Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

Only a fraction of mortgage borrowers return to their servicers to originate or refinance a mortgage loan, and it may be the industry's fault for not exhausting enough effort to keep them around.

February 27 -

Mortgage prepayment speeds fell to a 19-year trough despite recent interest rate declines, but could rise if those lower rates lead to an increase in home purchases, according to Black Knight.

February 25 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

Home affordability is at a 10-year low across the nation. Here's a look at the 12 cities most in danger of a housing bubble in 2019.

February 21 -

From FICOs to purchase volume, here's a look at seven mortgage lending trends that will shape the housing market this year.

February 20 -

Despite a healthier economy supporting wage and income growth, the narrative that homebuyers are struggling to afford homes for sale hasn't changed much. House values are still on the rise, meaning shoppers are struggling with how much house they can afford.

February 19 -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

Women have lower incomes than men, limiting their options when buying a house. But in some of the more pricey housing markets, single female homeowners outpace single male homeowners, which could suggest some tightening in the home value gap, according to Attom Data Solutions.

February 14 -

From Romeo, Colo., to Valentines, Va., here's a look at closing costs in some of the country's romantically-named cities this Valentine's Day.

February 14 -

While property values continued rising in most markets, they grew at a healthier pace for homebuyers, according to the National Association of Realtors.

February 13 -

Mortgage loan performance remained strong in November as serious delinquencies fell to their lowest reported level since before the housing bubble burst, according to CoreLogic.

February 12 -

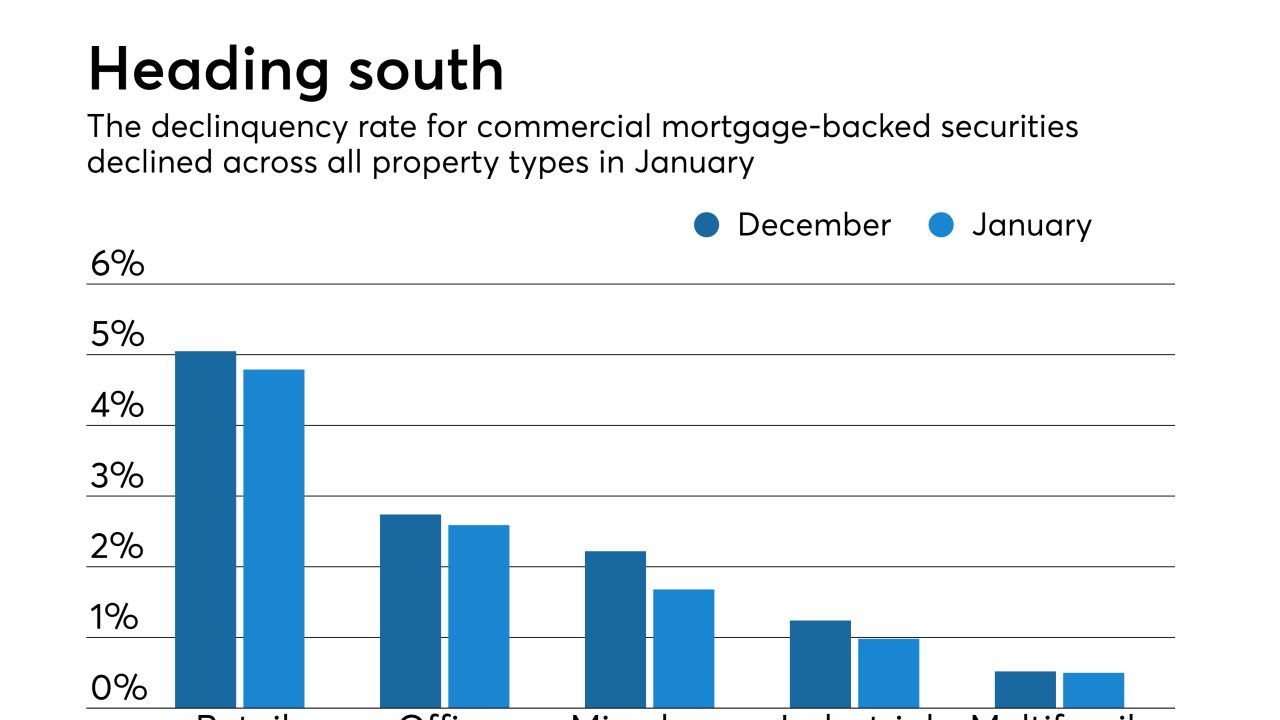

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

The share of home shoppers planning on buying a house within a year tanked in the fourth quarter, and those who are searching blame affordability struggles for their setbacks, according to the National Association of Home Builders.

February 8 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

Consumers have higher household incomes and more faith in cooling home price and mortgage rate growth than they did a year ago, which could allude to a stabilized housing market in 2019, according to Fannie Mae.

February 7 -

Och-Ziff Capital is suing BNY Mellon, as trustee, to compel it to calculate interest in a way that is more favorable to the class of securities it holds.

February 6 -

Despite the release of Senate Banking Committee Chairman Mike Crapo's outline of a government-sponsored enterprise reform plan, most policy changes will likely come from the White House, and may even materialize this year, said Keefe, Bruyette & Woods.

February 4 -

Homebuilders are growing confident in 55+ communities, which could suggest more movement in the housing market at a time when homeowners continue aging in place.

February 1 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31