-

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

As the House Financial Services Committee prepares to hold a hearing Thursday on oversight of the Federal Housing Finance Agency, the exact focus of the hearing remains somewhat in flux.

September 25 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

The CEOs of Fannie Mae and Freddie Mac are stepping down because the job they were hired to do — return the GSEs to profitability — is done. But attracting top-flight candidates to lead the mortgage giants into a new phase may not be easy.

September 24 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

The CFPB's move is in line with the other banking regulators who have offices in Atlanta.

September 21 -

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 19

-

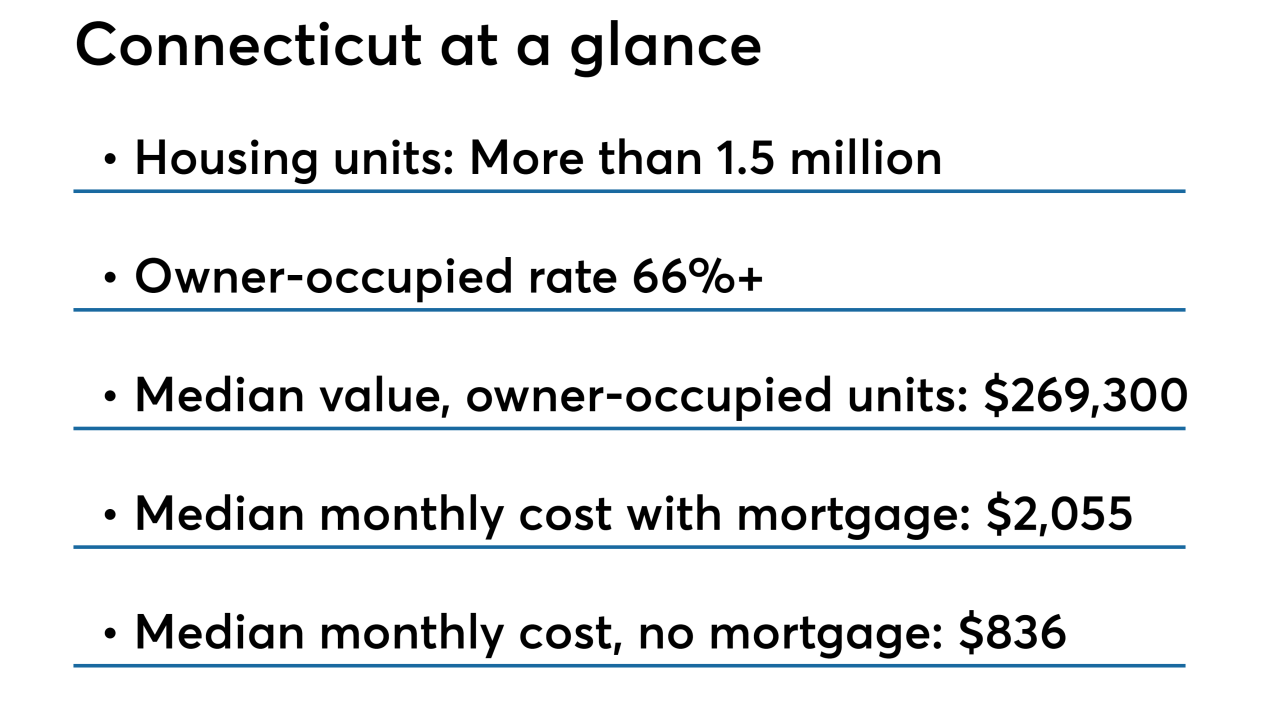

1st Alliance Lending plans to cut up to 35 employees in Connecticut and terminate efforts to expand its East Hartford headquarters in order to prepare for an expected increase in regulatory costs.

September 19