Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The tool is designed to help lenders adjust their underwriting to address the growing faction of non-W2 employees, which is expected to make up half of the workforce by 2027.

July 29 -

The newly public technology provider will use community and industry partnerships to give banking access to historically underserved communities.

July 27 -

The average mortgage borrower has gotten a hometown discount when buying a property, as the rise of remote work allowed for migration away from large metropolitan areas, according to a Redfin report.

July 26 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

As the distribution of at-risk housing markets spread across more states quarter-over-quarter, vulnerable clusters remained around Chicago, New York and Philadelphia, an Attom Data report finds.

July 22 -

More units sold above asking price as skyrocketing home values pushed consumers out of the single-family market, according to Redfin.

July 21 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

The cloud-based mortgage software company plans on trading on the New York Stock Exchange with a starting price of $24 to $26 per share.

July 19 -

The software provider’s offering hit the top of its price range estimate and started trading at $18 per share.

July 16 -

The new deal will remove manual bid taping and automate secondary loan sales directly on the Encompass platform.

July 15 -

In states where it is legalized, cannabis sales tax revenues led to greater home value appreciation through community reinvestment, according to an analysis by Clever Real Estate.

July 14 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

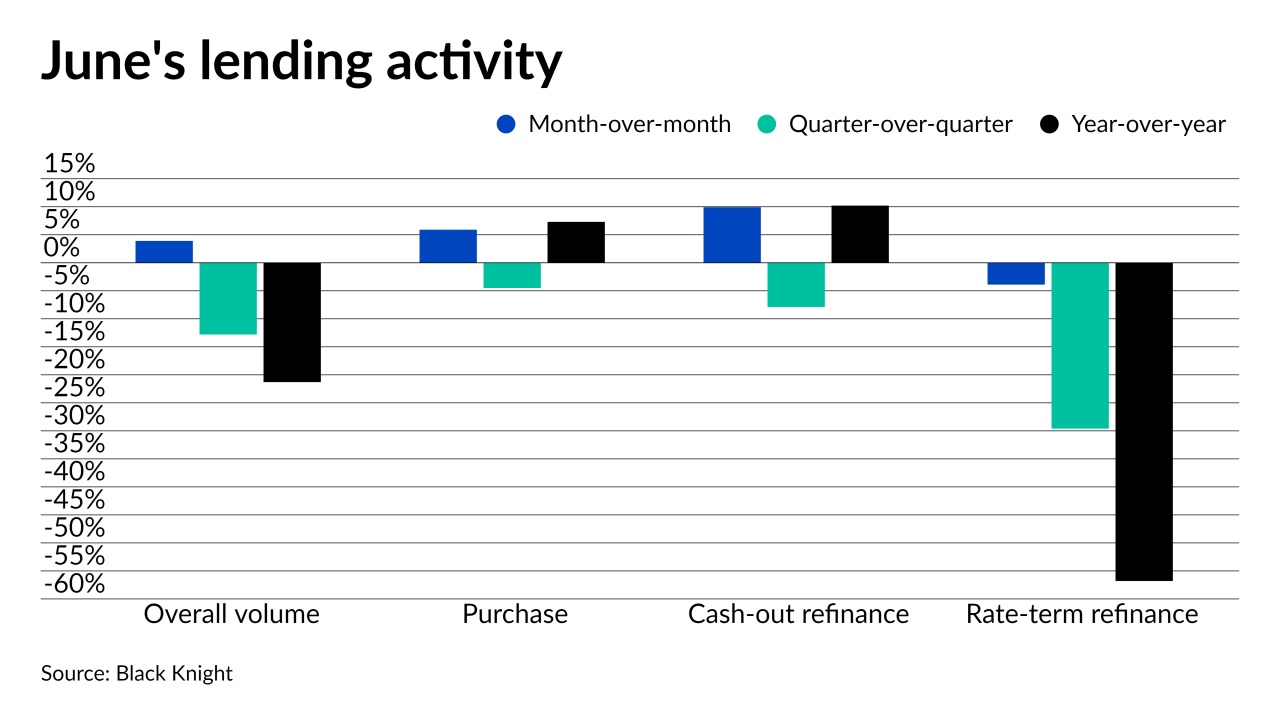

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Local mortgage and real estate professionals give insight on the metro areas projected to experience the highest appreciation over the next year, according to Zillow.

July 12 -

The defendant faces seven criminal counts — ranging from stolen property to falsifying business records — for two Harlem brownstones he paid just $20 for in 2012, according to tax filings.

July 9 -

Renters will need to reserve an additional $369 per month to keep up with rising listing prices over the next year, according to Zillow.

July 8 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

A Virginia-based builder announced a line of manufactured housing that features clean energy technology, reduced waste and “plug-and-play” assembly.

July 6 -

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

After lumber futures skyrocketed to an all-time high in mid-May, prices fell by more than half at the end of June.

July 2