-

The Louisiana company also said that credit quality in its energy portfolio improved during the first quarter.

April 28 -

The Trump administration's initial tax plan may be short on details, but a bipartisan bill offers some very specific relief for the commercial real estate industry.

April 27 -

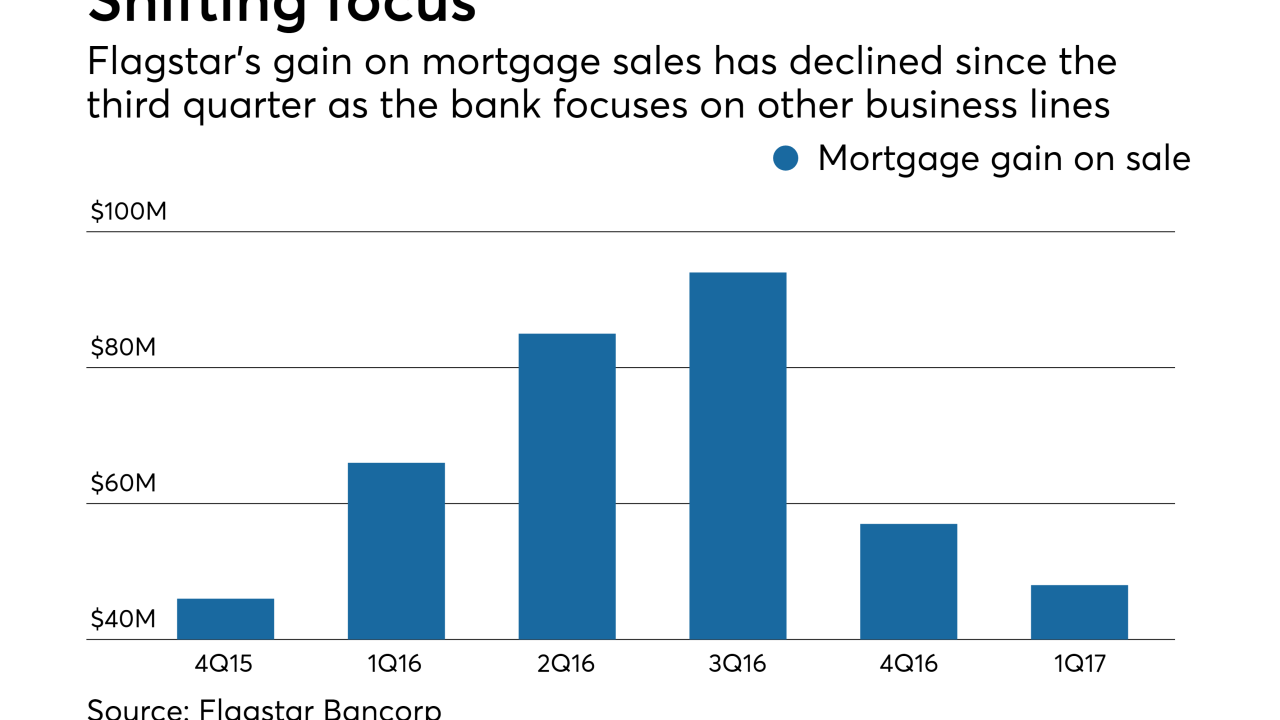

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Strong gains in low-cost health savings account balances helped fuel loan growth at the Waterbury, Conn., company.

April 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

Earnings per share fell a nickel short of estimates due in part to lower-than-expected revenue from the origination and sale of mortgages.

April 20 -

The New York bank has rapidly expanded its commercial real estate lending over the last several years, but now it is ready to slow down a bit and add more commercial and industrial loans to the mix.

April 19 -

Texas Capital Bancshares sharply reduced the size of its loan-loss provision as credit quality improved in its energy loan book. That helped the Dallas bank post a 77% rise in first-quarter profit.

April 19 -

The Mississippi company's first-quarter earnings rose 60% from a year earlier. Its results from last year were weighed down by a settlement with regulators.

April 19 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18 -

Bank of America's year-over-year loan growth was slow, but parts of its commercial and U.S. consumer businesses were strong, prompting optimism from the CEO in the face of lackluster numbers across banking so far this earnings season.

April 18 -

The Columbus, Ga., company also announced late Monday that it is buying the credit card assets and brokered deposits of the retailer Cabela's and will then sell the card portfolio to Capital One.

April 18 -

Net income climbed 13% as as the Fed's hike improved loan yields and the stock market’s surge boosted returns from PNC’s stake in BlackRock, the world’s largest asset manager.

April 13 -

Record loan originations and the continued accumulation of wealth management assets added up to 12% earnings growth at the San Francisco bank.

April 13 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11 -

Analysts at Goldman Sachs Group say it's not too late to bet against commercial mortgage bonds, even if parts of the trade have become crowded this year.

April 11 -

In his annual letter to shareholders, M&T Bank chief Robert Wilmers laid out in compelling detail how government policies intended to protect American families have ultimately stymied economic growth.

April 4 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers.

March 20 -

Banks are losing wealthier underbanked customers to alternative lenders — an undercurrent that is halting progress in expanding credit access for all.

March 17 Aite Group

Aite Group