Laura Alix is a reporter at American Banker.

-

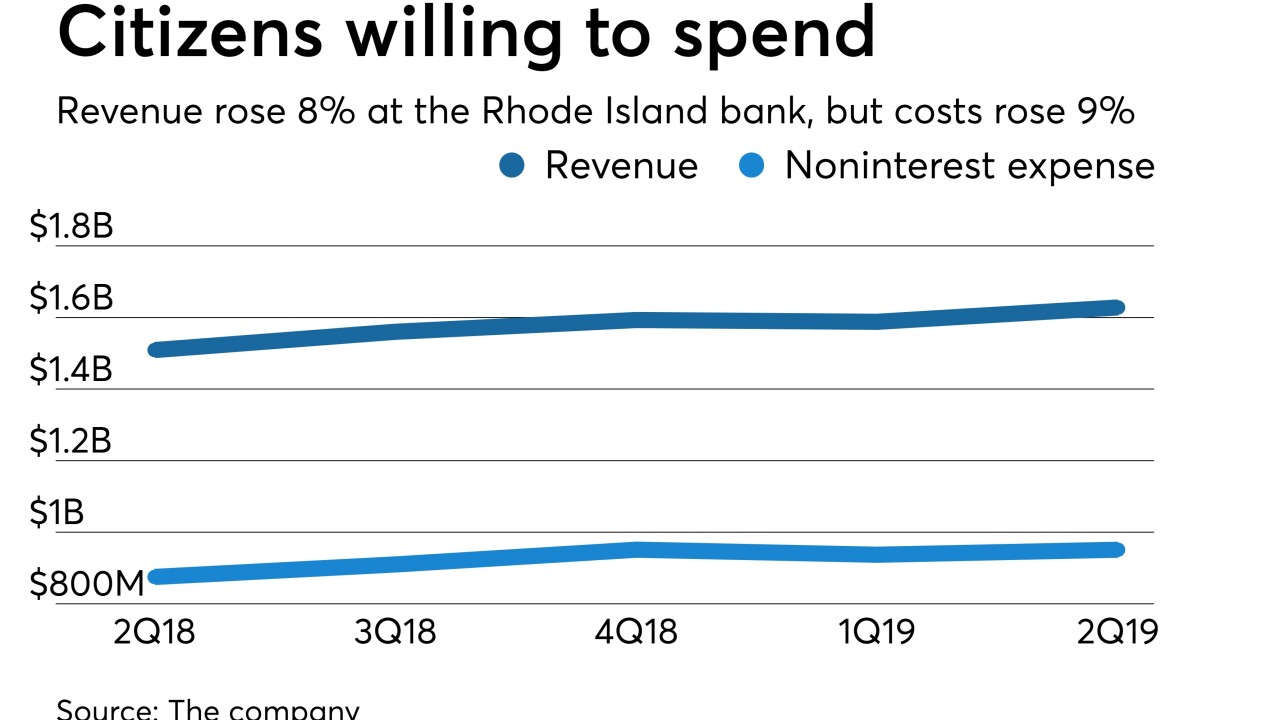

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

By Laura AlixJuly 21 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

By Laura AlixJuly 17 -

As policymakers mull ways to update the 42-year-old Community Reinvestment Act, economists at the San Francisco Fed have put forth a novel proposal.

By Laura AlixJuly 2 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

By Laura AlixJune 7 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

By Laura AlixApril 17 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

By Laura AlixJanuary 8 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

By Laura AlixOctober 30 -

The Portland, Ore, company also benefited from lower expenses and an improved efficiency ratio.

By Laura AlixOctober 18 -

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

By Laura AlixAugust 14 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

By Laura AlixJune 29 -

Call it mutual respect. Bankers from mutually owned British building societies and similarly structured U.S. thrifts recently gathered in New England to address common challenges and share ideas about staying relevant at a time of rapid change in financial services. Here are the takeaways from their meetings.

By Laura AlixMay 18 -

TriStar Bank in Tennessee says a shortage of appraisers is slowing down its commercial real estate lending and raising the cost of appraisals. The claim has outraged appraisers, who argue that the bank is simply trying to avoid paying their fees.

By Laura AlixApril 11 -

China’s threat to impose hefty tariffs on dozens of U.S. imports could weaken demand for soybeans, pork and other agricultural products. Here's what that could mean for farmers, ranchers and the banks that lend to them.

By Laura AlixApril 4 -

A majority of midsize and large banks complain that red tape is mounting and that they are passing on higher regulatory costs to customers and have less flexibility in designing products, according to a new survey by the RMA.

By Laura AlixMarch 28 -

Despite past missteps in the U.S. mortgage business, the bank is giving it another go, bringing servicing in-house and catering to millennials and international clients here, says HSBC’s Raman Muralidharan.

By Laura AlixMarch 12 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

By Laura AlixFebruary 13 -

Darryl White sees an opportunity for Bank of Montreal to take more market share in the United States, and he’s betting on investments in mortgage lending, commercial banking and capital markets to get there.

By Laura AlixFebruary 9 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

By Alan KlineJanuary 24 -

The Oregon company's commercial and consumer lending grew even though fee income declined sharply.

By Laura AlixJanuary 23 -

The Honolulu bank reported strong loan growth in the fourth quarter, but one-time charges related to the new tax law suppressed its profit.

By Laura AlixJanuary 22