Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

The frequency of loan application defects, fraudulence and misrepresentation in information fell 8.3% year-over-year in August, but did rise 1.3%

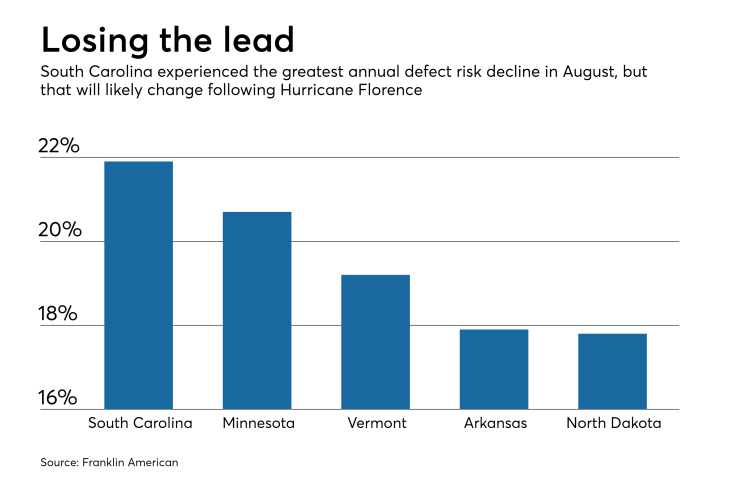

Only three states — Hawaii, Maine and California — experienced increases in defect risk, but this count will likely grow to include regions devastated by Florence. South Carolina, which took a major hit from the hurricane, experienced the greatest annual decline (21.9%) in defect frequency of all states.

"Unfortunately, on top of the damage to tens of thousands of homes, historical data indicates that hurricanes and loan application defect risk go hand-in-hand," said First American Chief Economist Mark Fleming in a press release. "Hurricanes, and especially the flooding associated with these natural disasters, create the potential and opportunity for significant misrepresentation of collateral condition."

More than $13 billion worth of homes (based on current market value) are likely flooded with at least a foot of water, totaling about 50,000 residential housing units likely to be damaged, according to a First American analysis of the National Hurricane Center's storm surge estimate.

When Harvey and Irma hit, loan application risk in Texas and Florida was declining, but in September 2017 the trend reversed and the defect index shot up 11.2% over a three-month period.

Houston was among the top five statistical areas experiencing the greatest annual gains in defect risk in August.