-

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

A judge denied the settlement terms in a TCPA lawsuit against Ocwen Financial Corp. over concerns that the proposed $17.5 million payment was insufficient.

October 1 -

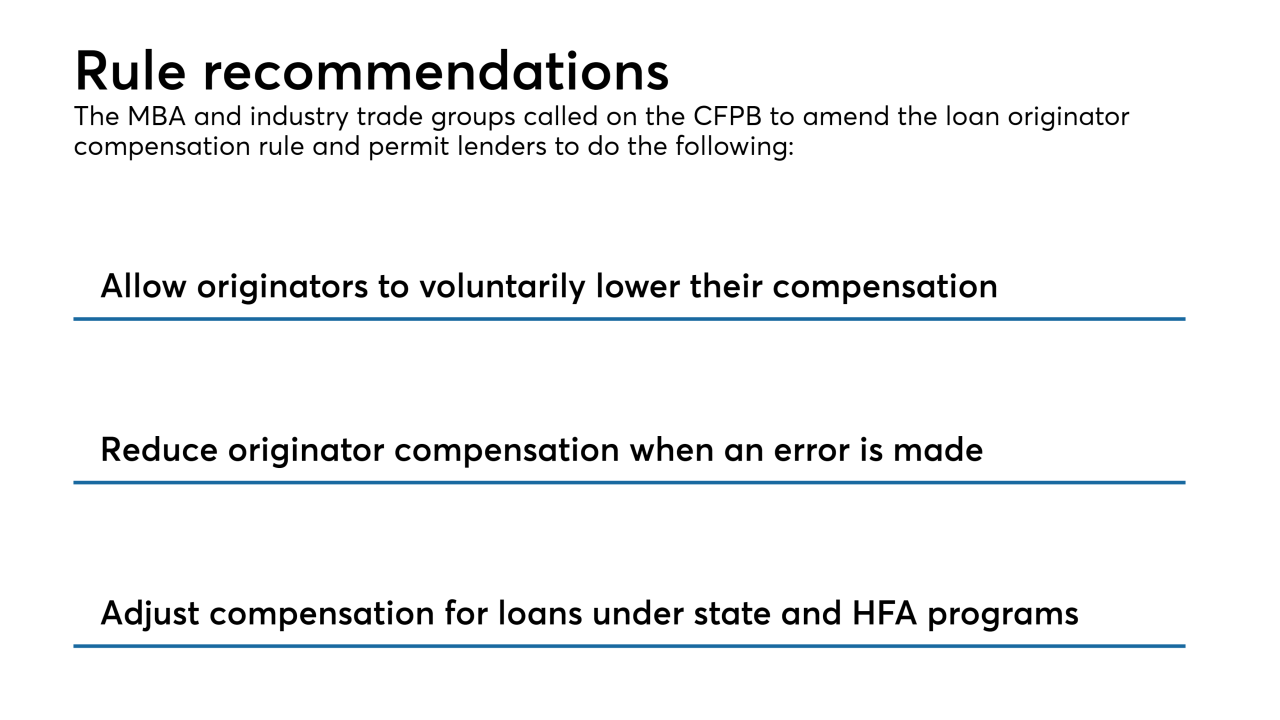

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30 -

The head of the agency’s fair-lending office cast doubt on a proposed reorganization of her office and raised concerns about blog posts written years ago by the political appointee overseeing the project.

September 28 -

At least six Trump administration picks to fill financial posts are still pending, but the bitterly partisan divide over Judge Brett Kavanaugh has taken up most of the energy in Congress.

September 28 -

Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

September 28 -

Another regulator has already gone out on its own with an advance notice of proposed rulemaking. But, Powell said, "It’s a process and we’re very much interested in pushing forward.”

September 26