-

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

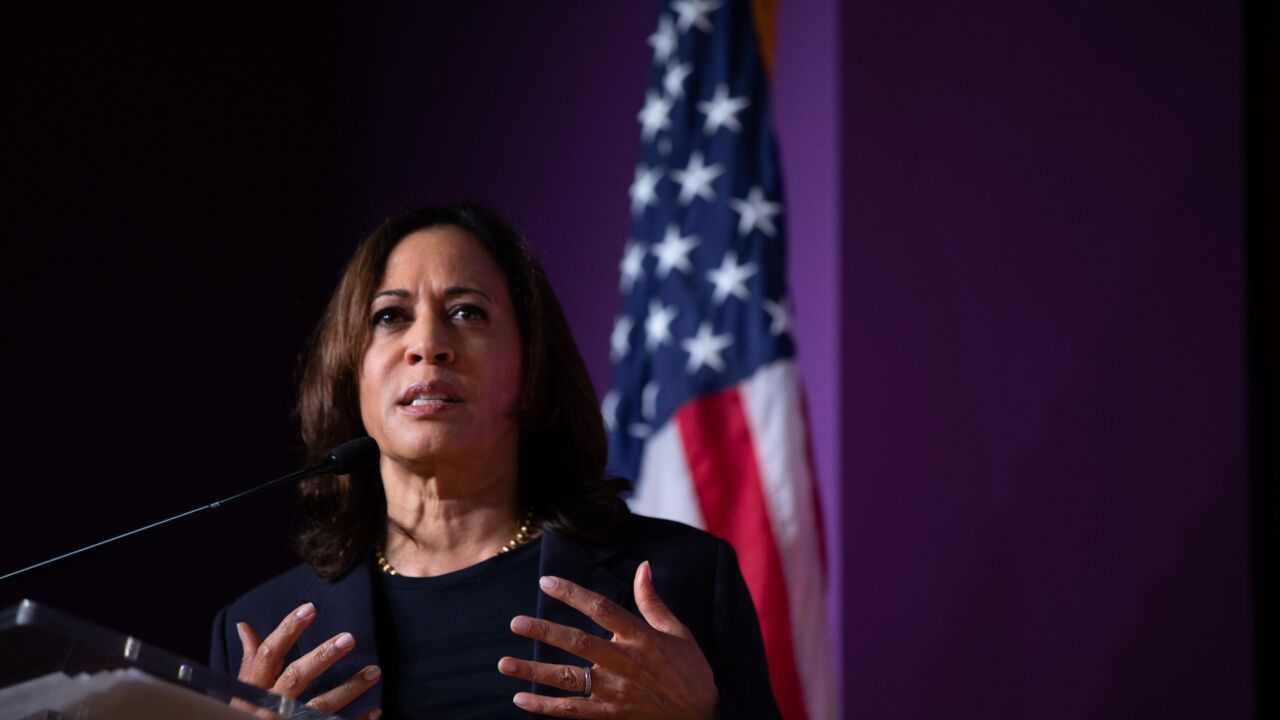

The House Financial Services chair is sponsoring a bill with one of the Democratic presidential contenders aimed at alleviating the public housing capital backlog.

November 21 -

Months after a citywide reassessment caused property values to shoot up across New Orleans, its likely impact on taxpayers' wallets is becoming clearer.

November 21 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The agency will review the TRID regulation, which combined disclosure requirements of two separate laws, as part of a mandate to evaluate major policies five years after their effective date.

November 20 -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

There's been chatter that investors are shying away from Fannie Mae and Freddie Mac mortgage-backed securities because Congress may not enact housing finance reform. Be skeptical of those claims.

November 19

-

Orange County's Housing For All task force has unveiled a 10-year plan to add tens of thousands of new homes and establish for the first time a local funding source that could pump $160 million into fighting Orlando's affordable housing crisis.

November 19