Consumer banking

Consumer banking

-

MVB in West Virginia will gain a 47% stake in the partnership in exchange for contributing its mortgage unit's assets to the new company.

March 3 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

A deferred-prosecution agreement with the Justice Department spares the bank a potential criminal conviction — provided it cooperates with continuing probes and abides by other conditions.

February 21 -

Alexander most recently headed up mortgage lending and before that co-led the integration of Key's acquisition of First Niagara. He replaces Dennis Devine, who recently left the company.

February 18 -

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

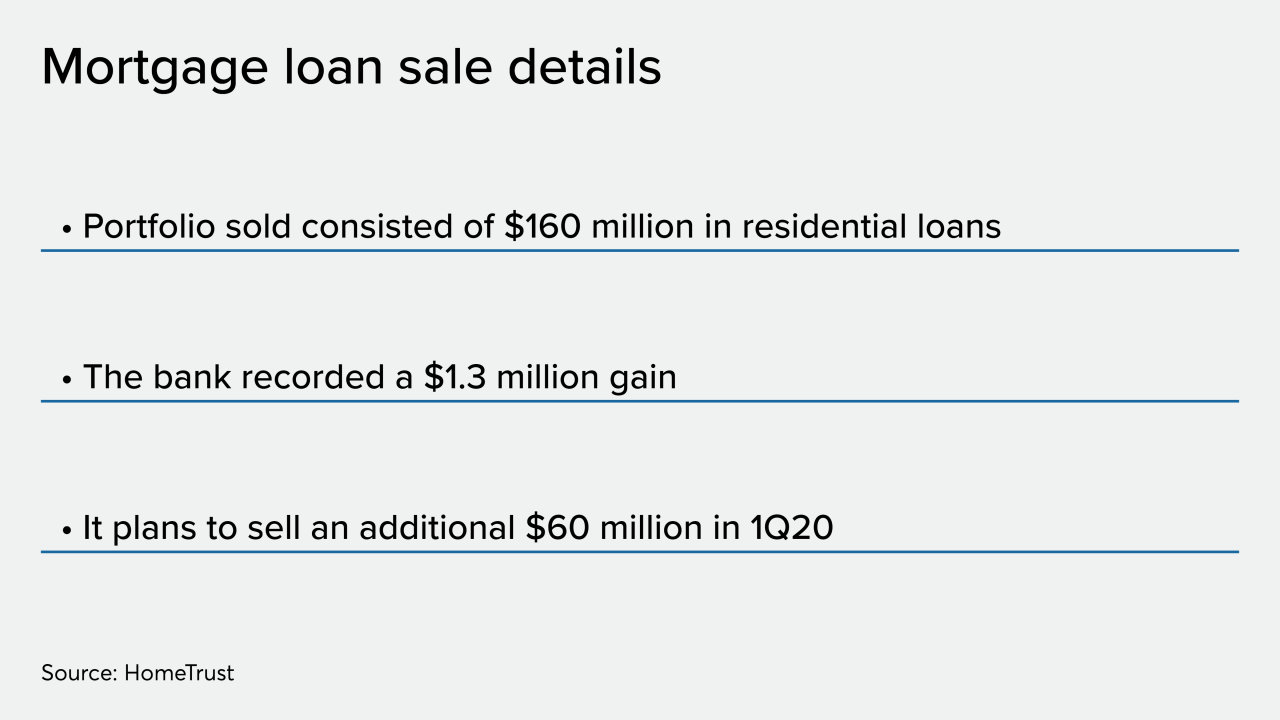

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

Yale researchers have recommended several consumer banking products and services that could help those with mental health challenges manage their money.

November 26 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

In recent months federal regulators have been speaking out on the risks that extreme weather events pose to the financial system, something their European counterparts have been doing for some time.

November 18 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

The FDIC ordered the Seattle bank to pay a nearly $1.4 million fine tied to improper agreements with real estate brokers and homebuilders.

November 6 -

Prosper hopes to do for lines of credit what it did for unsecured personal loans, while BBVA hopes to provide a better experience for customers.

November 4