Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

From debunking down payment myths to making sense of interest rates, here's a look at five essential lessons lenders can teach to millennials preparing for homeownership.

September 12 -

With interest rates lower than expected and existing-home prices driving demand, applications for new-home purchases grew in August.

September 12 -

The Terrorism Risk Insurance Act was created after 9/11 to serve as a crucial federal backstop for commercial real estate insurers, but an analysis of alternatives to fund the program reveals the continued challenges of measuring and predicting terror risk.

September 11 -

Overall mortgage lending increased by 20% in the second quarter but was still down from a year earlier, according to Black Knight Financial Services.

September 11 -

Consumer confidence in the housing market is growing overall, but the gap between those that say it's a good time to buy versus selling a home is widening, according to Fannie Mae.

September 11 -

The average number of days to close a home loan for a millennial varied significantly by state in July as buyers continued competing for tight inventory, according to Ellie Mae.

September 8 -

Mortgage companies in Florida are bracing themselves for the potential landfall of Hurricane Irma, which has followed close on the heels of Hurricane Harvey.

September 6 -

As housing demand continues to challenge low levels of supply, home prices are overvalued in 34% of the largest U.S. metropolitan areas, according to CoreLogic.

September 5 -

Residential flood damage from Hurricane Harvey could reach as high as $37 billion, with more than two-thirds of losses not covered by insurance, according to CoreLogic estimates.

September 1 -

From payment forbearances to financing to start the rebuilding process, here's a look at five ways homeowners affected by Hurricane Harvey can get mortgage help.

August 31 -

The Consumer Financial Protection Bureau set its 2018 thresholds for high-cost mortgages regulated under the Home Ownership and Equity Protection Act.

August 31 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

From San Francisco to Jackson, Miss., here's a look at the 12 cities where home sales are expected to be the weakest during the third quarter of 2017.

August 29 -

U.S. home prices reached a new record high in June, with values increasing 5.5% since the beginning of the year, according to Black Knight Financial Services.

August 28 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

With Hurricane Harvey rapidly making its way toward the Texas coast, lenders and servicers have activated business continuity plans to accommodate pending transactions and provide options and support to existing borrowers affected by the storm.

August 25 -

My Home is Realtor.com's attempt to compete with Zillow's Zestimate home valuation product, as it seeks to help homeowners manage their property as an investment.

August 24 -

Before joining NMN, our new reporter Elina Tarkazikis was a real estate agent. From endless fees to the benefits of working on a team, she explains why many things agents should know entering the business also apply to mortgage loan officers.

August 24 -

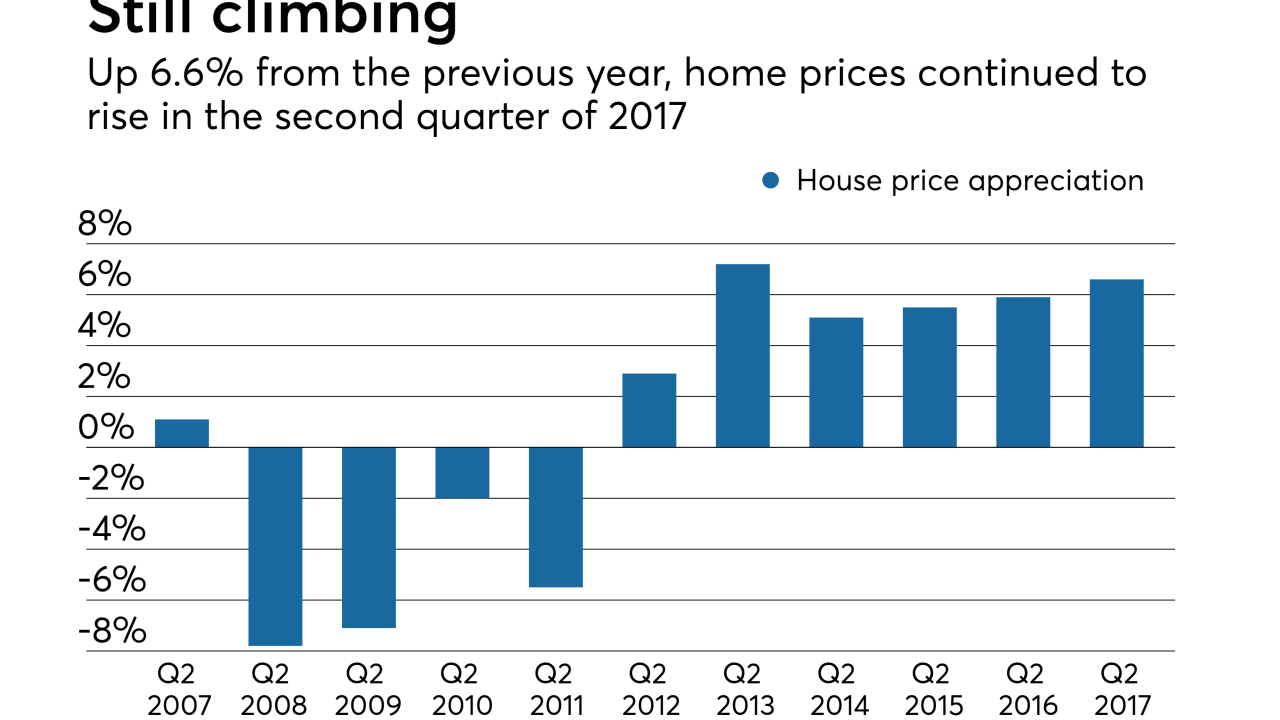

With inventory still low, home prices continued to rise in the second quarter of 2017.

August 23 -

The nonbank lender and servicer's long-awaited rebrand comes along with wholesale changes across its entire operation to better emphasize the customer experience.

August 21