-

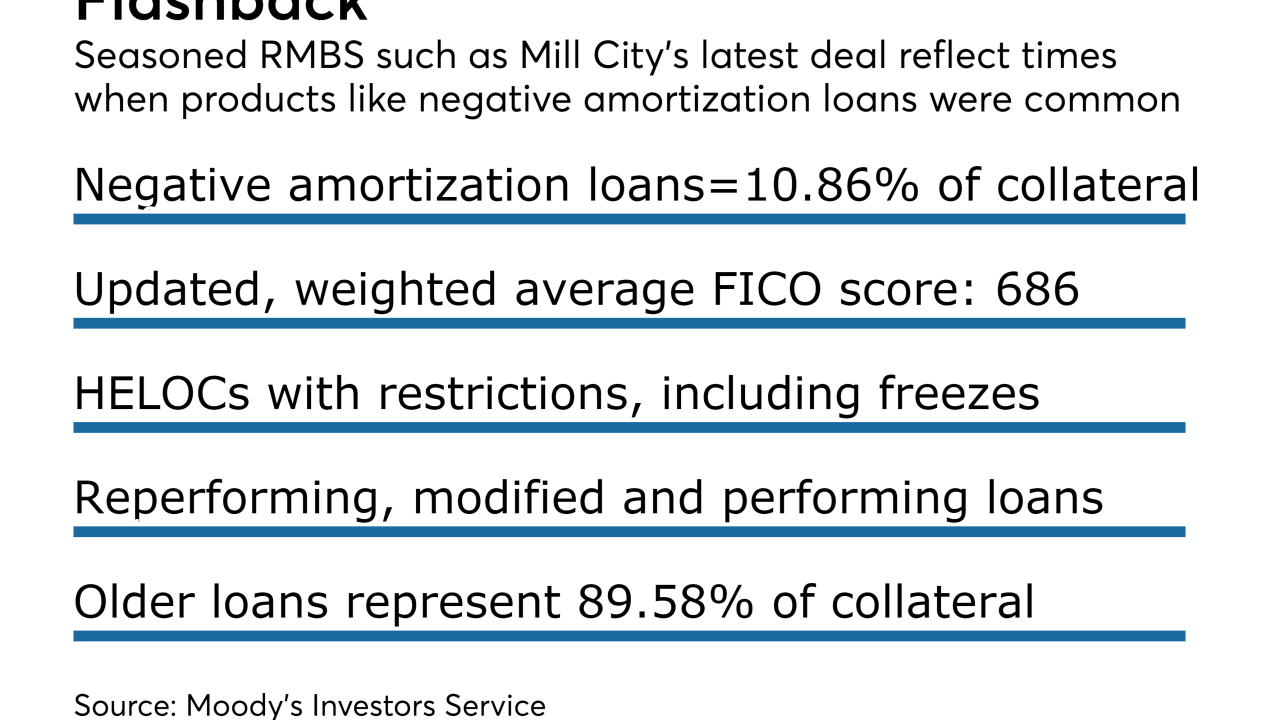

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

Following the lead of other California cities, Mayor Eric Garcetti two years ago proposed charging a fee on construction and using those funds to build affordable housing in Los Angeles.

June 12 -

As long as Fannie Mae and Freddie Mac exist, they must have adequate capital so taxpayers will never again be compelled to help them meet their financial obligations.

June 9 -

The Trump Administration’s anti-regulatory agenda has yet to permeate the Securities and Exchange Commission, which remains opposed to relief for collateralized loan obligations.

June 9 -

Ahead of the House vote Thursday on the Financial Choice Act, the two parties were assailing each other as proxies for Wall Street and painting themselves as defenders of community banking and the consumer.

June 9 -

The share of mortgaged properties underwater is inching down toward 6% but in certain areas like Las Vegas the percentage is more than twice as high, according to CoreLogic.

June 9 -

The House passed a bill that assigns Qualified Mortgage status to loans that banks hold in portfolio.

June 9 -

Clearing the bill through the House has value, giving baseline legislative language that the Senate might select in a more modest legislative package.

June 8 -

Senators on both sides of the aisle paid lip service Thursday to giving relief to community banks and credit unions, but didn't appear closer to specifics of what would be in a bill.

June 8 -

Not only is the uninsured sector growing, but the Bank of Canada is seeing some riskier mortgages within that area as it studies recent disruptions in the market.

June 8