CFPB News & Analysis

CFPB News & Analysis

-

The increased regulatory burden created by the Dodd-Frank Act restricted bank residential lending in 2017, especially when it came to non-qualified mortgages, according to an American Bankers Association survey.

May 18 -

Although the Consumer Financial Protection Bureau is loosening certain mortgage rules, others such as restrictions on loan officer compensation and state-level regulation will likely persist, according to industry attorneys.

May 18 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

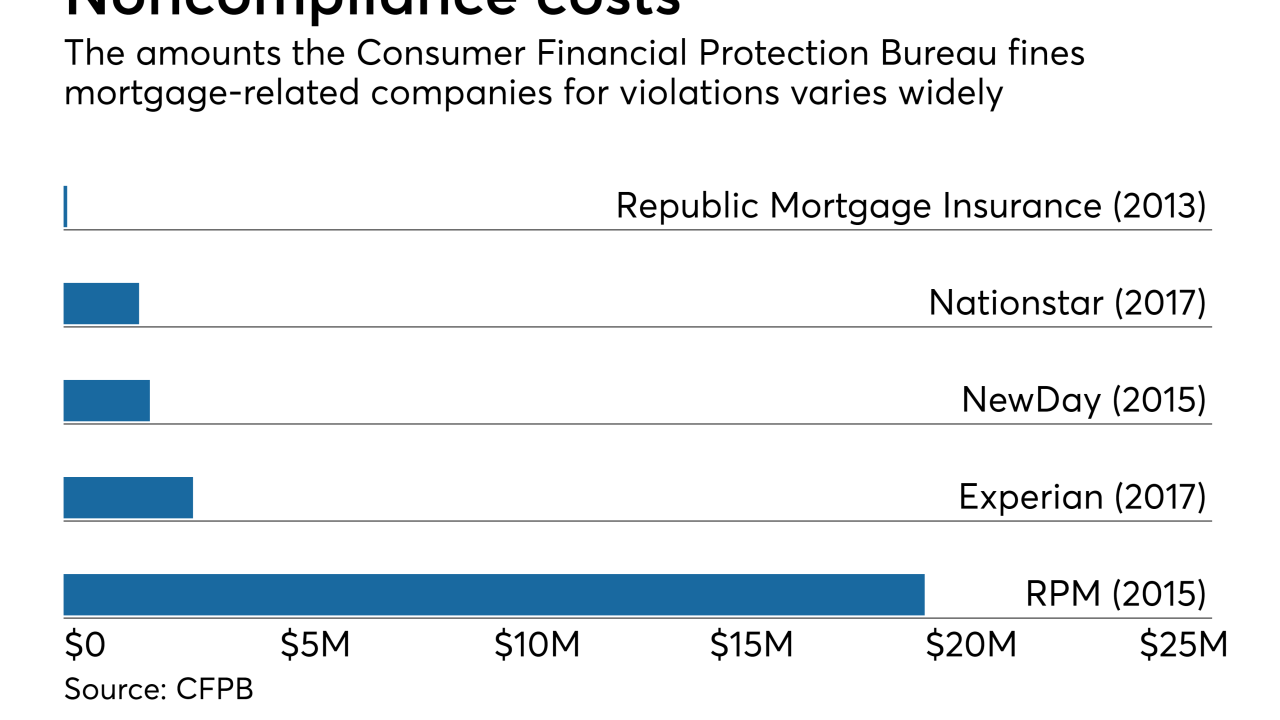

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

The union representing employees at the CFPB is already fighting acting Director Mick Mulvaney's efforts to restructure the agency, and readying for a potentially larger conflict as rumors of layoffs swirl.

May 10 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at eight key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 8 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The New Jersey mortgage lender and servicer won a huge victory in January when an appeals court threw out its fine levied by the consumer agency, but the court ruled against the claim that the agency's structure is unconstitutional.

May 3 -

The group says Mulvaney, who also runs OMB, was not totally forthcoming with the Senate Budget Committee about the foreclosure of a property he owns in South Carolina.

April 30 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

The CFPB finalized an amendment to its "know before you owe" mortgage disclosure rule that gives lenders more flexibility to adjust closing cost estimates and pass those increases on to borrowers.

April 26 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23