-

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

From a housing market in turmoil and the technology to save it to the myriad new faces in both the industry and Washington, here's a look back at some of the biggest and most read mortgage and housing stories of 2018.

December 21 -

For hedge funds that have been hoping the Trump administration would deliver a windfall on their investments in Fannie Mae and Freddie Mac, 2019 could be a make-or-break year.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

Kathy Kraninger's first official action as head of the Consumer Financial Protection Bureau is to reverse course on acting chief Mick Mulvaney's effort to rename it the Bureau of Consumer Financial Protection, which consumer groups and others had sharply criticized as confusing and costly.

December 19 -

A Flora Vista, N.M., man accused of five felony charges for forging a signature on real estate paperwork then ordering an employee to dispose of property from the victim's residence has agreed to a plea agreement.

December 19 -

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

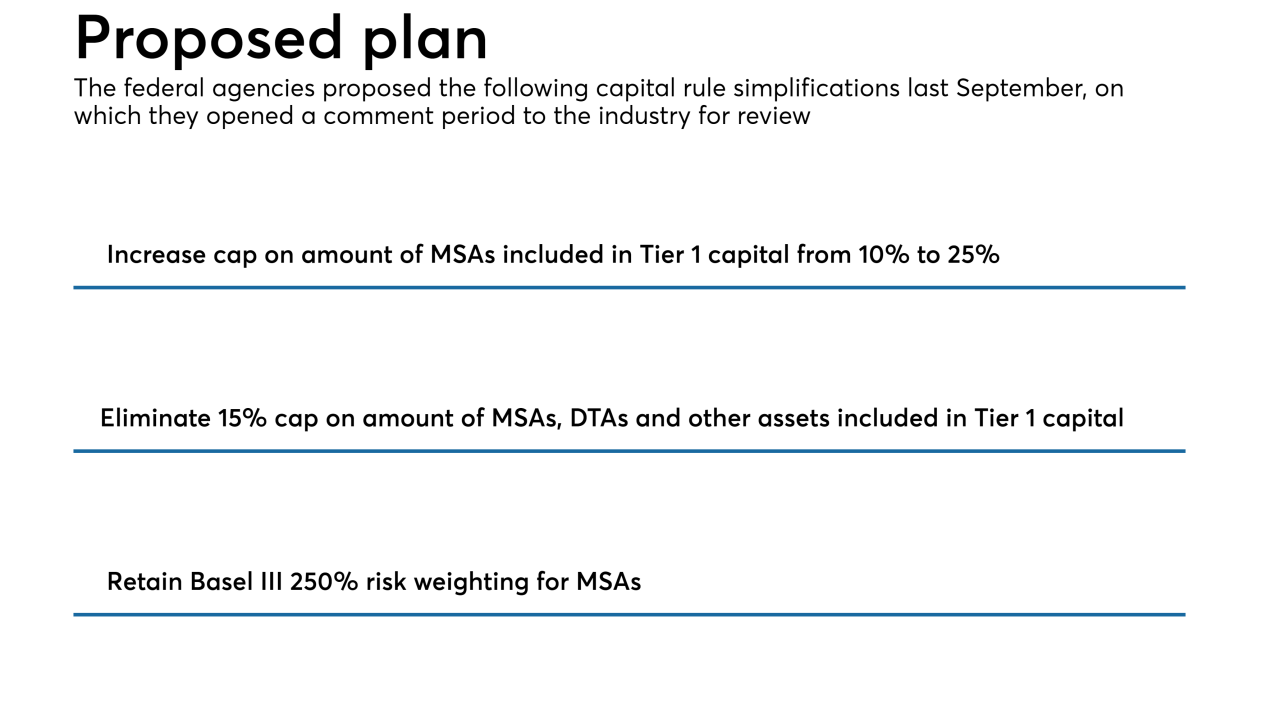

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18