-

Mortgage fraud risk took a serious dive in the second quarter amid lower interest rates, which brought more refinance transactions into the market, according to CoreLogic.

July 25 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24 -

New York Attorney General Letitia James is monitoring how the bankrupt Ditech Holding Corp. handles borrower-sensitive issues like foreclosure proceedings, and is backing the involvement of a consumer creditors' committee.

July 23 -

The timing of the settlement serves as a warning to other companies of the risks they face in an increasingly data-focused economy.

July 22 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

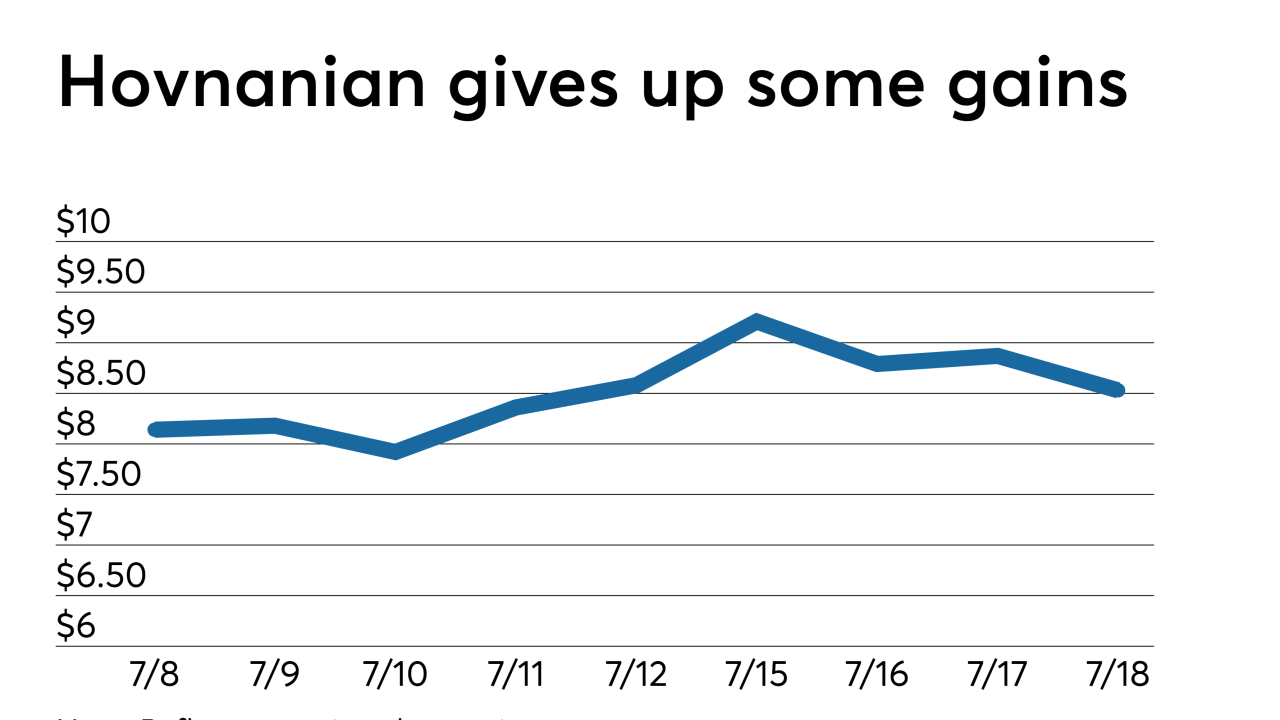

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

Former Lend America executive Michael Ashley was sentenced to three years in prison for his actions that led to the implosion of the once-high-flying Melville, N.Y.-based mortgage lender.

July 18 -

Although the presidentially directed reports on housing finance reform are "essentially done," FHFA Director Mark Calabria doesn't expect them to be published until August or September.

July 18 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

A builder based near the Lake of the Ozarks swindled six families that sought new homes in Kirkwood, Mo., out of $356,000, the builder's federal plea agreement says.

July 16