CFPB News & Analysis

CFPB News & Analysis

-

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

The timing of the settlement serves as a warning to other companies of the risks they face in an increasingly data-focused economy.

July 22 -

The agreement with authorities including the Federal Trade Commission and state attorneys general — and possibly the Consumer Financial Protection Bureau — may be announced as soon as Monday.

July 19 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

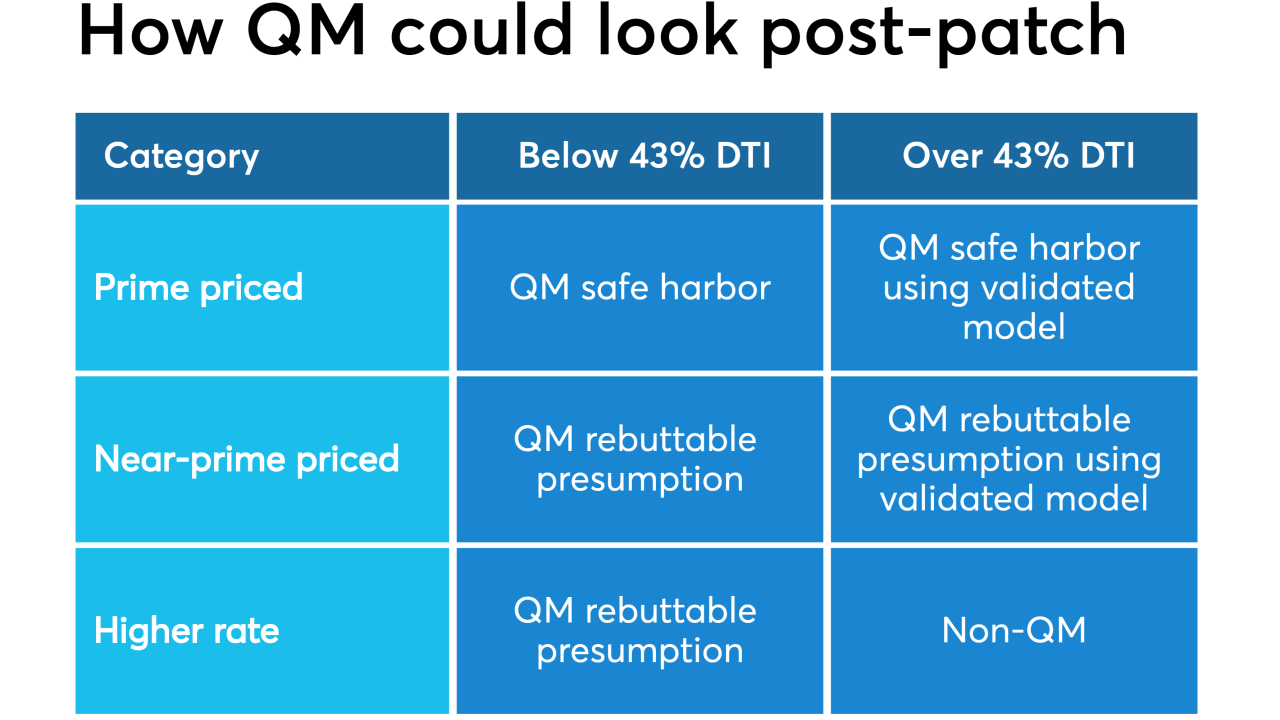

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

The CFPB did not file any fair-lending enforcement actions in the 2018 fiscal year and did not refer any Equal Credit Opportunity Act violations to the Department of Justice.

July 2 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Democratic lawmakers argue that Paul Watkins' former employment at a "homophobic hate group" makes him unfit to lead the agency's innovation office. Watkins says he did no advocacy work for that organization.

June 25 -

Sen. Elizabeth Warren said Eric Blankenstein's past writings disqualify him from working at the Department of Housing and Urban Development.

June 24 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

The little-known unit was launched in the wake of efforts by the CFPB and HUD to cut back on fair-lending activities, but the reach of the 10-month-old office is still unclear.

June 18 -

In her first four and a half months, Kathy Kraninger met with lawmakers more than twice as often as her predecessor, but her schedule demonstrates willingness to meet with industry and policy stakeholders from various camps.

June 17 -

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12 -

The agency announced the series in April as an effort to encourage public dialogue on policy issues.

June 11 -

The company intentionally submitted inaccurate borrower information overstating the number of white applicants, the consumer bureau alleges in a consent order.

June 5 -

For four years running, consumer complaints about the three national credit reporting agencies — Experian, Equifax and TransUnion — have dominated the CFPB’s database. What do they keep doing wrong?

June 4 -

The industry continues to push for an overhaul of the bureau’s leadership structure, but both parties seem uninterested.

May 30 -

BSI Financial agreed to pay a $200,000 fine along with restitution to settle allegations from the Consumer Financial Protection Bureau that it mishandled mortgage servicing rights transfers for loans in the loss-mitigation process.

May 29