-

The measure assigns the CFPB the task of developing ability-to-pay standards for financing repaid through local tax assessments; it has the support of both the PACE industry as well as mortgage bankers and Realtors.

By Glen FestNovember 20 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

By Glen FestNovember 15 -

The $785 million transaction, 2017-C41, is backed by a pool of 52 loans with an average balance of just $15.1 million, according to Kroll Bond Rating Agency; retail, hotel and office properties dominate the mix.

By Glen FestNovember 14 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

By Glen FestOctober 26 -

Cisco DeVries, the chief executive of Renew Financial, said the bills will bring much-needed stability to Property Assessed Clean Energy, which uses a property assessment to finance upgrades.

By Glen FestSeptember 18 -

The 4,443 single-family rental homes securing Starwood Waypoint Homes 2017-1 have an average age of 30 years, older than any previous transaction by the sponsor, but are bringing in more than $1,700 apiece in monthly rent.

By Glen FestSeptember 6 -

Damages have typically not been a "disruptive problem" with hurricanes because of commercial properties' insurance, Trepp reports, but expiring leases of major tenants and the energy industry fallout have already had an impact on Houston-area office buildings.

By Glen FestAugust 29 -

The average home value backing the loans is $117,000, well below the average $150,000 of other recent RPL securitizations, according to Fitch Ratings.

By Glen FestAugust 28 -

Five deals launched in the first week include another whole loan participation in New York's GM Building, as well as a single-borrower ABS for the Park Avenue office tower complex that includes Facebook and Buzzfeed as tenants.

By Glen FestAugust 9 -

The 1999 Avenue of the Stars tower in the Century City submarket is part of a second Goldman Sachs CMBS transaction, and is the largest loan in the new 2017-GS7 portfolio.

By Glen FestAugust 8 -

The private equity firm obtained an $825 million mortgage on the portfolio from Citi, Deutsche Bank and Barclays; proceeds, along with $500 million of mezzanine debt, will be used to repay exist debt and cash out $207 million of equity.

By Glen FestJuly 31 -

It's the sponsor's first securitization to be rated by Morningstar; DBRS and Kroll Bond Rating Agency are still capping their ratings of Property Assessed Clean Energy bonds at double-A.

By Glen FestJuly 25 -

BANK 2017-BNK6 is a transaction backed by 72 fixed-rate commercial property loans covering 189 properties, including midtown Manhattan's iconic General Motors Building.

By Glen FestJuly 11 -

With risk premiums on collateralized loan obligations at or near their tightest levels since the financial crisis, there may be nowhere to go but out, according to Wells Fargo Securities.

By Glen FestJuly 3 -

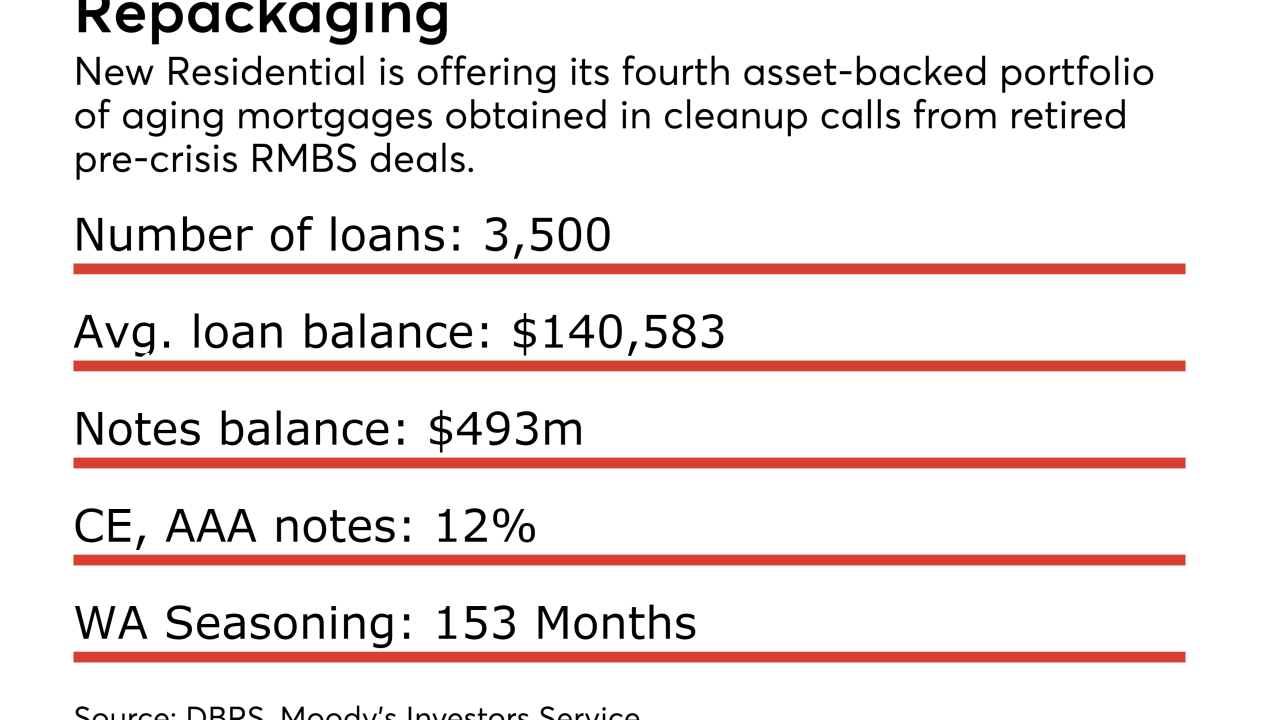

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

By Glen FestJune 28 -

Over 45% of the borrowers the collateral pool have FICO scores above 760, compared with just 36.42% in the marketplace lender's most recent transaction, completed in May.

By Glen FestJune 22 -

CLO managers who accept lower interest payments on loans risk running afoul of deal covenants; but if they take their money back, there are few attractive options for putting it back to work

By Glen FestJune 20 -

The move follows mounting criticism that many homeowners using property assessments to finance energy efficiency upgrades can neither understand, nor afford, the terms of deals.

By Glen FestJune 15 -

The $500 million commercial mortgage that serves as collateral was underwritten by Deutsche Bank and Citigroup; it allowed the building's owner, Alexander's, to cash out $187 million of equity.

By Glen FestJune 13 -

The Trump Administration’s anti-regulatory agenda has yet to permeate the Securities and Exchange Commission, which remains opposed to relief for collateralized loan obligations.

By Glen FestJune 9