-

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

CoreVest American Finance’s next offering of rental bonds is backed by homes that are older and smaller than any of its previous transactions, according to Kroll Bond Rating Agency.

June 25 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

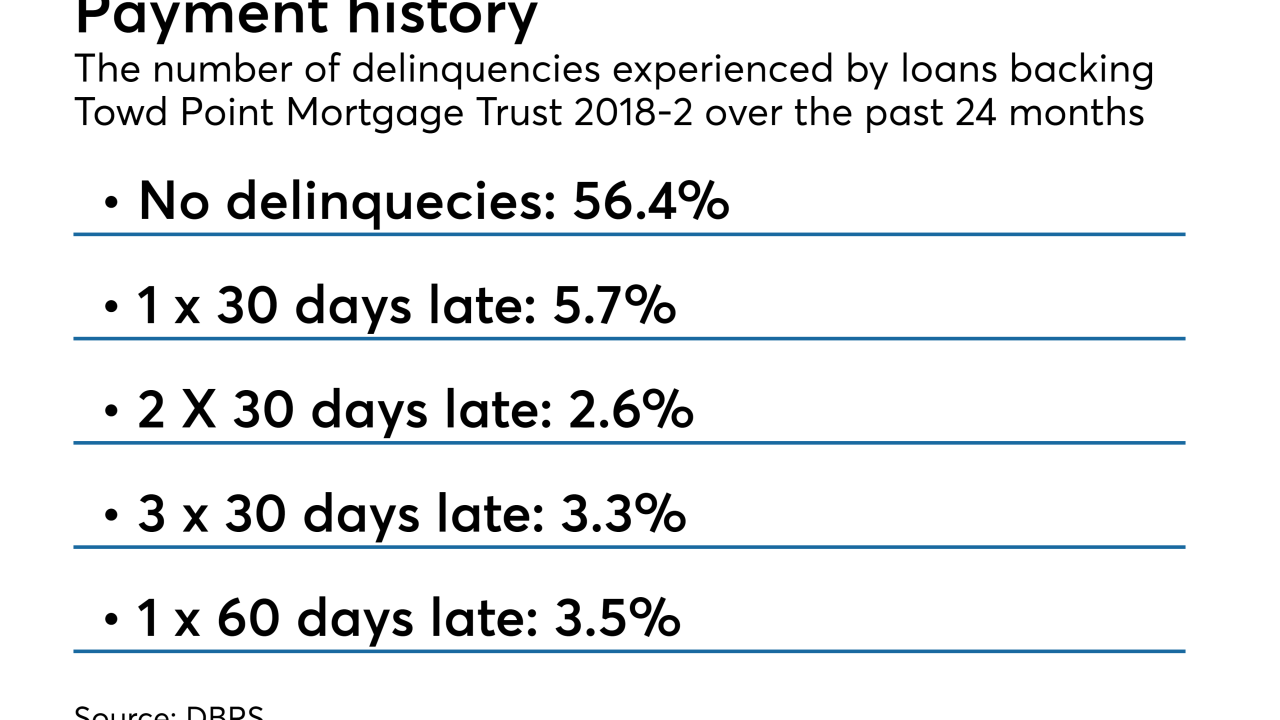

The $1.56 billion Towd Point Mortgage Trust 2018-2 also features higher exposure to loans on investment properties, in some cases loans backed by single-family homes in more than one state.

May 22 -

Unlike the sponsor's previous four deals, which were backed at least in part by jumbo loans, all of the collateral for FSMT 2018-3INV is eligible to be purchased by either Fannie Mae or Freddie Mac.

May 15