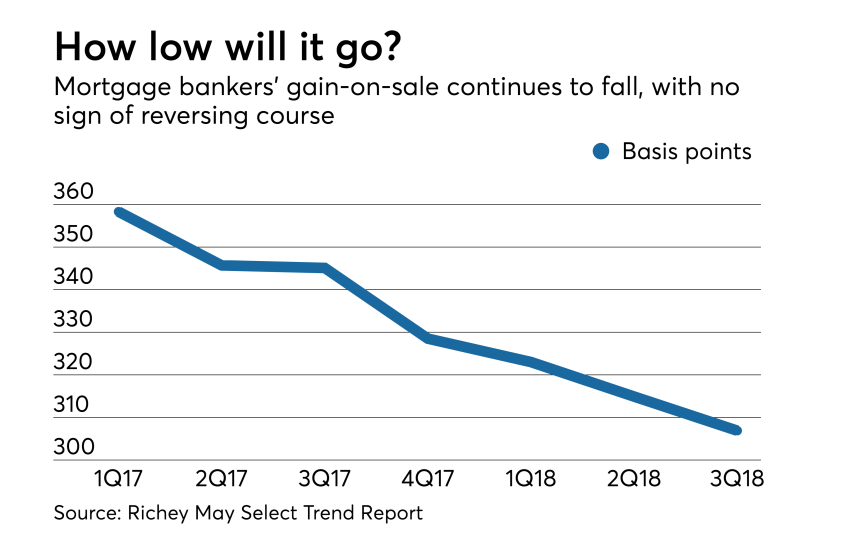

Ripple effects: Shifting demand creates mortgage winners and losers

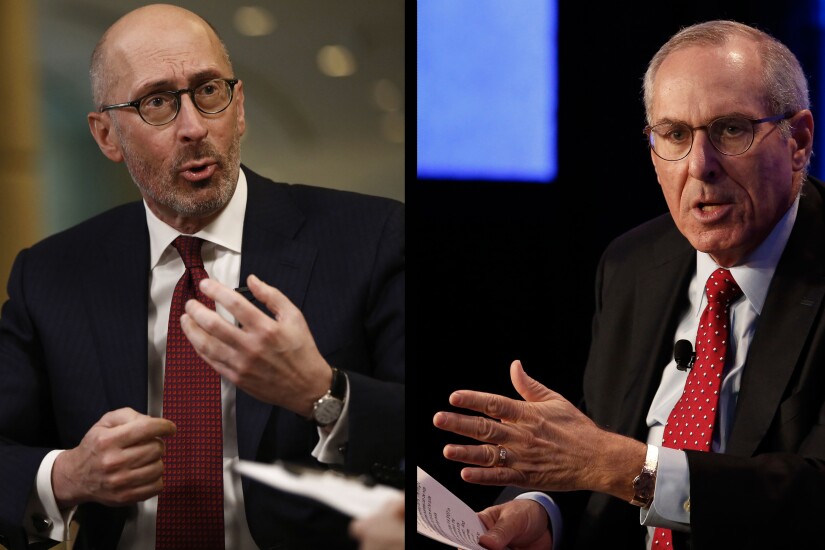

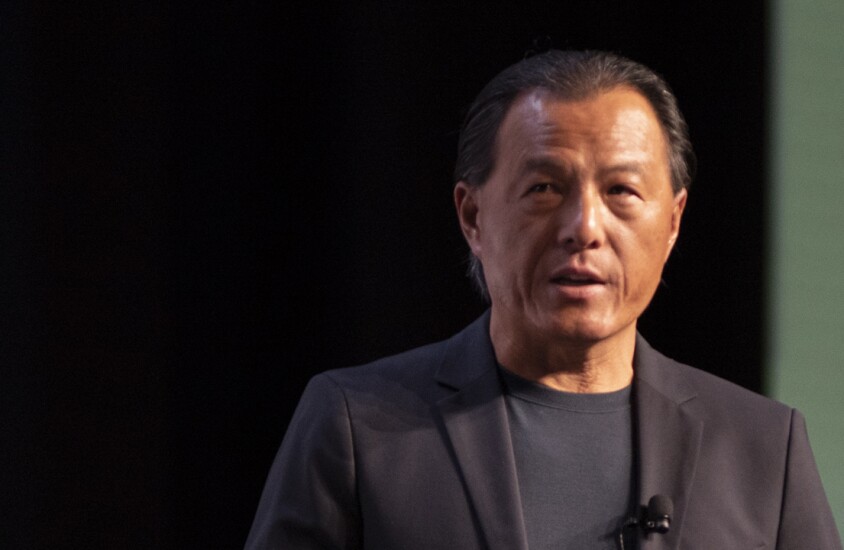

New MBA CEO Robert Broeksmit is ready to be the lender's advocate

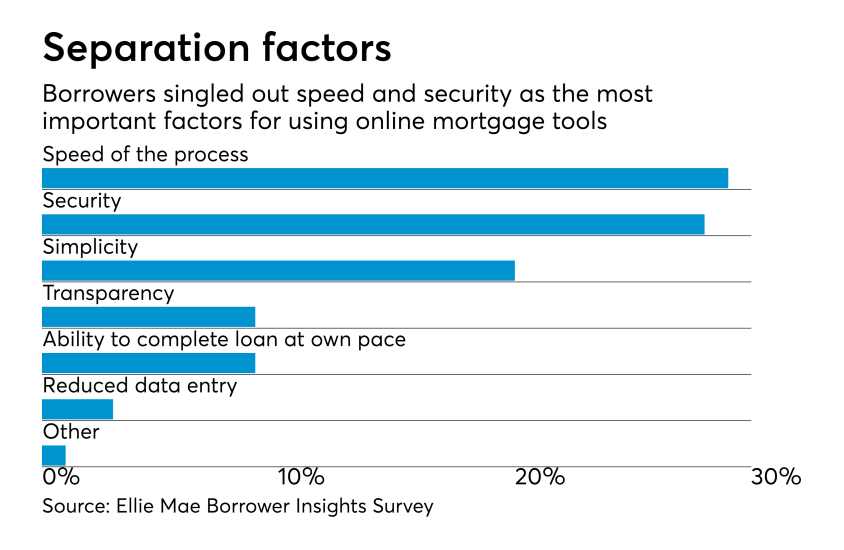

Closing the digital mortgage gap

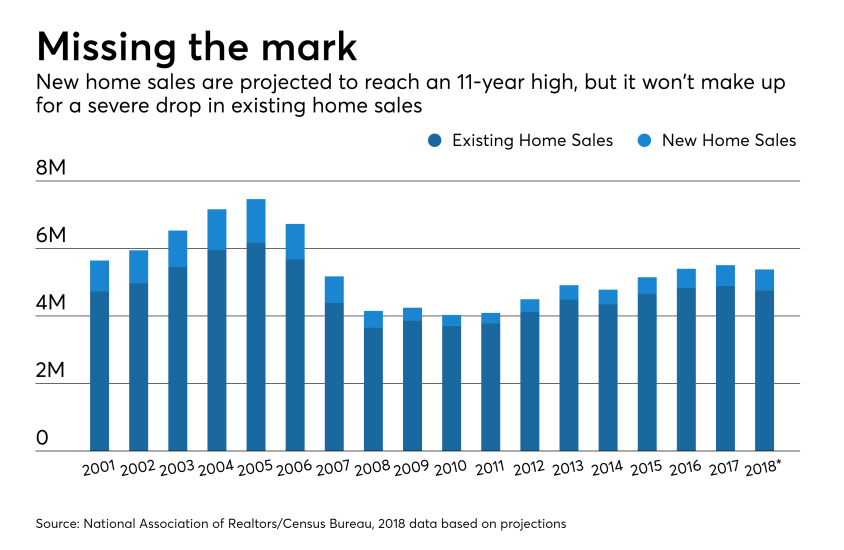

Housing bubble or not, the real estate market is in trouble

Chase Bank hit with downgrade over jumbo mortgage underwriting, fintech gaps

Why it will be hard to find new CEOs for Fannie and Freddie

Wells Fargo layoffs begin with 1,000 mortgage, tech jobs

10 mortgage reforms in the Senate reg relief bill

‘I am very excited to be here’: Kraninger signals new tone atop CFPB

Wholesaler's pitch to brokers: The best mortgage isn't always the cheapest

What 10 year Treasury yield at 3% means for average mortgage rates

FHA lenders warming up to reverse mortgages for new home purchases

Zillow enters the mortgage business by purchasing a lender

'Just a matter of time' before Amazon, Google enter mortgages: loanDepot CEO