CFPB News & Analysis

CFPB News & Analysis

-

Senate Democrats on Wednesday called for acting CFPB Director Mick Mulvaney to reveal the vetting process that led to the hiring of a political appointee whose past incendiary writings have caused an uproar at the agency.

October 3 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

The head of the National Treasury Employees Union said the appointment of Eric Blankenstein to a senior role “reflects poorly on CFPB management.”

October 2 -

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

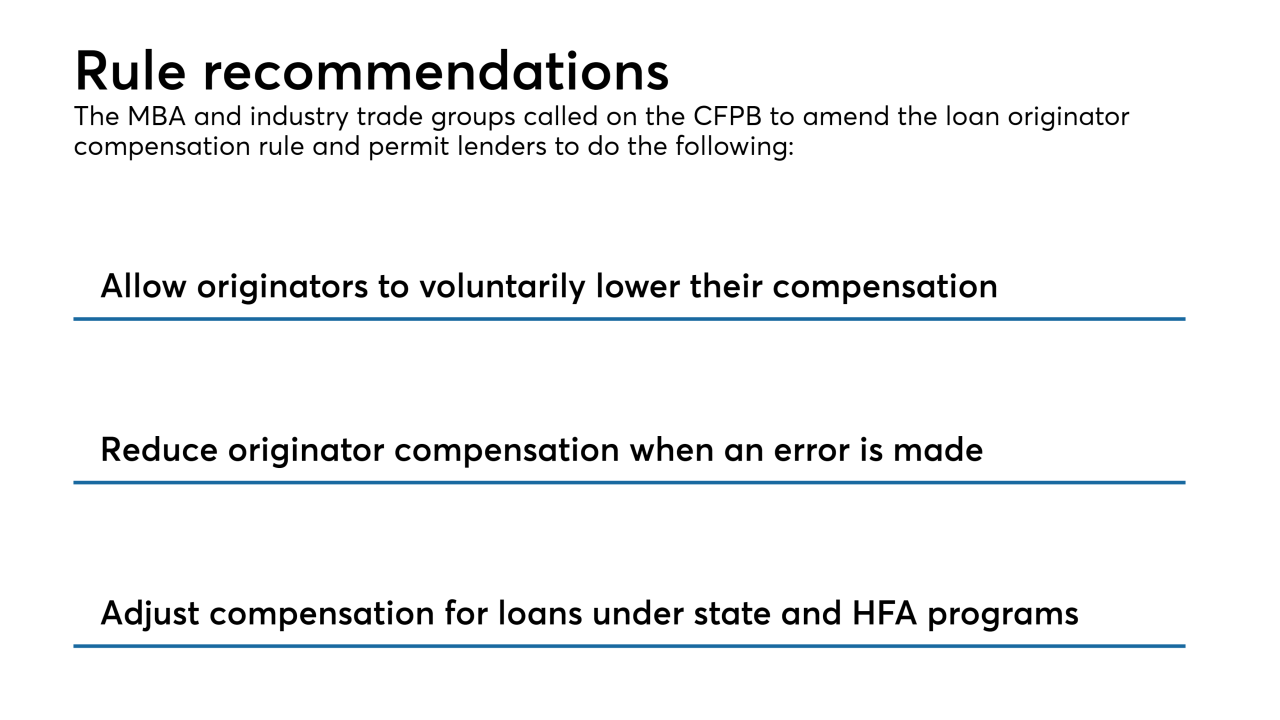

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30 -

A former Ocwen Financial executive is settling Securities and Exchange Commission charges that he engaged in insider trading related to his company's dealings with Altisource Portfolio Solutions following a CFPB enforcement action and its upcoming merger with PHH Corp.

September 28 -

The head of the agency’s fair-lending office cast doubt on a proposed reorganization of her office and raised concerns about blog posts written years ago by the political appointee overseeing the project.

September 28 -

At least six Trump administration picks to fill financial posts are still pending, but the bitterly partisan divide over Judge Brett Kavanaugh has taken up most of the energy in Congress.

September 28 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

The CFPB's move is in line with the other banking regulators who have offices in Atlanta.

September 21 -

A new financial technology company called Scratch is planning to use a new web-based platform along with an alternative pricing model to compete with companies that service mortgages and other consumer loans.

September 20 -

Though Acting CFPB Director Mick Mulvaney tried unsuccessfully to strip the agency's fair lending office of its enforcement powers earlier this year, he insisted this week that the bureau "is still in the fair lending business."

September 18 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

Kathy Kraninger has been tight-lipped about her plans for the consumer bureau, but some point to signs that she could curb the agency's power by reducing staff and other costs.

September 4 -

The Consumer Financial Protection Bureau issued an interpretive rule Friday to clarify changes made to the Home Mortgage Disclosure Act that were mandated by President Trump's regulatory relief law.

August 31 -

The committee approved the nomination of Kathy Kraninger to head the Consumer Financial Protection Bureau, despite strong Democratic opposition, as well as President Trump's picks for Ginnie Mae, the Export-Import Bank and several other positions.

August 23 -

Sen. Heidi Heitkamp, D-N.D., has compromised with Republicans on key issues and supported other Trump nominees, but she said Kathy Kraninger lacks enough experience to run the consumer bureau.

August 22