property data and analytics.

January 24 -

The Mortgage Industry Standards Maintenance Organization has extended the comment period on its proposed standard regarding the maintenance and sharing of commercial and multifamily rent-roll information.

January 24 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

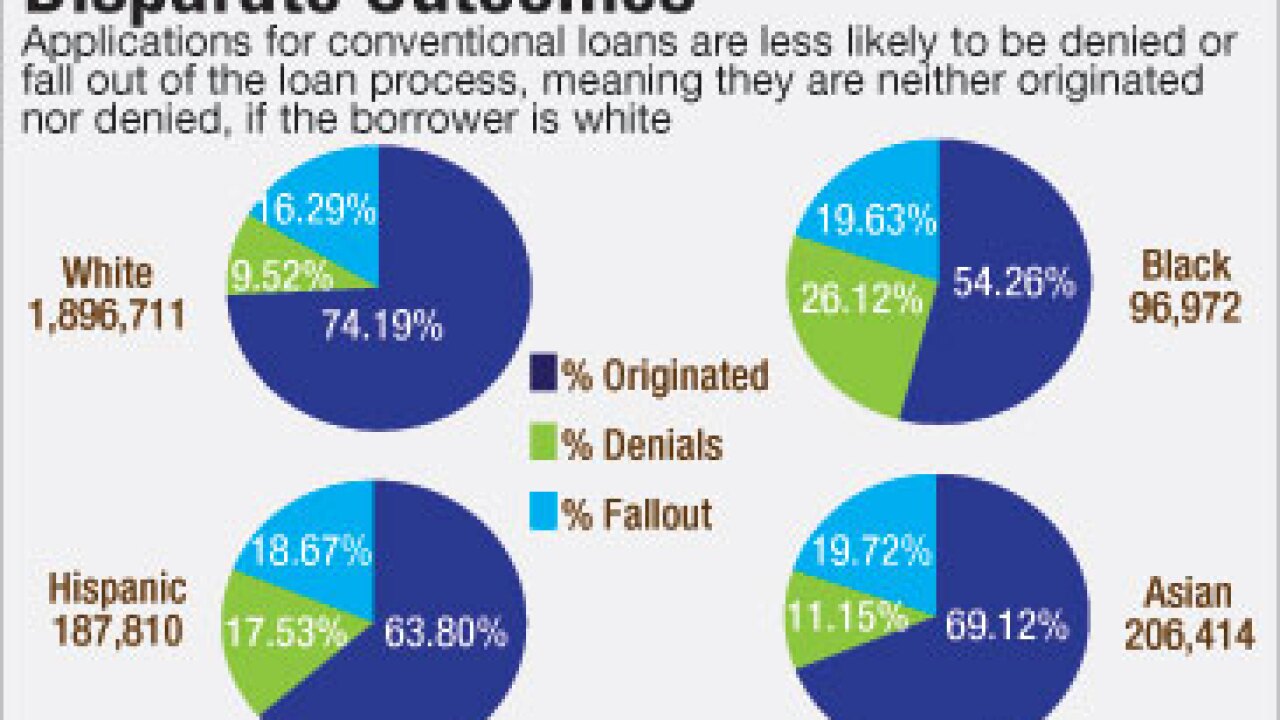

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28 -

Loans originated in the third quarter were among the highest in credit quality since 2000, according to CoreLogic.

December 20 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

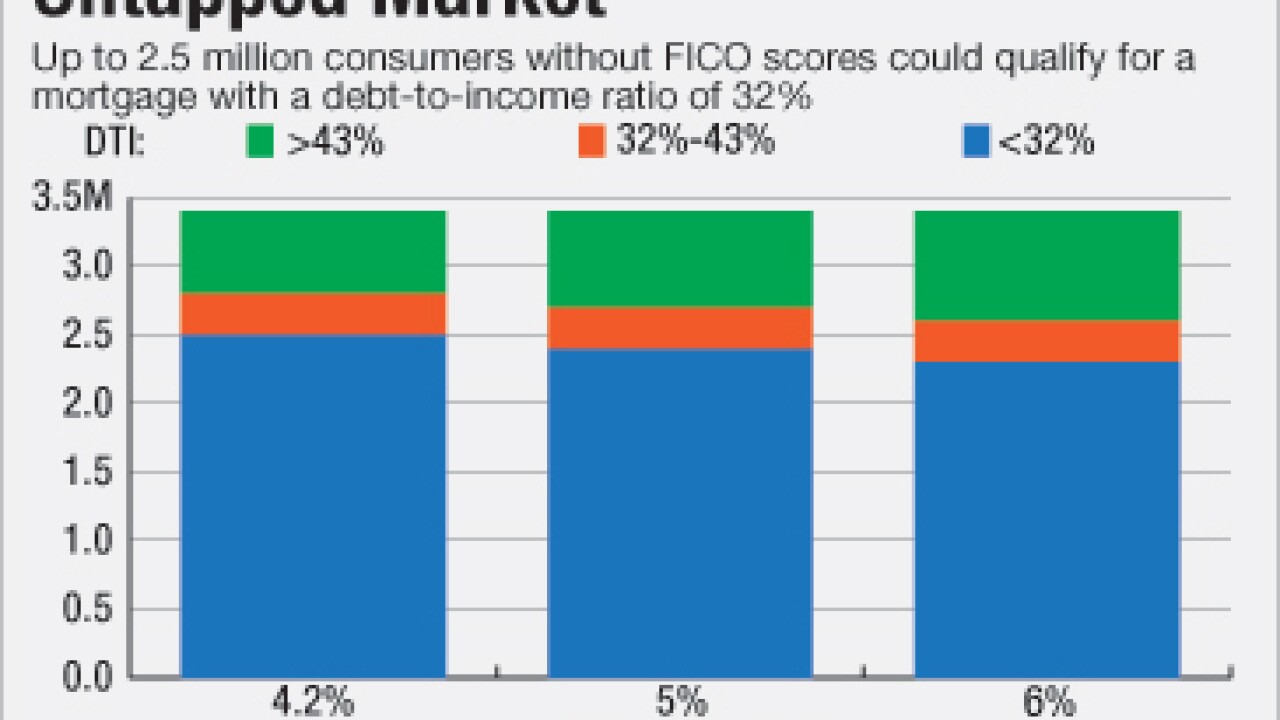

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

Donald Trumps stunning upset in the presidential race is likely to embolden his followers to push for changes to Internet law that could significantly alter how financial technology is conceived, built and delivered to market.

November 9 -

Equifax Workforce Solutions has been selected as a designated vendor for Fannie Mae's Desktop Underwriter validation service.

October 24 -

Roostify plans to connect its automated mortgage decisioning platform with employment and income data from Equifax.

October 21 -

ClosingCorp has rebranded its Loan Estimate and Good Faith Estimate products as a single service, SmartFees.

October 20 -

Lenders and servicers haven't faced the same scrutiny over data security as their peers in retail and other financial services sectors. But mortgage companies must remain vigilant, as the extensive data they collect can expose consumers to identity theft if it got in the wrong hands.

October 18