-

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

The rush to unload mortgage-backed securities signals that a credit meltdown that began with corporate bonds is spreading to other corners of the market.

March 23 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

March 17 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

March 16 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

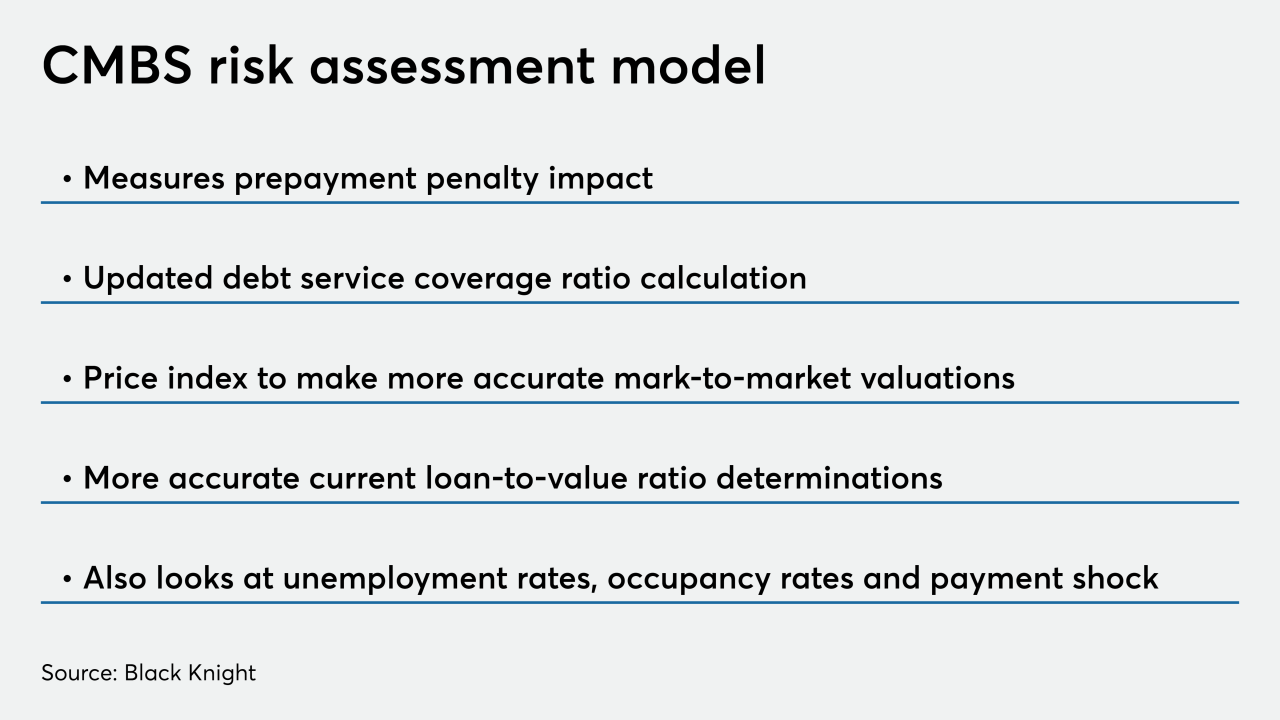

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

Negotiations went to the brink of a foreclosure trial for a Bradenton, Fla., mall, before a settlement was reached between the owners and the lender.

February 3 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

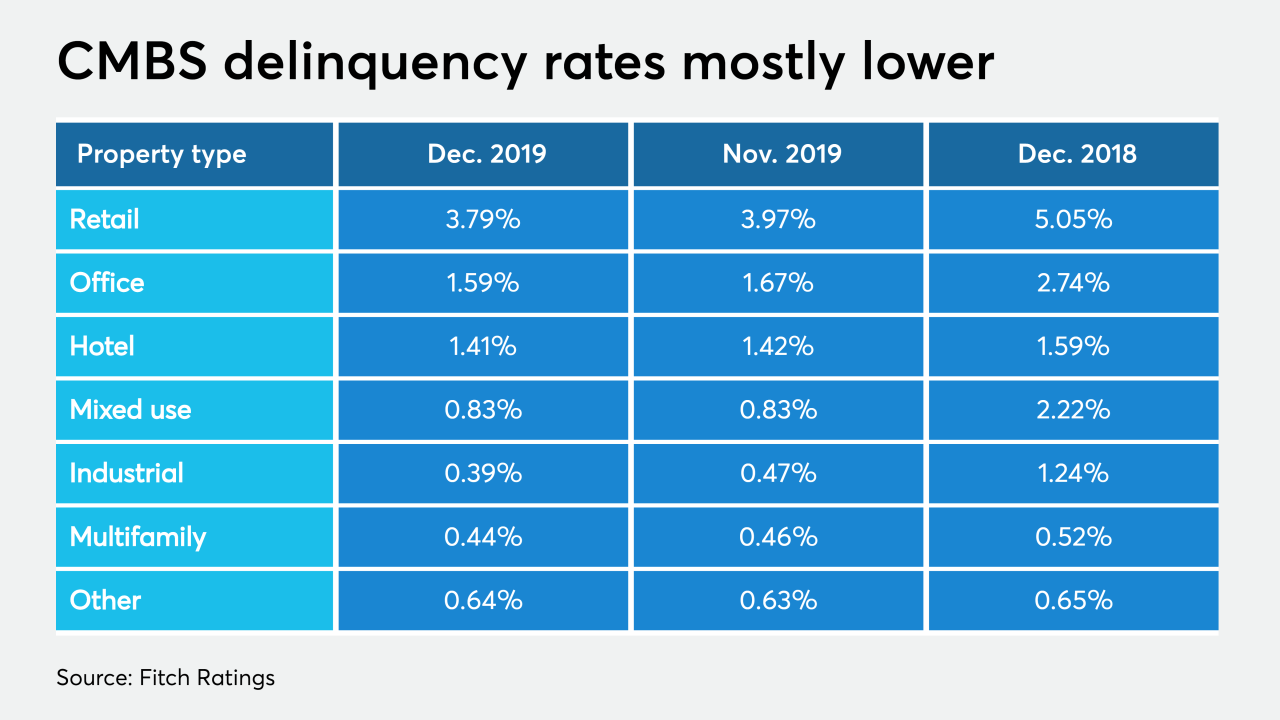

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

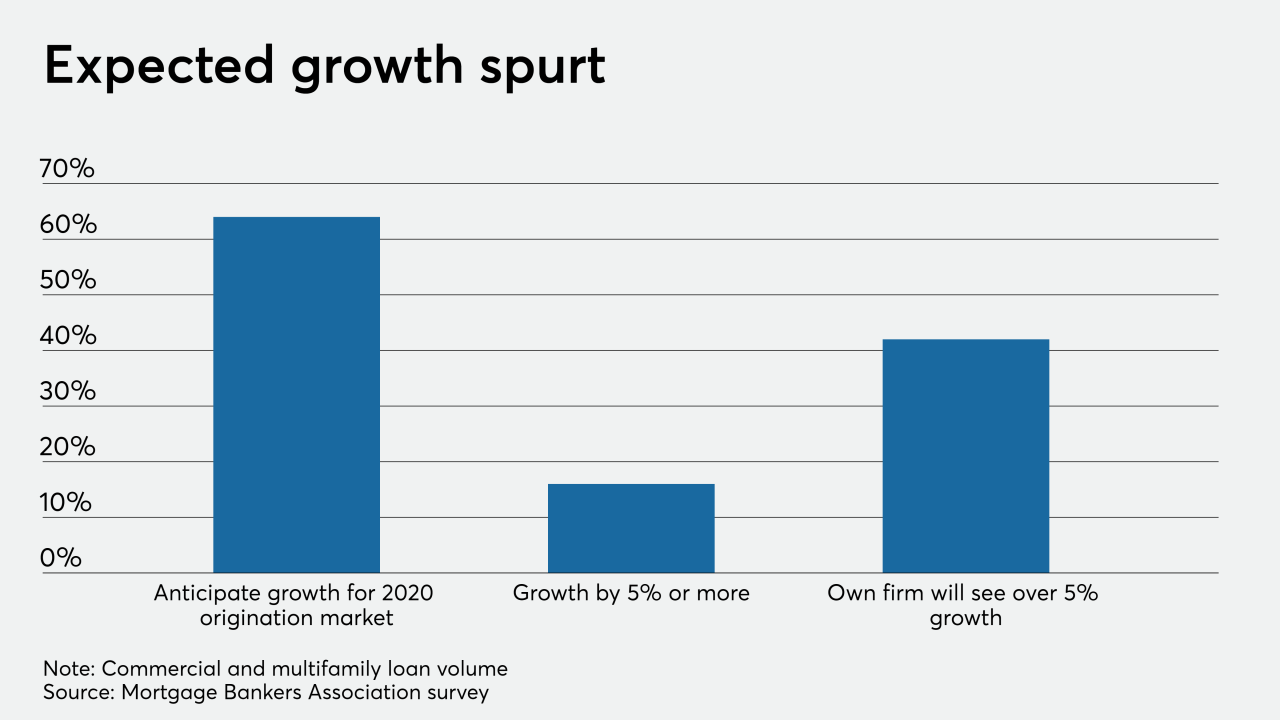

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7