Commercial real estate lending has come roaring back, but don't draw comparisons yet to the reckless pre-crisis years.

Regulators and industry analysts who warn that the CRE market is starting to look like 2007 again are overlooking a key fact, according to Matthew Anderson, a managing director at the analytics firm Trepp. Banks have added so much capital in the past several years that they're better insulated against CRE risk than they used to be, despite the huge increase in those loans on banks' books.

So where some see a possible CRE bubble, Anderson sees only a market stabilizing after the trauma of the financial crisis and recession. "I think CRE is getting back to normal more than anything else," he says. "The overall volume of lending has grown, but it hasn't reached the peaks of 2007 and 2008."

Taken in isolation, the growth might look worrisome. CRE, as defined by regulators, comprises commercial mortgages, land and construction loans, and multifamily, along with unsecured CRE, which is mainly lending to construction companies and real estate investment trusts.

The total amount of CRE on banks' balance sheets as of the end of the second quarter had grown 31%, to $1.37 trillion, since bottoming out in the second quarter of 2011, according to Trepp's analysis. Land and construction loans, a massive source of losses during the crisis, contracted 4% in that time frame, but other CRE loan types have more than made up the difference.

Multifamily lending increased 72% over the past four years, to $320 billion, and is an area that Kelly King, the chairman and chief executive at BB&T, has singled out as particularly troubling. "We don't have a bubble yet, but we have an impending bubble," King said at a conference in September.

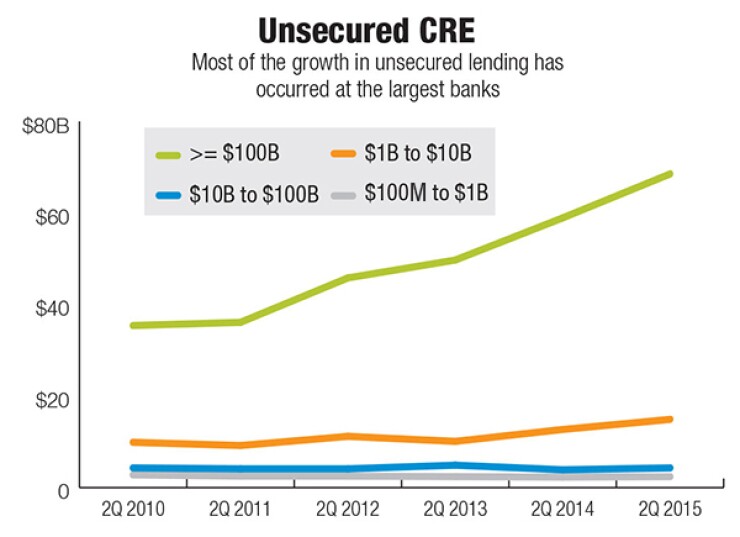

Unsecured CRE lending has grown 73% in that same four years. Though that's a slightly faster rate than even multifamily, it is coming off a lower base and totaled $90.3 billion at the end of the second quarter.

Higher capital levels have nearly balanced out the overall increase of $324 billion in CRE lending, though. The amount of risk-based capital in the banking system has increased by 24%, or $317 billion, since the second quarter of 2011, to more than $1.6 trillion, according to Trepp's data. This greatly increases the resilience of banks' balance sheets in case of a shock, Anderson points out.

In addition, the number of banks with high CRE concentrations as defined by regulators has dropped dramatically in recent years. At June 30, there were 597 banks where commercial real estate loans totaled more than 300% of capital or land loans surpassed 100% of capital, down from 1,375 five years earlier.

Another reason Anderson isn't worried is that, from his read on the CRE market, underwriting terms don't seem to have deteriorated nearly as much as they did in the years leading up to the crisis.

Even in multifamily, arguably the most bubbly segment of CRE, Anderson sees some reassuring signs. A lot of the growth is due to demographics, as the percentage of renters — particularly young adults — has increased from before the crisis, driving up demand for multifamily housing. And much of the growth in banks' multifamily portfolios has come from taking market share from other players, like securitized lenders and the government, he says.

"Some of lenders' enthusiasm for multifamily lending has led to easier loan terms and rapid growth for the loan type itself," Anderson says.

"Even with that, though, the growth in multifamily lending overall (including lenders beyond banks) doesn't appear to be excessive yet."